What Happens When You Hire an Insolvency Practitioner Many UK directors and business owners face stressful financial problems—ranging from mounting debts to the risk of compulsory liquidation. When these challenges surface, seeking professional support can be the turning point. Hiring an insolvency practitioner UK for your company brings legal protection, business rescue opportunities in the […]

Alternatives to Creditors Voluntary Liquidation: Practical Options for Struggling Businesses

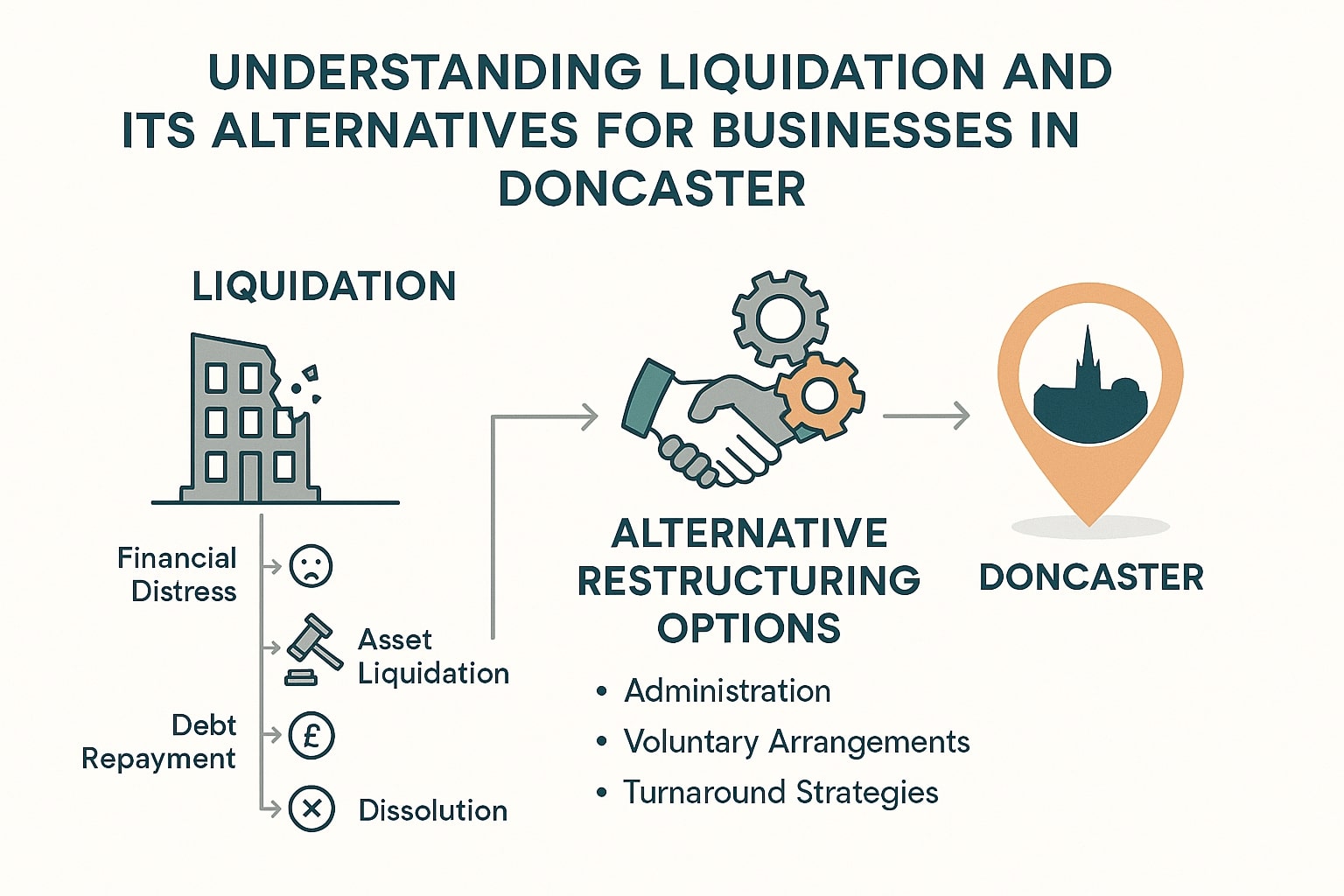

If your business is under financial pressure, a Creditors’ Voluntary Liquidation (CVL) may appear to be the only option. While liquidation can be the right route in some cases, it is not always the most beneficial outcome for directors, employees, or creditors. Understanding the available alternatives gives you the chance to protect assets, restructure operations, or even preserve the business. This page outlines practical alternatives to creditors voluntary liquidation, offering clear guidance on when each option may be appropriate. Creditors Voluntary Liquidation is a formal process where an insolvent company winds down by selling assets to repay creditors. Once complete, the business ceases trading, employees lose their jobs, and directors’ responsibilities end. For companies with no realistic chance of recovery, CVL ensures creditors are treated fairly and directors meet their legal obligations. However, entering liquidation too quickly can sometimes mean value is lost unnecessarily. Assets may be sold below market value, customers may be left unsettled, and directors may miss opportunities to restructure. Understanding CVL in the wider context of insolvency options allows directors to judge whether it is the right path, or whether there are more constructive alternatives worth pursuing before winding down operations entirely. The decision to liquidate is never easy, and many directors look for ways to avoid it. Alternatives to CVL often provide a greater level of control over outcomes and allow directors to demonstrate that they acted responsibly in the interests of creditors. Preserving business value is a common reason. Liquidation typically involves selling assets quickly, which rarely achieves full market price. Protecting employees is another important factor. Redundancies may be avoided if a business can continue trading under a new structure or agreement with creditors. Alternatives can also maintain supplier and customer confidence, safeguarding future business relationships. Finally, directors may wish to manage their own responsibilities more effectively, showing stakeholders that every possible route was considered before winding the company down. These motivations highlight why early advice is so valuable when financial difficulties arise. A Company Voluntary Arrangement (CVA) is a formal agreement with creditors that allows the company to repay debts over an agreed period. It is legally binding once approved and can provide directors with a structured way to deal with unmanageable liabilities while keeping control of the business. Benefits of a CVA include: Enabling trading to continue while debts are restructured. Offering creditors a higher return than liquidation through consistent repayments. Giving directors more time and flexibility to rebuild confidence in the company. A CVA works best when the business is fundamentally viable but hampered by short-term cash flow problems or historic debt. For example, a seasonal business with reliable income streams may simply need extra time to meet commitments. With the right proposal and professional guidance, creditors are often willing to support a CVA because it