Many business owners and individuals in the UK find that completing an Individual Voluntary Arrangement (IVA) is an important first step toward stabilising their finances. Yet, questions often linger about how long to rebuild credit after IVA and the broader timeline for financial recovery. By recognising the impact an IVA has on credit history, directors […]

Blogs

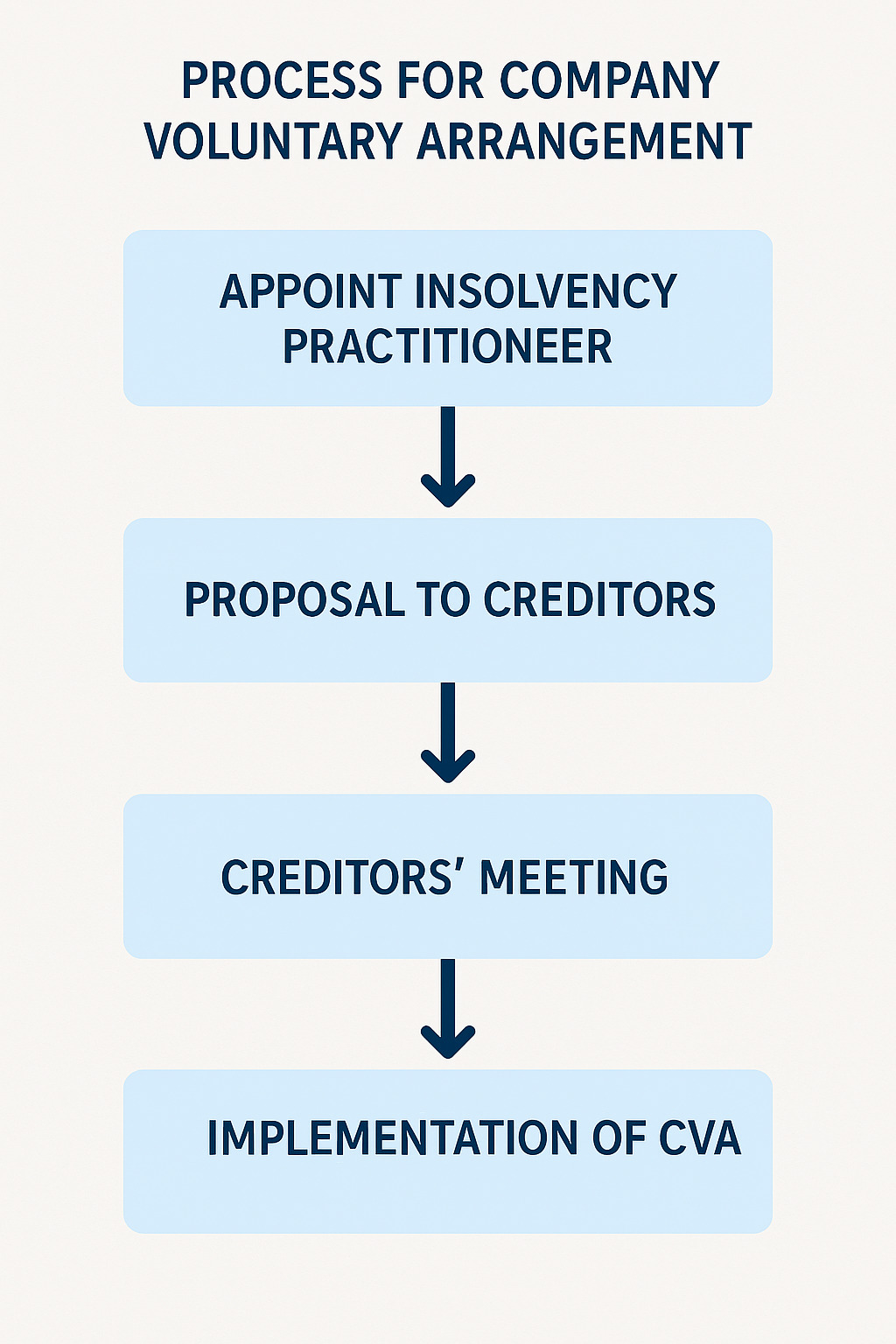

Process for Company Voluntary Arrangement: Essential Guidance for UK Businesses

Process for Company Voluntary Arrangement: Essential Guidance for UK Businesses

Struggling companies in the UK often seek a formal agreement with creditors that preserves viability and safeguards directors’ control. That’s where the process for a Company Voluntary Arrangement (CVA) comes in. This legally binding debt solution offers breathing space for businesses confronting creditor pressure or serious cash flow challenges. By partnering with a licensed insolvency […]

