Tax Implications of Creditors Voluntary Liquidation When a company can no longer meet its debts, directors may choose a Creditors Voluntary Liquidation (CVL) as a structured way to close the business. While the process helps protect creditors and ensures compliance with insolvency law, directors must also consider the tax implications of creditors voluntary liquidation. HMRC […]

Blogs

What Happens After Creditors Voluntary Liquidation?

What Happens After Creditors Voluntary Liquidation?

When a company enters a Creditors’ Voluntary Liquidation (CVL), it marks the end of trading and the beginning of a structured process to close down operations. For directors, creditors, and stakeholders, understanding what happens after creditors voluntary liquidation is vital to navigate responsibilities, safeguard interests, and prepare for the future. With expert guidance from licensed […]

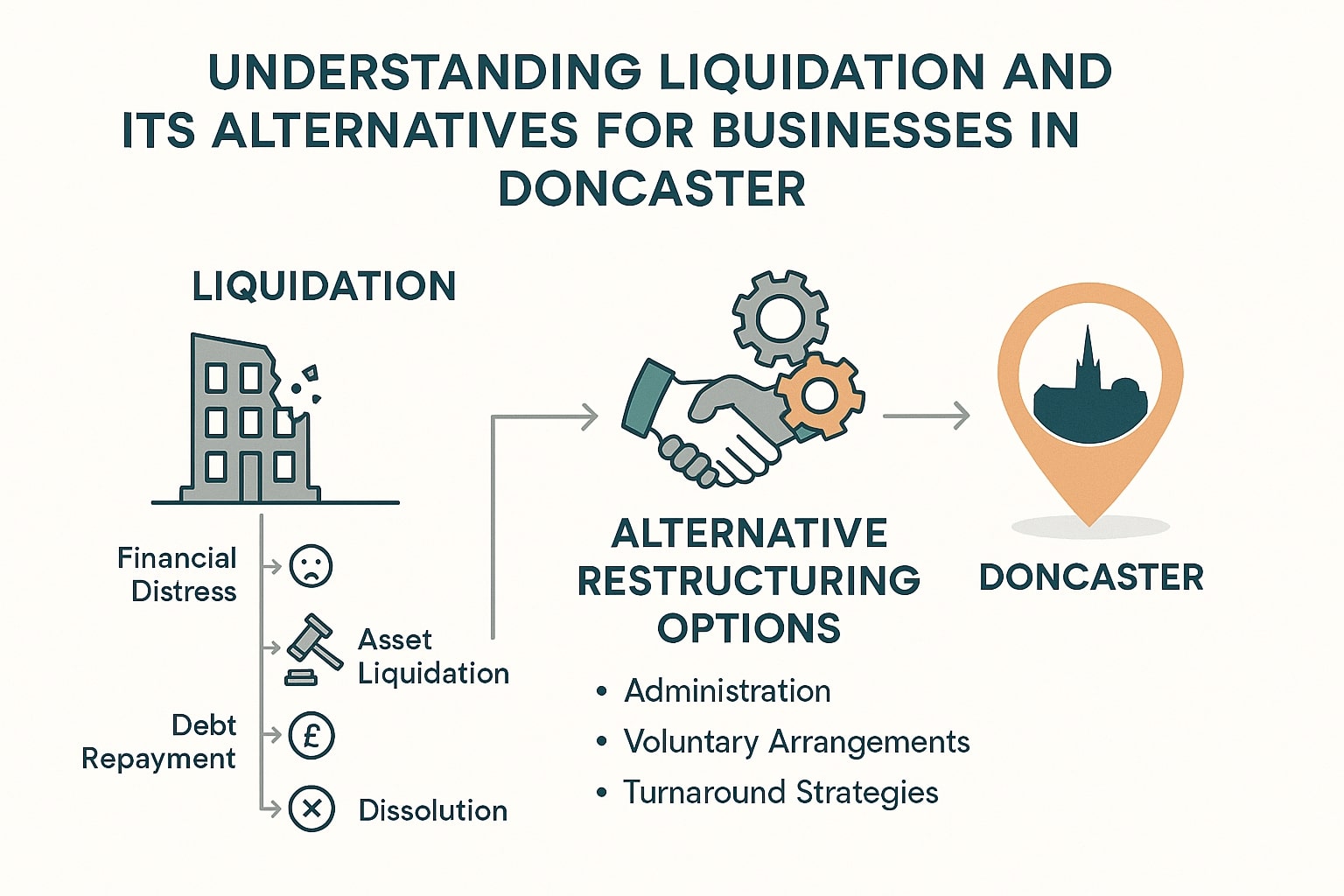

Alternatives to Creditors Voluntary Liquidation: Practical Options for Struggling Businesses

Alternatives to Creditors Voluntary Liquidation: Practical Options for Struggling Businesses

If your business is under financial pressure, a Creditors’ Voluntary Liquidation (CVL) may appear to be the only option. While liquidation can be the right route in some cases, it is not always the most beneficial outcome for directors, employees, or creditors. Understanding the available alternatives gives you the chance to protect assets, restructure operations, […]

The Effect of CVL on Employees: What to Expect During Company Liquidation

The Effect of CVL on Employees: What to Expect During Company Liquidation

When a business enters a Creditors’ Voluntary Liquidation (CVL), the effect on employees can be immediate and unsettling. Job security, unpaid wages, and future prospects suddenly become uncertain. For staff members, this transition is often marked by questions about redundancy, entitlements, and how long support might last. Understanding the effect of CVL on employees is […]

Are Insolvency Practitioners Legally Required to Be Licensed?

Are Insolvency Practitioners Legally Required to Be Licensed?

When people hear about businesses going under, they often wonder how the situation is handled. That is where insolvency practitioners step in. They guide companies through tough financial times, making sure creditors and other stakeholders are treated fairly. These experts follow strict rules set in law. So are insolvency practitioners legally required to be licensed? […]

