Running a business in the UK often involves juggling finances, meeting creditor demands, and keeping operations afloat. Yet unforeseen setbacks can plunge companies into debt, creating stress for directors and staff alike. Professional insolvency support can make a transformative difference, from safeguarding vital assets to ensuring compliance with UK regulations. By entrusting experts like Nexus Corporate Solutions, businesses can find clarity on how best to protect value, manage pressure, and secure a viable future.

For those on the brink of closure, services such as company voluntary arrangements (CVAs), administration, or liquidation—including CVL for struggling businesses—can offer much-needed relief. Each strategy has its specific uses, though all share a key goal—helping directors resolve mounting liabilities without sacrificing long-term aspirations. In cases where funds are severely limited, knowing how to pay for liquidation if funds are low becomes paramount to safeguarding both personal and corporate interests.

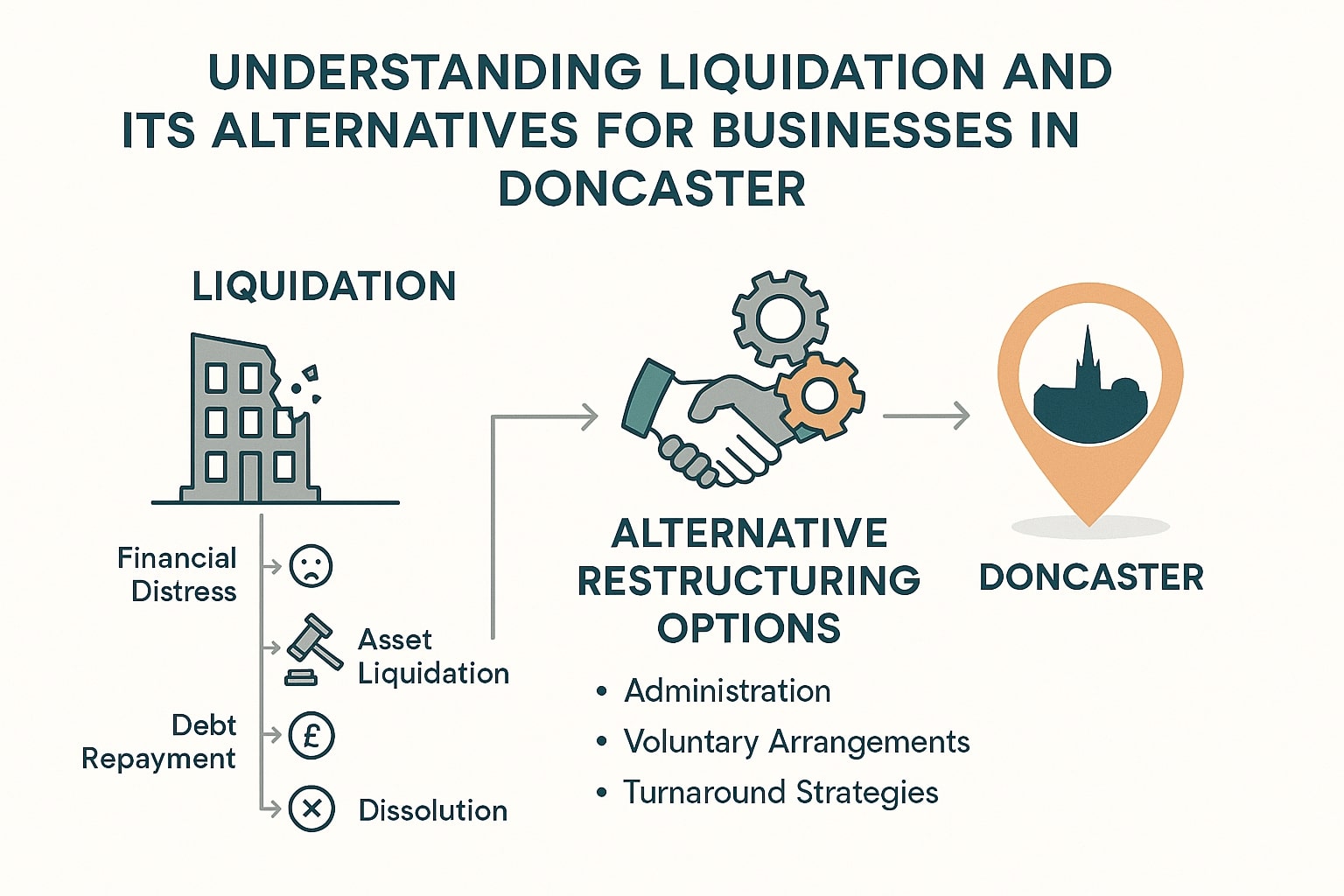

What Happens if a Ltd Company Runs Out of Money?

When a limited company faces insolvency, it can no longer meet its obligations. Directors may fear reputational damage, legal action, or job losses. However, running out of money does not automatically mean closure. Seeking professional support early can help explore rescue options like restructuring or a CVA, protecting the business from compulsory liquidation.

Nexus Corporate Solutions works closely with UK directors to review cashflow, negotiate with creditors, and chart a feasible turnaround strategy when possible. If rescue is not viable, a more formal insolvency approach can be taken, ensuring directors fulfil their duties. Throughout the process, clarity on personal liability and the consequences of insolvent trading is crucial.

What to Do if You Can’t Afford to Liquidate a Company?

Lack of funds can deter some directors from taking necessary steps to close an insolvent business. Directors might wonder if there is a way to liquidate a company with no money to cover professional fees. Fortunately, there are options that could ease the financial burden, making formal closure feasible without personal ruin.

In instances where directors cannot pay upfront for a creditors voluntary liquidation (CVL), alternative financing or the sale of company assets may help cover liquidation costs. Nexus Corporate Solutions advises on the best strategy to ensure compliance with UK insolvency regulations, while protecting directors from allegations of misfeasance or wrongful trading when funds are scarce.

Exploring the Cheapest Way to Liquidate a Company

Directors sometimes ask, “What is the cheapest way to liquidate a company?” Some choose administrative dissolution (strike off) if the company has no assets or liabilities, but this informal route is not suitable for a business saddled with debt. For those with outstanding liabilities, a formal insolvency liquidation procedure, such as a CVL, is more appropriate.

While a strike off may appear cheaper, it exposes directors to disputes if creditors are not informed. An affordable CVL, guided by a licensed insolvency practitioner, ensures transparency and compliance. By working with Nexus Corporate Solutions, directors can clarify what is permissible, explore cheap ways to liquidate a company, protect themselves from future claims, and minimise costs without compromising their legal obligations.

Managing Debts and Creditor Pressure

Mounting debts and impatient creditors may push directors towards panic. In extreme cases, an inability to pay leads to creditor petitions for compulsory liquidation. Handling these pressures proactively can save a business. Nexus Corporate Solutions facilitates negotiations, potentially using CVAs or other debt restructuring tools to manage liabilities when a company’s assets outweigh the immediate cash available.

Even when day-to-day cashflow is tight, formal arrangements can help directors regain control. The key is timely action and professional guidance. By engaging an insolvency practitioner early, directors can reduce the risks of personal responsibility and ensure creditors’ demands are addressed responsibly. This approach stabilises the business and protects directors from potential claims of trading while insolvent.

The Formal Insolvency Liquidation Procedure

Once directors decide on liquidation, an insolvency practitioner is appointed to value assets, confirm liabilities, and handle distributions. Creditors’ claims are assessed, and any returns are shared in accordance with the Insolvency Act 1986. Nexus Corporate Solutions steers this process efficiently, ensuring all stakeholders are properly informed before finalising the liquidation of a company with outstanding debts.

During liquidation, directors’ conduct comes under scrutiny. Any signs of director misfeasance or failure to act in creditors’ best interests may result in investigations. However, with professional support and complete transparency, such risks are mitigated. While fees are unavoidable, they can often be covered by realising company assets, ensuring the closure is both compliant and cost-effective.