Cash Flow Problems in Insolvency: Essential Insights for UK Directors

Cash Flow Problems in Insolvency: Essential Insights for UK Directors

Cash flow difficulties can keep directors awake at night—threatening payroll, supplier payments, and overall business continuity. In the UK, a missed invoice or growing creditor pressure could signal deeper challenges ahead. Effective insolvency support offers more than just crisis management. It provides legal protection, eases the strain on directors’ personal liabilities, and paves the way […]

How to Avoid Business Insolvency: Your Comprehensive UK Guide

How to Avoid Business Insolvency: Your Comprehensive UK Guide

For many UK directors, the possibility of insolvency looms ever closer when cash flow issues and creditor days begin to stretch. Realising how to avoid business insolvency is crucial if you want to maintain business continuity, safeguard employees jobs, and stay on the right side of UK insolvency regulations. With the right support from trusted […]

Does IVA Affect Mortgage Applications? A Trusted UK Perspective

Does IVA Affect Mortgage Applications? A Trusted UK Perspective

Many UK individuals and company directors grappling with unmanageable debts wonder whether an Individual Voluntary Arrangement (IVA) will harm their pursuit of mortgage approval. Financial challenges often arise from cashflow strains, creditor pressures, or business setbacks. In the midst of such uncertainty, clarity around the linkage between IVAs and mortgages can be vital. Nexus Corporate […]

Exploring Alternatives to an IVA in the UK for Debt Relief

Exploring Alternatives to an IVA in the UK for Debt Relief

Facing unmanageable debts can be daunting, and many individuals turn to an Individual Voluntary Arrangement (IVA) as a structured way to repay creditors. However, “alternatives to an IVA in the UK” do exist to accommodate varying personal and business circumstances. Professional insolvency support can make all the difference by offering clarity, reducing creditor pressure, and […]

How to Pay for Liquidation if Funds Are Low

How to Pay for Liquidation if Funds Are Low

Running a business in the UK often involves juggling finances, meeting creditor demands, and keeping operations afloat. Yet unforeseen setbacks can plunge companies into debt, creating stress for directors and staff alike. Professional insolvency support can make a transformative difference, from safeguarding vital assets to ensuring compliance with UK regulations. By entrusting experts like Nexus […]

Company Liquidation Cost vs Voluntary Liquidation: Understanding Your Options

Company Liquidation Cost vs Voluntary Liquidation: Understanding Your Options

In the UK, directors of struggling businesses often wonder whether closing through standard company liquidation or opting for a voluntary liquidation route is more economical. Deliberating over company liquidation cost vs voluntary liquidation can be daunting, especially if you are unsure how fees are structured. From insolvency practitioner services to court petition expenses, each choice […]

Legal Risks and Fees in Compulsory Liquidation: What Directors Need to Know

Legal Risks and Fees in Compulsory Liquidation: What Directors Need to Know

Forced by creditors, or prompted by unpaid debts, compulsory liquidation in the UK can be one of the most stressful processes for company directors. Unlike voluntary closures, a compulsory winding up is a formal insolvency process ordered by the court. Legal risks and fees in compulsory liquidation often escalate rapidly, covering winding up petition (WUP) […]

Affordable Ways to Close a Small Business: Your Guide to a Cost-Effective Exit

Affordable Ways to Close a Small Business: Your Guide to a Cost-Effective Exit

In the UK, deciding to shutter a small enterprise can be challenging, especially when financial pressures mount and creditors knock. Fortunately, there are affordable ways to close a small business that avoid hefty fees and lengthy court battles. With the right insolvency guidance, you can follow a structured route that respects regulations, protects your interests, […]

Address: Apex Building, 1 Water Vole Way, Balby, Doncaster, South Yorkshire, DN4 5JP

Tel: 01302 430180

Services

Company