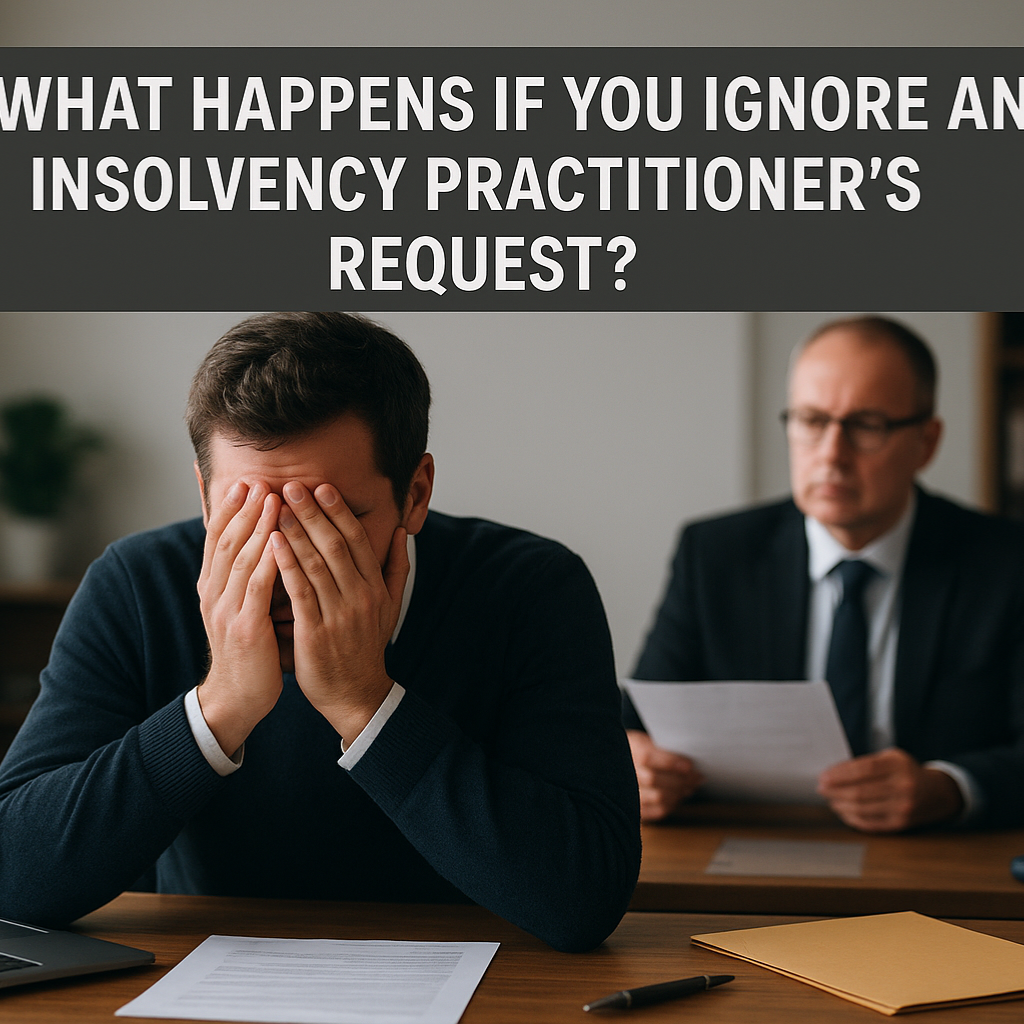

What Happens If You Ignore an Insolvency Practitioner's Request?

What Happens If You Ignore an Insolvency Practitioner's Request?

Insolvency in the United Kingdom is a serious affair. If a business or individual is in over their head, an insolvency practitioner may step in to assess assets and liabilities. Some people fail to respond, hoping the matter fades away. However, ignoring their requests can create lasting problems, both legally and financially. Insolvency Practitioner and […]

How Are Retail Insolvencies Impacting the Retail Sector in 2025?

How Are Retail Insolvencies Impacting the Retail Sector in 2025?

The retail sector has faced unprecedented challenges, grappling with evolving consumer behaviours, rising operational costs, and intensified competition from digital platforms. Many retailers have experienced declining profit margins, increased overheads, and mounting pressure from online competitors. Retail insolvencies have become increasingly prevalent, creating significant concerns for employees, suppliers, landlords, and the broader business community. Understanding […]

What Triggers Insolvency in the Construction Industry and How Is It Handled?

What Triggers Insolvency in the Construction Industry and How Is It Handled?

Insolvency in the construction industry represents a persistent challenge that emerges when companies cannot manage their debts or meet contractual obligations. The construction sector consistently accounts for 17-18% of all insolvencies in England and Wales, making it the worst-affected industry for business failures. This blog explores the specific triggers of construction industry insolvencies and examines […]

What Are Directors' Duties to Creditors in Insolvency?

What Are Directors' Duties to Creditors in Insolvency?

Directors' duties to creditors in insolvency represent one of the most complex and critical areas of company law, with significant personal liability implications for those who fail to understand and comply with their obligations. When a company approaches or enters insolvency, the fundamental nature of directors' duties undergoes a crucial transformation, shifting from primarily serving […]

How Does Filing for Insolvency Work? A Guide to UK Insolvency Procedures

How Does Filing for Insolvency Work? A Guide to UK Insolvency Procedures

Filing for insolvency represents a critical decision for businesses and individuals facing insurmountable financial difficulties. The UK insolvency system, governed by the Insolvency Act 1986 and overseen by the Insolvency Service, provides structured legal frameworks designed to address financial distress whilst protecting stakeholder interests. For companies, procedures include administration, Company Voluntary Arrangements (CVAs), and liquidation. […]

Address: Apex Building, 1 Water Vole Way, Balby, Doncaster, South Yorkshire, DN4 5JP

Tel: 01302 430180

Services

Company