Key Considerations for Directors

Directors often ask if they might be personally responsible for company debts once liquidation commences. Generally, limited liability protects personal assets unless accusations of wrongful trading arise. However, ignoring the situation or attempting to strike off while debts remain could lead to serious repercussions. Engaging expert advice prevents confusion and protects directors’ reputations.

If you owe money to a liquidated company, the appointed liquidator handles outstanding debts. They may seek repayment from debtors to maximise returns for creditors. Conversely, if your own business is on the brink, planning ahead can safeguard personal interests, reduce stress for staff, and preserve whatever remaining value exists. Thoughtful action is vital in uncertain times.

Choosing Nexus Corporate Solutions for Expert Guidance

At Nexus Corporate Solutions, we understand the anxieties surrounding closure, insolvency fees, and the most suitable path forward. Directors benefit from our technical expertise, compassionate support, and in-depth knowledge of UK insolvency law. We customise strategies to address unique circumstances, helping directors access manageable solutions even when funds for liquidation appear dangerously low.

From cheap company closure in the UK to more comprehensive measures like CVAs, we guide you every step of the way. Our team takes pride in providing clear advice, enabling directors to handle each phase—from informing creditors about company dissolution to filing the necessary paperwork for a strike off or formal liquidation procedure—confidently and legally.

Conclusion

Liquidating a company when resources are minimal needn’t cause long-term anxiety. By exploring how to pay for liquidation if funds are low and seeking timely professional help, directors can avoid the pitfalls of wrongful trading, protect their reputations, and comply with UK insolvency obligations. Nexus Corporate Solutions offers a clear route to closure, minimising disruption and maximising peace of mind for everyone involved. Whether through a CVA, administration, or formal liquidation, our goal is to safeguard directors’ interests while navigating complex financial challenges responsibly.

In the UK, directors of struggling businesses often wonder whether closing through standard company liquidation or opting for a voluntary liquidation route is more economical. Deliberating over company liquidation cost vs voluntary liquidation can be daunting, especially if you are unsure how fees are structured. From insolvency practitioner services to court petition expenses, each choice has distinct budget implications, and the stakes are high when personal liability or director disqualification risk come into play.

At Nexus Corporate Solutions, we know how critical it is to find an affordable, practical business liquidation solutions method for dealing with financial distress. Our goal is to help you compare costs, minimise liability, and adhere to UK insolvency regulations. In this blog, we explore liquidation fees UK-wide, how they are determined, and highlight the key distinctions between an official winding up and a voluntary approach—so you can make an informed decision that protects both you and your company.

Understanding the Basics of Company Liquidation

Company liquidation refers to the formal process of closing an insolvent or solvent company, ensuring all obligations are settled under UK law. In an insolvent scenario, an appointed company liquidator takes control, realising company assets to pay creditors. Professional liquidation fees vary widely based on company size, complexity, and the licensed insolvency practitioner fees. Compulsory liquidation begins when a creditor files a petition—where petitioning creditor pays costs—and the court orders the company’s closure.

How Voluntary Liquidation Differs

Voluntary liquidation is often initiated by directors or shareholders themselves. In this process, the company voluntarily engages an insolvency practitioner who manages the closure. This approach typically avoids the court route and, so long as the directors act responsibly, reduces legal tangles. Meanwhile, the initial outlay—voluntary liquidation paid by company—can be more predictable. Such a controlled exit minimises stress, preserves reputations, and frequently proves cost-effective compared to a forced closure.

Key Cost Factors in Liquidation

The cost to liquidate a limited company depends on multiple elements:

- Professional liquidation fees: The practitioner’s role includes asset valuation, processing claims, and liaising with creditors.

- Company assets sold to pay fees: Physical company assets like property, vehicles, or machinery can reduce net costs.

- Complexity of the case: Complex liquidation cases require more time and resources, raising overall fees.

By evaluating these factors, you can assess the cost difference between company vs voluntary liquidation more accurately.

Compulsory vs Voluntary Liquidation Petitioning Costs

Compulsory liquidation petition fees often come from the creditor’s side. If the court grants a winding-up order, the insolvent company liquidation costs can escalate, involving court expenses and a possible investigation into director legal duties in insolvency. These added expenses often go hand in hand with the legal consequences of compulsory liquidation, such as frozen accounts, director scrutiny, or disqualification risks. On the other hand, a voluntary liquidation cost analysis usually reveals lower administrative burdens, provided directors cooperate and keep comprehensive records. This collaborative approach typically avoids the additional legal fees inherent in a court-driven liquidation.

Members’ Voluntary Liquidation (MVL) for Solvent Companies

MVL caters to solvent businesses that can settle all their debts within 12 months. While still a formal insolvency process, an MVL has unique fee structures. Solvent company liquidation cost often includes set-priced packages for licensed insolvency practitioner fees, which can be lower than those for insolvent companies. MVL costs allow directors to streamline distribution of surplus funds among shareholders. This route is favoured by businesses with good cashflow and zero creditor disputes.

Who Pays for Liquidation?

In a typical creditors’ voluntary liquidation, professional fees come from the company’s remaining funds or by realising company assets. Voluntary liquidation paid by company means directors must authorise the arrangement before the business’s closure finalises. Conversely, in compulsory liquidations triggered by unpaid creditors, petitioning creditor pays costs upfront, later reclaiming them from potential asset realisations. Understanding who shoulders these fees clarifies any risk of personal liability for company debts.

Comparing Compulsory and Voluntary Liquidation Costs

When looking at company liquidation cost comparison, compulsory liquidation can carry hidden risks. The official receiver or appointed liquidator scrutinises director conduct, raising the possibility of breach of director duties claims. Court involvement may mean added professional fees, and the process can be difficult to control. By contrast, a voluntary approach offers more certainty around licensed insolvency practitioner charges, fewer legal overheads, and a swifter process, making it an attractive solution.

Director Duties and Potential Liabilities

Directors are duty-bound to act in the best interests of creditors when their company becomes insolvent. Ignoring these responsibilities leads to breaches of director legal duties in insolvency. Personal liability can emerge if directors continue trading while insolvent or fail to cooperate during liquidation. Demonstrating transparency via a voluntary liquidation method cost comparison often highlights that compliance can save money in the long run, and reduce director disqualification risk.

Plant, Property, and Equipment Valuation

Physical company assets—such as property, vehicles, or machinery—hold value that can offset liquidation fees. During both court-led and voluntary liquidations, a liquidator asset valuation process determines realistic market prices for these holdings. In a voluntary scenario, directors and insolvency practitioners collaborate to organise timely asset sales, often achieving stronger returns. When realising company assets is done carefully, the net cost difference company vs voluntary liquidation becomes more pronounced.

Insolvent and Solvent Closure Timelines

Besides the monetary factor, time is crucial in deciding which is cheaper: company liquidation or voluntary liquidation. Compulsory routes often span many months, if not longer, due to court scheduling and investigations. Voluntary wind-ups can unfold more swiftly, especially when directors prepare meticulously. Early engagement ensures a smoother path: it shortens the company winding up cost vs voluntary winding up gap, allowing you to settle matters before liabilities multiply.

Managing Complex Liquidation Cases

If your company holds intricate financial structures, multiple creditors, or disputed liabilities, the liquidation method cost comparison becomes critical. Complex liquidation cases may force deeper investigations, escalate licensed insolvency practitioner fees, and prolong timelines. By proactively gathering documentation and consulting experts like Nexus Corporate Solutions, you can reduce the extra costs that arise from unforeseen legal hurdles. Collaboration with creditors helps prevent disagreements that drive up professional fees.

Professional Fee Structures in Voluntary Liquidations

In a voluntary liquidation, cost transparency is generally higher. Insolvency practitioners often propose streamlined packages, factoring in realisable assets and the tasks required for closure. Some directors fear that total liquidation fees UK are out of reach, but with the right planning, fees can be proportionate. As you compare company liquidation cost vs voluntary liquidation, remember that voluntary approaches typically allow more negotiation, making them especially advantageous for cost containment.

How Liquidation Fees Are Paid

The method of paying liquidation fees depends on the company’s remaining funds, assets, or an agreement with directors. Where there is sufficient cash, the insolvent company liquidation costs come off the top before creditors receive distributions. Proceeds from selling property and vehicles can also offset fees. If the company remains solvent, members might pay for licensed insolvency practitioner fees directly, ensuring the business closure does not drag on because of limited liquidity.