offers them a fairer and more predictable return than liquidation. Administration is another route that can provide struggling businesses with the time and space they need. Once an administrator is appointed, creditors are prevented from taking legal action, which gives directors a chance to reassess the company’s position. This process can be used to restructure operations, secure investment, or prepare for a sale. In some cases, administration results in a pre-pack sale, where assets or the business itself are sold quickly to a new entity. This often preserves jobs, contracts, and goodwill that might otherwise be lost. Administration is particularly helpful when the company has underlying potential but requires external expertise to stabilise operations. It ensures decisions are made under the guidance of a licensed insolvency practitioner, balancing creditor interests with the possibility of recovery. Compared to CVL, administration provides a more flexible and constructive framework, offering directors a chance to safeguard value rather than accepting immediate closure. For some directors, a voluntary strike-off may be more suitable than liquidation. This process involves dissolving the company and removing it from the Companies House register. It is only appropriate if the business has ceased trading, has no outstanding debts, and holds no significant assets. When used correctly, strike-off is a cost-effective and straightforward way to close a dormant or redundant company. If debts remain, however, a strike-off is not legally permissible, and directors must consider liquidation or another formal insolvency procedure. Attempting to strike off a company with unpaid debts can lead to legal complications, including personal liability. Other possibilities include Individual Voluntary Arrangements (IVAs) for directors with personal guarantees, and informal debt management plans where creditors agree to extended repayment terms. These options can be useful in specific circumstances but require careful assessment to avoid worsening financial risks. Advice from an insolvency practitioner ensures directors choose the correct procedure for their situation. Every business situation is unique. Choosing the right solution depends on the company’s debts, cash flow, assets, and creditor relationships. Without professional guidance, directors risk choosing a path that fails to protect creditors or exposes them to personal liability. Working with an insolvency practitioner provides clarity on all available options,from CVA and administration to liquidation and strike-off. It also reassures creditors that directors are acting transparently and in good faith. By addressing financial issues early, directors retain more control over the outcome, whether that means turning the business around or closing it responsibly. At Nexus Corporate Solutions Limited, we specialise in helping businesses across Doncaster and beyond to find the right path forward. Our role is to explain processes clearly, assess your company’s prospects, and guide you through the most effective strategy for recovery or closure. Acting early with professional support can preserve value, protect relationships, and minimise stress during challenging times. If your business is facing financial uncertainty, you don’t have to make decisions alone. Understanding your alternatives to creditors voluntary liquidation could open up new opportunities to protect value and move towards recovery. Contact Nexus Corporate Solutions Limited today to discuss your options in confidence. Our team will help you assess the right strategy for your business, creditors, and future.Understanding Creditors Voluntary Liquidation