Avoiding Additional Legal Consequences

Waiting for creditors to file a compulsory liquidation petition can lead to further liabilities and potential allegations of wrongdoing. Directors who ignore warning signs risk personal claims from creditors, along with costly court procedures. By opting for a voluntary liquidation cost analysis and responding swiftly, you demonstrate accountability to creditors and reduce the possibility of personal liability for company debts. This responsible choice frequently minimises overall expense and stress alike.

Nexus Corporate Solution's Approach

At Nexus Corporate Solutions, our aim is to demystify liquidation method cost comparison and advise you on whether a court-led or voluntary route suits your situation. We recognise that each company’s finances, asset base, and circumstances differ. Through comprehensive assessments, we estimate potential liquidation fees, highlight ways to realign your business strategy, and handle communications with creditors. Our holistic support ensures you understand which route offers greater financial stability and clarity, while guiding you towards cost-effective business exit strategies that preserve value and minimise personal risk.

Realising the Financial Benefits of Voluntary Action

While a forced closure can strain relationships and rack up costs, a voluntary liquidation cost analysis often reveals financial benefits: fewer legal entanglements, a clearer timeline, and more control over how liquidation fees are allocated. Directors who choose a voluntary route maintain better creditor rapport and demonstrate cooperation, improving the chance of more favourable terms. By evaluating these factors in advance, you lay the foundation for a more cost-effective outcome.

Practical Steps for Directors Considering Voluntary Liquidation

Gather updated financial statements and inventories of all physical company assets.

Consult a licensed insolvency practitioner to discuss cost to liquidate a limited company.

Compile evidence of insolvency or solvency, ensuring compliance with directors’ obligations.

Engage with shareholders early for support, especially if an MVL is an option.

Stay communicative with creditors and third parties to maintain transparency.

By following these guidelines, directors streamline the winding up process.

Summing Up the Cost Difference

Ultimately, the cost difference company vs voluntary liquidation hinges on timing, cooperation, and asset realisation strategy. Court involvement risks additional expenses, extended timelines, and heightened scrutiny. Voluntary routes offer predictability, letting directors preserve as much value as possible while avoiding undue stress. The exact expense depends on each business’s circumstances, but with diligent preparation and a trusted insolvency partner, you can find the most effective route for your closure.

Conclusion

When weighed properly, company liquidation cost vs voluntary liquidation typically favours a voluntary approach—provided directors act early and responsibly. This safeguards company assets, curtails legal complexities, and reduces the overall expense. By comparing all aspects—from licensed insolvency practitioner fees to realising tangible assets—you can make a strategic decision.

Ready to explore the best solution for your business? Nexus Corporate Solutions offers professional guidance on liquidation fees, asset valuations, and compliance with UK insolvency law. Our specialists will help you determine if a voluntary liquidation is right for you, ensuring a transparent process that protects both your finances and peace of mind.

Forced by creditors, or prompted by unpaid debts, compulsory liquidation in the UK can be one of the most stressful processes for company directors. Unlike voluntary closures, a compulsory winding up is a formal insolvency process ordered by the court. Legal risks and fees in compulsory liquidation often escalate rapidly, covering winding up petition (WUP) costs, official receiver expenses, and more. Understanding how these fees arise is key to minimising your exposure.

Backing businesses through financial distress, Nexus Corporate Solutions helps directors navigate the uncertainties and obligations tied to this legal procedure. If you are grappling with outstanding debts, unsettled statutory demands, or a potential winding up order court hearing, exploring your options early—including considering voluntary liquidation for insolvent companies—can spare you from punitive legal consequences of liquidation. In this guide, we will walk you through the typical compulsory liquidation legal fees, associated risks, and ways to protect your position.

How Compulsory Liquidation Begins

Compulsory liquidation starts when a creditor files a winding up petition, usually after repeated attempts to recover debts fail. If the court grants the petition, a winding up order finalises the process, and the official receiver takes control of the company. At this stage, directors lose control of day-to-day operations. Company bank accounts are commonly frozen, preventing normal trading. These steps not only incur legal costs of winding up a company but also limit potential rescue options.

The Court-Ordered Nature of Liquidation

Unlike a creditors voluntary liquidation (CVL), where directors choose an insolvency practitioner, a compulsory liquidation is overseen by the court. The court-controlled liquidation process entails formal hearings and official receiver involvement, which drives up compulsory winding up costs. The petitioning creditor pays initial legal fees, but those costs often transfer to the company’s assets if they can be recovered. Therefore, if your firm lacks resources, liabilities may extend into personal guarantees.

Legal Consequences of Liquidation

When a winding up order is issued, the company faces immediate legal implications of company liquidation. Ongoing contracts are voided or paused, employees are laid off, and outstanding debts remain enforceable. This formal cessation influences how any remaining stock, vehicles, property, or machinery are handled. Selling company assets liquidation style allows for creditor repayment, but seldom yields any surplus for directors. If misconduct is suspected, further legal risks of compulsory liquidation arise.

Risks and Penalties in Liquidation

Compulsory liquidation expenses and risks can include the potential for wrongful trading or even fraudulent trading allegations. Directors who continue taking credit while knowing the business is insolvent may violate the law. Such breaches encounter stiff penalties, ranging from personal liability to director disqualification compulsory liquidation. Courts scrutinise whether directors have prioritised creditors’ interests once insolvency is likely. Minimising these risks requires professional advice and transparent financial practices.

Official Receiver and Investigations

Soon after the court order, the official receiver assumes control of the company’s affairs, investigating its finances and director conduct. This phase can unearth wrongdoing or personal guarantees covering certain company debts, intensifying the risks of compulsory liquidation. Directors refusing to cooperate may face swift legal consequences of liquidation, including forced interviews, account scrutiny, and potential criminal charges. Early engagement with a licensed professional is essential for limiting reputational and financial damage.

Compulsory Liquidation Legal Fees Explained

Compulsory liquidation legal fees can be significant, covering solicitors’ charges, court costs, and official receiver’s fees. Initially, petitioning creditors foot these bills. However, once the liquidator recovers money from selling business assets, the creditor can recoup their legal outlay. Both secured and unsecured creditors might line up, hoping to claim a portion of any funds. If the asset realisation falls short, you could face ongoing liabilities if personal guarantees are in place.

Directors’ Personal Exposure

When debts outstrip assets, directors may wonder whether outstanding debts are written off liquidation style. Generally, the company’s liabilities dissolve, but if personal guarantees were provided, you remain personally liable. Breach of fiduciary or wrongful trading duties can also open the door to lawsuits or director disqualification. Personal assets—like your home—could be at risk if creditors can prove you did not act in good faith under insolvency rules.

Comparing Compulsory Liquidation vs Voluntary Liquidation

In many instances, directors can avoid massive compulsory liquidation legal fees by proactively entering a creditors voluntary liquidation. Under a CVL, directors choose an insolvency practitioner and maintain a certain level of control. By swiftly addressing unpaid debts, you sidestep court interventions and reduce the possibility of an extensive official receiver probe. In contrast, a court-driven approach inflates litigation overheads, prolongs finalisation, and may expose directors to deeper legal scrutiny.

Costs Linked to Asset Realisation

During compulsory liquidation UK processes, the official receiver or appointed liquidator sells off company property, vehicles, machinery, or stock to repay creditors and cover liquidation legal charges explained in court documents. Each step—valuation, marketing, auctions—incurs expenses. Lower-value assets might not offset these costs, leaving little for unsecured creditors. Directors who misinterpret these procedures or underestimate associated fees risk higher personal financial exposure if personal guarantees or other liabilities are discovered.

Immediate Effects on the Business

Once a winding up petition is granted, company accounts are usually frozen. This cripples day-to-day trading, making it impossible to fulfill orders, pay employees, or settle bills. It is a stark reminder of the risks of compulsory liquidation. Because directors lose control company closure, brand reputation also suffers, and customers may move on permanently. Being proactive, seeking advice, and potentially choosing a voluntary route helps prevent such abrupt disruption.

Potential for Director Disqualification

If investigations uncover misconduct—like fraudulent trading or continuing to accept credit while insolvent—directors can face disqualification for several years. The official receiver’s report to the Insolvency Service often triggers this procedure. In severe cases, criminal charges or fines follow. The same scrutiny occurs in some voluntary settings, but typically with fewer unknowns and crippling legal implications of company liquidation. Foresight and cooperation with insolvency practitioners can mitigate personal liability.

Statutory Demand Non-Compliance

Ignoring a statutory demand for unpaid debts is often the first step on the road to a winding up petition. Failing to act within the specified timeframe gives creditors serious legal ammunition to seek compulsory liquidation. Consequently, you risk larger compulsory winding up costs, plus the stigma of court involvement. Simultaneously, you miss out on negotiated payment plans or arrangements that reduce or spread out legal fees and liquidation risks.

Court Hearings and Representation

A winding up order court hearing grants creditors and the company an opportunity to present evidence. Missing the hearing can accelerate a detrimental judgment. The court typically charges fees, and legal costs of winding up a company can mushroom if multiple hearings are necessary. Solicitor representation is often essential, leading to further compulsory liquidation legal fees. Preparing robust financial records and clarifying any misunderstandings in advance can avert costly delays.

Personal Guarantees in Focus

Personal guarantees for business loans or supplier contracts add another layer of compulsory liquidation expenses and risks. If the business cannot repay the loan from asset sales, creditors may enforce personal liability against the directors who signed guarantees. This highlights why ignoring or postponing a formal insolvency process is rarely wise. By proactively seeking professional assistance, you stand a better chance of negotiating payment offsets or minimising potential personal losses.

Potential Alternatives to Compulsory Liquidation

Directors who see trouble ahead do not have to wait for a forced winding up. Options like a creditors voluntary liquidation (CVL) or informal negotiations with creditors can lower both risks and penalties in liquidation. Affordable and low-cost voluntary liquidation solutions are often available, helping directors resolve debts without excessive legal costs or severe personal liability. By voluntarily entering insolvency, you align with best practices, mitigating official receiver scrutiny. This reduces the prospect of severe penalties such as disqualification or personal liability for debts. Moreover, voluntary avenues often cost less overall.

Minimising Legal Consequences of Liquidation

Early, transparent communication is paramount. Provide honest financial documents, consult an insolvency expert, and consider restructuring your business before formal legal action occurs. In many cases, potential disputes can be resolved without the courts, saving you from compulsory liquidation legal fees. If formal liquidation is inevitable, thorough preparation calms creditor nerves and ensures the official receiver sees you made every effort to discharge your duties correctly, minimising further penalties.

Conclusion

Compulsory liquidation brings steep legal consequences of liquidation, from court hearings and official receiver fees to director investigations and potential personal liability. By failing to address statutory demands or creditor disputes promptly, you risk reputational harm, frozen accounts, and intense scrutiny. Understanding these dangers helps you protect your business interests.

If you suspect compulsory liquidation may be on the horizon, reach out for professional help. Nexus Corporate Solutions stands ready to advise on the legal risks and fees in compulsory liquidation, while also guiding you through understanding company liquidation options like voluntary routes and debt management strategies. With timely action, you can limit exposure, safeguard your assets, and navigate distress with confidence.

In the UK, deciding to shutter a small enterprise can be challenging, especially when financial pressures mount and creditors knock. Fortunately, there are affordable ways to close a small business that avoid hefty fees and lengthy court battles. With the right insolvency guidance, you can follow a structured route that respects regulations, protects your interests, and ensures minimal disruption.

At Nexus Corporate Solutions, we specialise in helping company directors identify low-cost company liquidation options and business closure options. Whether you opt for a voluntary liquidation process, formal dissolution, or a solvent Members’ Voluntary Liquidation (MVL), our focus is on minimising stress and expenses. In this guide, we explore crucial steps to reduce costs, maintain compliance, and exit gracefully, all while safeguarding your financial position.

Why Plan for a Low-Cost Business Closure?

Closing a business involves legal obligations, insolvency practitioner fees, and potential court actions. By planning in advance, you can achieve budget-friendly business winding up, lock in affordable voluntary liquidation terms, and avoid unnecessary delays. Timely record-keeping and open communication with creditors are essential. These measures help reduce expenses when closing a company, allowing you to exit smoothly and protect directors’ interests.

Considering the Type of Liquidation

For insolvent businesses, a Creditors’ Voluntary Liquidation (CVL) often proves cheaper than waiting on compulsory liquidation. If your business remains solvent, an MVL can trim costs further, since fewer creditor claims must be resolved. The cheapest way to liquidate a small business depends on company size, complexity, and cashflow. A licensed insolvency practitioner can advise on choosing the most suitable path. By taking time to compare business liquidation costs, directors gain clarity over fees, professional charges, and asset realisation strategies—making it easier to budget for a smoother closure.

Exploring Company Dissolution for Small Businesses

An affordable company dissolution may be ideal for smaller entities with no outstanding debts. Filing to strike off the business from the Companies House register can be a cost-effective way to shut down a business, provided all liabilities are settled. Directors must ensure they meet the eligibility criteria, and an expert review decreases the risk of legal complications later on.

Utilising Director Redundancy Pay

Directors who qualify for redundancy can use part of that payout to help with the liquidation process. This funding can provide valuable financial support when liquidating a limited company. By bringing it into the formal insolvency process, you ensure the closure is managed properly and remains within the framework of UK regulations.

Engaging a Licensed Insolvency Practitioner Early

Many directors delay professional help, only to face spiralling costs. By appointing an insolvency practitioner early and liaising with creditors from the outset, you create cheap small business liquidation options. Quick action stops interest and penalties from ballooning. With guidance on shareholder cooperation and a transparent approach, you sidestep complications, preserve goodwill, and keep the liquidation timescale as short as possible.

Following a structured small business liquidation guide ensures each step is handled efficiently and affordably.

Managing the Liquidation Timescale

How long does liquidation take? It depends on clarity and cooperation. When directors provide accurate financial statements and maintain prompt contact with stakeholders, the liquidation timescale shortens. This proactive stance curbs rising fees. By ensuring all documentation is in order, from final accounts to director conduct checks, you streamline the voluntary liquidation process and limit unnecessary administrative costs.

Maintaining Accurate Financial Records

Disorganised accounts can significantly inflate the cost of closing a small business. For a truly budget-friendly business winding up, ensure your records are comprehensive, up-to-date, and ready to review. Proper bookkeeping helps the insolvency practitioner quickly assess liabilities, realisable assets, and creditor claims, thus reducing professional fees. Transparency also improves negotiations with creditors, encouraging mutual confidence and smoother settlements.

Negotiating Payment Terms with Creditors

In some cases, striking agreements with creditors can lower small business closure cost savings. Creditors prefer settled amounts over contentious, drawn-out disputes. By showing genuine willingness to repay, you may secure reduced balances or extended deadlines. This amicable approach cuts legal fees tied to compulsory liquidation and keeps relationships intact—particularly useful if you plan future ventures in the UK.

Asset Realisation for Cost Coverage

A crucial part of cheap small business liquidation options lies in realising valuable assets. By auctioning equipment, selling stock, or transferring intellectual property, directors can generate funds to cover liquidation expenses. Adequate asset valuation ensures these items fetch fair market prices, offsetting costs like insolvency practitioner fees. This helps directors minimise liabilities promptly and finalise an affordable exit strategy.

Streamlining the Formal Insolvency Process

Complexities often arise from incomplete paperwork, shareholder disagreements, or unexpected liabilities. Every extra day brings administrative costs. Focusing on a clear plan to close your small business using cost-effective ways, like early creditor engagement and consistent updates, helps control fees. This structured approach reduces the risk of delays and ensures you remain compliant with UK insolvency rules and regulations.