Why Businesses Seek Alternatives

Company Voluntary Arrangements (CVA)

Administration as an Alternative to Liquidation

Voluntary Strike-Off and Other Options

Why Professional Insolvency Advice Matters

Next Steps

How Are Insolvency Practitioners Appointed – UK Expert Guide Navigating financial turmoil can be overwhelming for company directors and sole traders alike. Faced with mounting debts, threats of compulsory liquidation, or creditor demands, knowing “how insolvency practitioners are appointed” becomes crucial for preserving your organisation. In the UK, professional insolvency services, such as company voluntary […]

Administration might be your lifeline when your company's drowning in debt and creditors are circling. But here's what most directors don't understand: it's not just about buying time — it's about buying the right kind of time, with the proper professional support. The difference between administration working for you or against you often comes down […]

Can an Insolvency Practitioner Stop Creditors? In the UK, mounting pressure from creditors can disrupt cash flow, increase stress for directors, and push a company toward insolvency. Professional guidance plays a pivotal role in countering these challenges. Nexus Corporate Solutions Limited specialises in helping businesses find relief from persistent creditors, providing strategic solutions that align […]

When your company's in financial trouble, one of the biggest worries is what happens to everything you've built. Your equipment, property, stock — the assets that represent years of hard work. It's a valid concern, and you're not alone. The reality? How insolvency practitioners handle your company's assets can make or break the outcome for […]

Insolvent trading can trigger severe repercussions for UK directors, including personal liability and possible disqualification. When a business is unable to pay debts and continues to trade without a reasonable prospect of avoiding insolvency, the law may classify this as wrongful trading. The Insolvency Act 1986, alongside related legislation, outlines civil and criminal penalties for […]

Recognising the signs of business insolvency early is vital for UK companies. Overlooked warning signals—such as recurring cash flow issues, unpaid HMRC tax arrears, or missed staff wages—can quickly escalate into serious risks that demand immediate attention. Being aware of these common signs of business insolvency enables directors to take timely action, whether through careful […]

Supplier insolvency can have serious consequences for UK companies, creating ripple effects that extend beyond the affected supplier. Cash flow interruptions, delayed payments, and increased operational risks are common outcomes. When a key supplier or client becomes insolvent, contracts may be disrupted, insurance coverage can be affected, and overall profitability may decline. Nexus Corporate Solutions […]

Struggling with IVA monthly payments can feel overwhelming, especially when daily financial obligations pile up. An Individual Voluntary Arrangement (IVA) is designed to help those in debt regain stability by consolidating and managing repayments under a legally binding agreement. However, life changes—like reduced monthly income, sudden expenses, or shifts in personal circumstances—often make sticking to […]

Experiencing financial difficulty can make everyday life more challenging, especially when an individual or business director needs to secure a stable living arrangement. In the UK, an Individual Voluntary Arrangement (IVA) offers a legally binding debt solution that eases pressure from creditors. However, many worry about problems renting after IVA. Questions about how this might […]

Address: Apex Building, 1 Water Vole Way, Balby, Doncaster, South Yorkshire, DN4 5JP

Tel: 01302 430180

Services

Company