How Nexus Corporate Solutions Helps

Nexus Corporate Solutions champions affordable ways to close a small business through expert advice and proactive strategies. Our licensed insolvency practitioners handle everything from insolvent company liquidation to solvent closures. We tailor our support to your budget, minimising professional fees while ensuring high compliance standards. By addressing issues early, we shorten liquidation timescales and create a smoother exit for directors.

Considering Alternatives to Liquidation

Liquidation might not always be your best path. Company administration, or a structured deal with creditors, may be more cost-effective if your enterprise has potential for rehabilitation. Meanwhile, partial restructuring or time-to-pay arrangements can reduce immediate liabilities. Exploring these alternatives in partnership with an insolvency practitioner offers a fresh start without incurring unnecessary formal fees.

Conclusion

Closing a small business can be financially daunting, but cost-effective methods exist. By safeguarding records, identifying affordable voluntary liquidation options, and exploring director redundancy entitlements, you can secure an efficient exit. This approach helps you avoid hidden fees, streamline timelines, and uphold director responsibilities in line with UK insolvency regulations.

If you are ready to minimise expenses or assess alternative routes, Nexus Corporate Solutions can help. From low-cost company winding up processes to tailored advice, our team ensures you receive the right support at each stage. Speak with our licensed insolvency practitioners, and start preparing an affordable exit plan for your small business today.

In the UK, closing a struggling business can be daunting, especially when directors face mounting debts and urgent creditor demands. A major concern is finding closure methods that align with budget constraints. Naturally, many ask: is voluntary liquidation cheaper than other alternatives? From comparing compulsory liquidation expenses to exploring the cost of voluntary liquidation, understanding what influences final fees can save significant time, stress, and money. It all starts with careful research.

That is where an insolvency partner like Nexus Corporate Solutions makes all the difference. We work alongside you, focusing on affordable company liquidation options suited to your specific needs—be it a solvent liquidation procedure or a creditors voluntary liquidation (CVL). In this guide, discover why voluntary liquidation often proves cost-effective, what fees to expect, and how to make the right decision for your business.

Voluntary Liquidation vs Compulsory Liquidation Cost

Voluntary liquidation vs compulsory liquidation cost remains a hot topic among directors. When creditors force a winding-up petition through the courts, expenses can quickly escalate. Court fees, legal representation, and official receiver involvement all contribute to hefty company liquidation charges. In contrast, a voluntary liquidation is often managed directly by licensed insolvency practitioners, reducing administrative overheads. This can translate to a smoother and, in many cases, cheaper way to close a limited company UK-wide.

Beyond fees, directors must also weigh compulsory liquidation legal risks—from the potential for director investigations to reputational damage and loss of control once the process is handled by the courts.

How Much Does Voluntary Liquidation Cost?

The cost of voluntary liquidation will vary depending on factors such as company size, creditor numbers, and complexity of assets. Generally, fees include a licensed insolvency practitioner’s services, as well as administrative tasks like creditor notifications. While there is no single price tag to suit all, those seeking the cheapest way to liquidate a company often find a voluntary process more predictable. Proactive directors can also help manage costs by keeping records up to date and planning carefully for company liquidation with limited funds.

Is Liquidation Affordable for Small Enterprises?

Smaller companies may fear the liquidation process is too expensive. However, is liquidation affordable? The answer often lies in proper planning. By opting for a creditors voluntary liquidation (CVL) and cooperating fully, you can expect lower licensed insolvency practitioner fees because the procedure is more straightforward. Directors who promptly gather financial records, address creditor concerns, and coordinate asset valuations ease the workload, helping ensure a quick company liquidation without hidden surprises.

The Role of Solvent Company Closure Options

When a business remains solvent, a Members Voluntary Liquidation (MVL) is a structured, cost-effective pathway. Here, the company has sufficient assets to repay its debts, reducing risk for all parties. MVLs also come with potential MVL tax advantages, such as capital gains tax savings MVL can provide over standard income tax rates. This solvent liquidation procedure ensures the process is transparent, allowing directors to extract remaining funds while avoiding unnecessary legal fees.

Cheap Company Dissolution vs Voluntary Liquidation

Dissolving a company by striking it off at Companies House is sometimes viewed as the cheapest way to close a company. However, it only applies if there are no outstanding debts. A quick online company strike off application can sound appealing, yet HMRC strike off objections quickly arise if taxes or debts go unpaid. Where liabilities exist, you cannot simply dissolve and walk away; ignoring debts can prompt a compulsory liquidation risk instead.

Factors Affecting Voluntary Liquidation Affordability

Is voluntary liquidation cost-effective? Several aspects determine your final bill:

Company complexity: More creditors or disputed debts increase costs.

Realisation of assets: Liquidation fees covered by assets can reduce direct expenses.

Licensed insolvency practitioner fees: Agreed pricing can depend on the time needed to close insolvent company debts.

With proactive communication and orderly finances, your business stands a better chance of achieving a truly budget-friendly closure.

The Importance of Director’s Personal Liability Considerations

Beyond fees, directors must also guard against personal liability risks. If a firm is insolvent, continuing to trade could result in wrongful trading claims. Voluntary liquidation encourages compliance with insolvency legislation and prevents further debt escalation. By embracing a formal closure route, directors show good conduct, thereby reducing claims from creditors and preserving their future business reputation. The earlier you act, the more cost savings you typically achieve.

Choosing the Cheapest Way to Liquidate a Company

Directors often want the cheapest way to liquidate a company without jeopardising compliance. A well-managed CVL is typically more cost-effective than letting disgruntled creditors push for a court-led liquidation. Ensuring that financial records are complete significantly helps your insolvency practitioner speed up the process, minimising professional charges. This approach provides clarity for all parties while allowing for an orderly repayment of debts, a fair distribution of assets, and minimal legal complications.

MVL vs CVL: Which Suits You?

An MVL applies to solvent businesses looking for a structured exit. It can swiftly release funds to shareholders, often at favourable tax rates. A CVL deals with insolvent firms that can no longer manage outgoings. In each scenario, the voluntary process tends to be cheaper than compulsory liquidation. Whether you are seeking a solvent or insolvent company closure option, weigh your company’s financial status carefully to identify the most appropriate and cost-efficient route.

Quick Company Liquidation and Time Savings

Time is often money when it comes to business closures. The three month company strike off process, for instance, can be hindered by HMRC objections if the business owes taxes. Meanwhile, a voluntary liquidation can wrap up sooner if records are thorough and creditors are cooperative. This reduces extra costs tied to prolonged administrative tasks, ensuring no unnecessary extension of licensed insolvency practitioner fees or additional company liquidation charges.

Can Redundancy Pay Offset Voluntary Liquidation Fees?

Many directors do not realise they might be entitled to redundancy pay for directors, depending on employment status within the business. If eligible, any payout can help offset the cost of voluntary liquidation, giving you extra financial relief. This can be particularly beneficial if the company’s assets are limited. Ensuring you properly document your director-employee status is vital when applying for redundancy. Consult with an insolvency expert to confirm eligibility and streamline the process.

Strategies to Minimise Voluntary Liquidation Expenses

Maintain accurate accounts: Up-to-date bookkeeping lowers investigation time.

Engage early: Rapid responses to creditor queries prevent disputes.

Negotiate with suppliers: Settling essential liabilities upfront can reduce further interest or late-payment penalties.

Conduct a thorough asset review: A clear itemisation of physical stock, property, or trademarks bolsters valuations.

By applying these tactics, you can ensure that your voluntary liquidation is as streamlined—and budget-friendly—as possible.

The Nexus Corporate Solutions Advantage

At Nexus Corporate Solutions, our focus is guiding UK companies towards the most suitable closure path. We emphasise affordable company liquidation options, whether through an MVL for solvent businesses or a CVL for insolvent situations. Our licensed insolvency practitioners handle every detail, from asset valuation to creditor negotiations. By partnering with us, you benefit from expert oversight, ensuring minimal disruption, complete disclosure, and a cost of voluntary liquidation that aligns with your budget.

Avoiding Compulsory Liquidation Pitfalls

Once creditors escalate matters to court, director autonomy declines. This path can bring heavier court fees, official receiver scrutiny, and reputational harm. Directors might even face personal financial losses if they have given personal guarantees. Meanwhile, with a voluntary liquidation process in full motion, you keep more control over how quickly the closure unfolds, who manages the assets, and how to reduce expenses. Voluntary liquidation vs compulsory liquidation cost rarely favours the forced approach.

Planning for a Post-Liquidation Future

While the closure of your company may feel final, it can also present an opportunity to move on with minimal baggage. By acting responsibly and choosing a cost-effective route, you finish on good terms with creditors and employees. This approach helps maintain your future standing as a director, facilitating any new ventures you pursue. A quick company liquidation also spares you ongoing stress, freeing you to focus on fresh opportunities.

Conclusion

So, is voluntary liquidation cheaper? In many cases, yes. By acting early, maintaining proper records, and engaging an insolvency expert, you can keep costs low and take more control of the timeline. This approach often proves the cheapest way to close a company responsibly, protecting you from extra legal and financial headaches.

If you are exploring how much voluntary liquidation cost—and whether it is truly affordable—speak with Nexus Corporate Solutions. Our licensed insolvency practitioners tailor solutions to your specific situation, ensuring compliance with UK regulations. From CVLs to MVLs, we will help you navigate the process, preserve value, and close your limited company with confidence.

In the UK, many company directors worry about the financial and legal hurdles of closing a failing business. Factors such as mounting creditor pressure, cashflow difficulties, or dwindling market demand can quickly lead to the need for professional assistance. When the time comes to shut down operations, finding ways of reducing small business liquidation expenses is crucial. From legal protection to ensuring assets are handled correctly, expert insolvency guidance helps preserve financial stability and peace of mind during a stressful period.

That is where Nexus Corporate Solutions comes in. As a trusted UK-based firm specialising in debt solutions, restructuring, and various forms of liquidation, the team is dedicated to helping you avoid unnecessary costs and make informed decisions. This blog explores proven strategies to cut liquidation costs for small business owners, from understanding fee structures to leveraging cost-effective alternatives, including a clear overview of the creditors voluntary liquidation procedure.

Understanding Liquidation Costs

Before you can begin cutting liquidation costs for small business closures, it is essential to understand the fees involved. Typical expenses include the liquidator’s fee (often determined by the size and complexity of the case), insolvency practitioner fees, and statutory advertising. Additional administrative costs can arise from preparing the statement of affairs, finalising accounts, and covering disbursements, such as professional asset valuations. By learning how these elements factor into the total bill, you can identify key areas for potential savings.

The type of liquidation also has a bearing on the costs. In Creditor’s Voluntary Liquidation (CVL), a licensed insolvency practitioner (IP) negotiates with creditors to manage unpaid debts and oversee the process. In Members’ Voluntary Liquidation (MVL), reserved for solvent companies, the costs may be lower due to fewer creditor complications. Compulsory liquidation, initiated by creditors through court orders, can incur significant legal adviser fees and court expenses. Recognising these distinctions helps highlight where you might reduce voluntary liquidation fees.

Once you grasp the liquidation fees breakdown, consider the role of professional guidance. Without expert insolvency support, missteps can increase your financial burden. Directors who attempt a “DIY” approach sometimes face penalties, claims from creditors, or unexpected administrative costs. Seeking a cost-effective liquidation solution through a reputable firm like Nexus Corporate Solutions helps ensure compliance with UK insolvency regulations. This step empowers directors to minimise liquidation charges and avoid spiralling costs while winding up a business.

Key Steps to Cut Liquidation Costs

Proactive planning is among the most effective methods of minimizing business closure expenses. Being organised with up-to-date financial records, including bank statements, invoices, and liabilities, makes it easier for the insolvency practitioner to expedite the procedure. Timely preparation of a comprehensive statement of affairs, final accounts, and relevant compliance documents can lower small business closure costs. This streamlines the administrative workload, leading to fewer billable hours on the IP’s part and improved clarity for all stakeholders.

Negotiating fixed-cost liquidation packages offers another way to secure affordable liquidation costs. Licensed insolvency practitioners will often tailor their fees based on your business’s complexity. This approach lets you know precisely what to expect and budget accordingly. By choosing an IP with transparent pricing, you can avoid hidden charges that may inflate your final bill. With a clear cost framework, it becomes easier to keep track of disbursements, statutory advertising fees, and any additional administrative costs.

Asset realisation forms a critical part of the company liquidation process, as proceeds from asset sales offset liquidation expenses. Engaging a professional asset valuation expert—such as a chartered surveyor—ensures that you receive a fair and accurate estimate for tangible assets like machinery, office equipment, or real estate. By accurately pricing these assets, you avoid underestimating their worth. This directly reduces the cost of closing a company, as potential buyers are more likely to pay fair market value in a structured sale.

Selecting an experienced insolvency practitioner is key to achieving budget-friendly business liquidation. A seasoned IP can identify opportunities for early engagement with creditors, arrange possible payment plans, and guide you through workable debt solutions. By developing a well-informed strategy, you mitigate the risk of compulsory liquidation proceedings. This not only protects your reputation but also helps you focus on how to reduce liquidation expenses. Ultimately, trusted professional support can be far less expensive than hasty or ill-informed decisions, making closing a small business on a budget more achievable.

Navigating the Voluntary Liquidation Process

Voluntary liquidation typically involves several stages—director resolutions, shareholder meetings, and formal appointments of an insolvency practitioner. The goal is to control the process, rather than wait for a compulsory liquidation forced by the courts. Throughout the voluntary liquidation process, cost-saving tips for liquidation can be implemented, such as maintaining consistent communication with all parties involved. This fosters transparency and ensures creditors understand the steps you are taking to address outstanding liabilities.

Keeping accurate records helps reduce the cost of closing a company by allowing the IP to demonstrate that all information is gathered efficiently. Misplaced documents or unclear financial histories can slow the procedure and increase fees. By investing in proper bookkeeping and open communication, you show creditors a genuine attempt to resolve matters. This approach can help negotiate better terms or payment plans, ultimately lowering company winding up costs and easing administrative burdens.

Where a business remains solvent, a Member’s Voluntary Liquidation is well-suited for closing your company while keeping liquidation charges under control. If the company has sufficient assets to repay debts plus statutory interest, the IP can distribute remaining funds to shareholders. This route is often faster, with fewer complications than a CVL. Although there are still insolvency practitioner fees and statement of affairs fees to consider, early engagement and thorough planning can cut liquidation costs for small business owners substantially.

Exploring Cost-Effective Alternatives

Liquidation may not always be the only or the best route. Administration is sometimes used to protect the company from creditor actions while exploring rescue strategies. Though it comes with associated fees, it could be more cost-effective if there is a viable plan for turning the business around. By stabilising operations and working with an insolvency practitioner, directors have the chance to preserve value, which can lessen the financial destabilisation associated with shutting down operations prematurely.

Other debt solutions could also be worth exploring before winding up a business. A Company Voluntary Arrangement (CVA) allows directors to repay creditors via manageable instalments. This method helps you avoid court-initiated closures and preserve relationships with customers and suppliers. While there are still administrative costs and some legal adviser fees, a successful CVA can be more affordable than liquidation. By opting for a structured payment plan, directors have an opportunity to safeguard jobs and maintain a portion of the business.

For certain smaller entities with limited assets or liabilities, company dissolution might be a straightforward alternative. However, strict eligibility criteria apply, and it is vital to seek ethical, compliant advice. The process involves striking off the company from the Companies House register, eliminating many formal steps required in a full liquidation. Although there are still administrative essentials and potential statutory advertising costs, dissolution can be a cost-saving approach—provided there are no outstanding debts or unresolved disputes with creditors.

How Nexus Corporate Solutions Helps

Nexus Corporate Solutions offers specialised guidance on the best route forward, whether that means a CVL, MVL, or exploring administration and restructuring. The firm’s licensed insolvency practitioners are committed to minimising business closure expenses by clearly outlining each step of the process, from any liquidator’s fee to potential ways to negotiate with creditors. By customising a plan aligned with UK insolvency regulations, Nexus Corporate Solutions ensures you receive a transparent pathway to handle your debts responsibly.

A core principle at Nexus Corporate Solutions is providing cost-effective liquidation solutions that proactively safeguard directors’ interests. The team recognises how daunting liquidation expenses can be, especially for smaller businesses. They work closely with directors to identify unnecessary overheads, reduce voluntary liquidation fees, and direct resources where they matter most. This collaborative approach helps directors retain as much value as possible from the company’s remaining assets, while maintaining compliance with UK regulations and best practices.

From the initial consultation through to the final stages of winding up, Nexus Corporate Solutions offers unwavering support to ensure that you understand every fee. The firm’s commitment to clarity means you can expect a detailed liquidation fees breakdown, highlighting potential areas for further savings. This level of personalised expertise empowers you to make informed decisions, preserve financial stability, and exit a difficult situation with confidence. Ultimately, Nexus Corporate Solutions’ tailored approach can help to lower small business closure costs.

Conclusion

Closing a small business can be both emotionally and financially challenging, but reducing small business liquidation expenses is entirely feasible with the right support. By choosing professional guidance and exploring routes like MVLs, CVLs, or alternative rescue strategies, you ensure compliance with UK regulations while minimising costs. Taking these steps allows you to protect directors’ interests, preserve assets, and comply with legal duties during the winding-up process.

If you are ready to explore how to reduce liquidation expenses or need tailored guidance, reach out to Nexus Corporate Solutions. Their licensed insolvency practitioners will help you weigh your options, provide transparent pricing, and secure a viable pathway forward. Whether you are aiming for a cost-effective liquidation, restructuring, or rescue plan, professional advice can be the most valuable investment in safeguarding you and your business’s future.

How to Choose the Right Liquidator for Your Company Liquidation

Understanding how to choose the right liquidator is essential for any director facing the challenges of company liquidation. The decision you make will influence how smoothly the process runs, how creditors are treated, and how your responsibilities as a director are managed. A licensed insolvency practitioner brings the knowledge and structure needed to protect your interests, comply with the law, and guide your company through financial closure.

At Nexus Corporate Solutions Limited, we specialise in helping businesses in Doncaster and across the UK take confident steps toward liquidation with tailored advice and transparent support. By selecting the right liquidator, you gain more than technical expertise. You gain peace of mind and the reassurance that every stage of the process will be handled with care and professionalism.

The Role of Liquidators in Company Liquidation

A liquidator is an independent, licensed insolvency practitioner appointed to oversee the process of winding up a company. Their duties include:

-

Assessing the company’s assets, liabilities, and debts.

-

Selling or distributing assets to raise funds.

-

Ensuring creditors are treated fairly and in line with insolvency law.

-

Advising directors on their duties and responsibilities during liquidation.

-

Managing communication with creditors and stakeholders.

Beyond these responsibilities, liquidators act as a bridge between struggling businesses and the law, ensuring compliance while offering directors practical reassurance. They also provide clear documentation for legal and financial purposes, preventing costly mistakes that could lead to director penalties. In some cases, a liquidator may even identify alternatives to closure, such as restructuring or administration, if these serve the business and its stakeholders better. By taking responsibility for the company’s financial closure, a liquidator allows directors to focus on their future rather than the day-to-day stress of insolvency.

Why Experience and Local Expertise Matter

Not all liquidators bring the same level of expertise. Directors should look for a practitioner with proven experience in:

-

Handling voluntary liquidation and administration processes.

-

Advising on creditor negotiations and debt management.

-

Working with businesses of similar size and industry.

Experienced insolvency practitioners understand the nuances of different sectors, whether retail, construction, hospitality, or manufacturing. They anticipate creditor concerns, know how to manage complex asset sales, and can spot potential risks early in the process. Local knowledge also makes a difference. Insolvency practitioners based in Doncaster and the surrounding areas understand regional business challenges and can offer practical, accessible support. This combination of expertise and proximity ensures faster communication and solutions that reflect the realities of your business environment. For directors already dealing with stress, having a trusted local expert nearby provides reassurance and accessibility when it matters most.

How to Choose the Best Liquidator for Your Business

When comparing potential liquidators, directors should consider several criteria:

-

Licensing and Credentials – Always confirm the liquidator is a licensed insolvency practitioner.

-

Transparency on Costs – Request a clear breakdown of fees and services before proceeding.

-

Communication Style – Choose someone who provides honest advice and regular updates.

-

Track Record – Ask about their experience in similar cases and request examples of outcomes.

-

Support Beyond Closure – A reliable practitioner will guide directors through post-liquidation matters, including compliance and potential investigations.

These criteria help ensure you find not just a qualified professional, but a partner who understands your unique circumstances. A good liquidator will explain complex terms in plain language, offer realistic timelines, and reassure you about your obligations as a director. They’ll also make time to answer your questions, no matter how small, so you never feel left in the dark. By weighing these factors carefully, directors can make an informed decision that protects both company and personal interests. Remember, choosing a liquidator is not only about managing debts, but also about securing peace of mind for the future.

What to Expect During the Liquidation Process

Once a licensed insolvency practitioner is appointed, directors can expect a structured process:

-

Initial Review – The liquidator examines company finances, debts, and obligations.

-

Asset Realisation – Assets are sold or distributed to generate funds for creditors.

-

Creditor Communication – The liquidator keeps creditors informed and ensures compliance with insolvency law.

-

Fee Settlement – Liquidation costs, including practitioner fees, are deducted from asset proceeds.

-

Closure and Reporting – The company is formally dissolved, and directors are advised on any ongoing responsibilities.

Each of these stages involves clear communication with directors, so there are no surprises along the way. For example, during the asset realisation stage, directors are updated on how proceeds are applied and what portion will cover liquidation costs. At the reporting stage, a full account of the process is provided, giving directors transparency and closure. While liquidation can feel daunting, understanding the journey ahead can remove much of the stress. With an experienced practitioner guiding the process, directors know what to expect, how long it will take, and what steps will follow after closure.

Get Expert Liquidation Advice

Choosing the right liquidator shapes the outcome of your company liquidation and directly affects your future as a director. At Nexus Corporate Solutions Limited, we combine licensed expertise, local knowledge, and clear communication to make the process as smooth as possible. We recognise that every business is different, which is why our team tailors advice and support to your circumstances. Whether you’re exploring voluntary liquidation, restructuring options, or simply need advice on next steps, we provide straightforward guidance without unnecessary jargon.

Talk to Our Specialists Today

If your business is facing financial difficulty, contact us for a confidential, no-obligation consultation. Our friendly advisors will explain your options, outline the liquidation process, and provide tailored guidance to protect your interests. With our proven insolvency solutions, you’ll gain clarity, reassurance, and a structured plan for moving forward.

Tax Implications of Creditors Voluntary Liquidation

When a company can no longer meet its debts, directors may choose a Creditors Voluntary Liquidation (CVL) as a structured way to close the business. While the process helps protect creditors and ensures compliance with insolvency law, directors must also consider the tax implications of creditors voluntary liquidation. HMRC remains a priority creditor, and mismanaging tax obligations can expose directors to further risks.

The financial and legal outcomes of liquidation extend beyond asset disposal. Directors must manage corporation tax, VAT, and PAYE obligations, as well as understand how distributions and reliefs may apply. Failing to prepare adequately often leads to penalties, unnecessary costs, or prolonged closure. This guide provides practical insight into tax responsibilities, the role of insolvency practitioners, and strategies for directors who want to navigate liquidation responsibly and transparently.

What is a Creditors Voluntary Liquidation?

A CVL is initiated by the directors of an insolvent company when it becomes clear that the business cannot pay its debts. Unlike compulsory liquidation, which is forced through the courts, a CVL is a director-led process that involves:

-

Passing a board resolution to liquidate

-

Appointing a licensed insolvency practitioner

-

Notifying creditors and holding meetings

-

Selling company assets to repay debts

-

Removing the company from the register at Companies House

This procedure allows directors to take a proactive approach, demonstrating responsibility to creditors while ensuring the company’s affairs are wound up correctly.

Beyond the mechanics, CVLs also provide directors with a degree of control over the process. By acting early, directors can minimise the reputational damage associated with court-driven liquidation and show creditors that they are taking accountability. Although the company ultimately closes, choosing voluntary liquidation can reduce the risk of compulsory winding-up petitions, which often carry higher costs and stricter oversight.

For businesses in distress, the CVL framework represents a structured path to closure while balancing creditor protection and compliance with insolvency regulations.

The Role of Insolvency Practitioners in Tax and Compliance

Licensed insolvency practitioners (IPs) play a central role in managing tax matters during liquidation. Their responsibilities include:

-

Filing outstanding corporation tax returns

-

Handling VAT deregistration

-

Reporting to HMRC about director conduct

-

Ensuring PAYE and National Insurance obligations are addressed

By working with an IP, directors gain professional support that reduces errors and ensures statutory compliance. This is vital, as HMRC scrutinises the process closely to ensure all recoverable tax is paid before other creditors are considered.

Additionally, insolvency practitioners protect directors from inadvertently breaching regulations. For instance, directors may not always realise that they must stop trading once insolvency is identified. Continuing to trade could worsen the company’s financial position and lead to accusations of wrongful trading. IPs ensure directors meet their obligations, from filing correct paperwork to prioritising creditor interests. Their involvement also reassures creditors that the process is being handled fairly, which can encourage smoother cooperation during asset distribution and reduce disputes over tax or legal compliance.

Tax Implications During Liquidation

1. Corporation Tax and Business Taxes

Before liquidation, any unpaid corporation tax, VAT, and PAYE become part of the company’s outstanding liabilities. The insolvency practitioner calculates what is owed and ensures these debts are included in the claims made by HMRC. Directors should be aware that:

-

Tax returns up to the date of liquidation must still be filed

-

Late filings may trigger penalties, even during insolvency

-

HMRC often ranks as an unsecured creditor but retains significant influence in the process

These obligations demonstrate that liquidation does not eliminate the need for accuracy in tax reporting. If directors fail to cooperate, HMRC may escalate investigations, which could involve a review of company accounts over several years. This scrutiny can also extend to directors personally, particularly where loans or dividends were issued before insolvency. Early engagement with an insolvency practitioner ensures HMRC receives timely updates, reducing the likelihood of drawn-out disputes.

2. Liquidation Tax on Asset Disposal

When company assets are sold, the proceeds are used to repay creditors. The tax treatment of these disposals varies:

-

Capital Gains Tax (CGT) may apply on the sale of property or significant assets

-

Certain reliefs, such as Business Asset Disposal Relief, can reduce the tax burden in limited cases

-

VAT may still apply on asset sales, depending on the nature of the goods

For directors, understanding these rules is important because poor planning can increase tax exposure unnecessarily. Insolvency practitioners guide the process to ensure valuations are accurate, sales are conducted fairly, and records meet HMRC’s standards. This transparency reduces the risk of challenges after the liquidation is complete.

3. Distribution of Remaining Funds

If any funds remain after creditors are repaid, distributions to shareholders may be treated as capital rather than income. This often results in more favourable tax rates, but only if the liquidation is managed properly. Professional advice is crucial here to maximise outcomes.

The distinction between income and capital is often misunderstood, yet it can have a significant impact on tax efficiency. For example, in some cases, capital treatment may qualify for reduced CGT rates, whereas income distributions could attract higher income tax rates. Correctly structuring these final payments requires detailed knowledge of both tax law and liquidation procedures, making specialist advice essential.

Liquidation Fees and Their Impact on Tax Position

The costs of a CVL, including practitioner fees, legal expenses, and administrative costs, are paid from company assets before distributions to creditors. While these fees reduce the total available to creditors, they may also affect the tax position of the company by lowering the final balance that is subject to tax.

Transparent fee structures help directors and creditors understand the financial impact of the liquidation process. Working with a practitioner who clearly outlines costs can prevent disputes and reduce delays.

It is worth noting that fees vary depending on the complexity of the liquidation. Larger companies with multiple creditors, extensive assets, or ongoing disputes may face higher charges, whereas simpler liquidations can often be completed at lower cost. Directors should request a clear fee breakdown early in the process and ask how these charges may affect the treatment of company assets and outstanding tax. By doing so, they can plan effectively, avoid unexpected shortfalls, and reassure creditors that resources are being used responsibly.

Regulatory Duties and Winding Up Requirements

Directors must follow strict legal duties when entering voluntary liquidation. These include:

-

Acting in the best interests of creditors

-

Ensuring accurate financial reporting

-

Avoiding preferential payments to certain creditors

-

Submitting statutory documents to Companies House and HMRC

Failure to comply can result in personal liability or director disqualification. Insolvency practitioners ensure these duties are met, reducing the risks directors face.

The winding up process is governed by UK insolvency legislation, which places directors under legal obligations to remain transparent. For example, directors must not conceal assets or attempt to repay certain creditors ahead of others once insolvency is declared. Any sign of preferential or fraudulent activity may lead to formal investigation. By following the regulatory framework carefully, directors protect themselves from future penalties while ensuring creditors receive the fairest possible outcome. This structured compliance also improves confidence among stakeholders and strengthens the integrity of the process.

How Asset Disposal Affects Tax and Creditors

The disposal of company assets is a defining stage of liquidation. Assets such as property, equipment, or stock are sold to generate funds for repayment. The tax treatment depends on the asset type and disposal method. For example:

-

Property sales may involve CGT and Stamp Duty considerations

-

Inventory sales could trigger VAT liabilities

-

Transferring assets to connected parties requires scrutiny to avoid undervaluation

Handled correctly, asset disposal maximises value for creditors while reducing the likelihood of HMRC intervention.

Effective disposal strategies also influence how creditors perceive the process. For instance, transparent valuations and competitive sales methods reassure creditors that they are receiving fair treatment. Insolvency practitioners may choose between private sales, auctions, or trade-ins depending on the type of asset and the market conditions. Each decision carries tax consequences, which must be carefully managed to ensure compliance. By aligning disposal methods with creditor expectations and regulatory requirements, directors can reduce challenges and speed up the winding up process.

Personal Tax Implications for Directors

Although company debts generally remain within the company, directors may face tax-related consequences if they:

-

Have outstanding director loan accounts

-

Received dividends not supported by profits

-

Made preferential payments before liquidation

In these cases, HMRC may seek repayment directly from directors. This underlines the importance of clear financial records and early professional advice.

Beyond financial accountability, directors should also be aware that HMRC assesses their behaviour during insolvency. If a director has withdrawn funds improperly or prioritised personal gain over creditor interests, HMRC can take legal action to recover amounts owed. Personal guarantees linked to loans may also be enforced, leaving directors liable even after the company is dissolved. Seeking advice early helps directors anticipate these risks and develop strategies to protect personal finances while cooperating fully with insolvency requirements.

Tax Relief Opportunities in Liquidation

Despite the challenges, some tax reliefs may be available during a CVL:

-

Loss relief: Losses carried forward may reduce corporation tax up to the liquidation date

-

Business Asset Disposal Relief (BADR): Potentially applies to capital distributions, reducing CGT to 10% for qualifying directors and shareholders

-

VAT bad debt relief: If VAT was paid on invoices that remain unpaid, this may be reclaimable

Insolvency practitioners can help directors identify and apply for these reliefs, improving overall outcomes.

Reliefs are often overlooked because directors focus primarily on winding up the business. However, taking advantage of available reliefs can significantly reduce the financial burden. For example, VAT bad debt relief may be reclaimed if the company has written off unpaid invoices, while BADR may lower the tax rate on capital distributions to directors who qualify. These reliefs not only mitigate losses but also highlight the importance of seeking expert advice, as eligibility depends on precise conditions. Identifying reliefs early and building them into the liquidation strategy can make a tangible difference to the final financial picture.

Protecting Your Business Interests with Expert Guidance

Facing liquidation is daunting, but professional guidance ensures that directors meet their obligations while mitigating risks. Nexus Corporate Solutions Limited provides:

-

Detailed advice on liquidation tax and HMRC compliance

-

Support with asset valuation and disposal

-