Company Voluntary Arrangement: A Guide to Business Recovery

When a business begins to experience financial strain, directors often fear that insolvency or liquidation is the only way forward. In reality, there is a practical alternative designed to rescue struggling companies and preserve their future. A Company Voluntary Arrangement (CVA) is a statutory process that allows businesses to restructure debts, agree repayment schedules with creditors, and continue trading.

Start the CVL Process and Move Toward Resolution

Contact UsPersonalised Guidance

Informed Decisions

Continuous Support

Understanding the Fundamentals of a CVA

When a company faces financial distress, understanding your options is the first step to recovery. A Company Voluntary Arrangement, or CVA, offers businesses in financial difficulty an alternative to insolvency routes like liquidation or administration. Unlike more drastic processes, a CVA gives directors the chance to restructure liabilities and continue trading under the guidance of an insolvency practitioner.

At Nexus Corporate Solutions Limited, we believe every distressed company deserves clear advice and a tailored solution. That’s why we help demystify the CVA process, ensuring directors know what to expect at each stage and how a voluntary arrangement can benefit their company’s future.

Understanding a Company Voluntary Arrangement

A Company Voluntary Arrangement is a formal agreement made between a company and its creditors. It is legally binding and administered by a licensed insolvency practitioner, often referred to as the nominee or supervisor.

Unlike liquidation or administration, which usually involve selling assets or relinquishing control, a CVA enables directors to remain in charge of their business. The arrangement allows the company to repay debts over time, typically between three and five years, according to what the company can reasonably afford.

For directors, this means continuity of trading, retention of staff, and the opportunity to rebuild customer and supplier confidence. For creditors, it means a structured repayment that often produces better returns than forcing a business into administration.

For a company voluntary arrangement to proceed, at least 75% (by value) of the voting creditors must agree to the terms. This pivotal meeting determines whether the company’s future will be guided by the CVA or whether more severe steps, such as administration or liquidation, might follow. If approved, the CVA comes into effect immediately. At Nexus Corporate Solutions Limited, we’re committed to ensuring directors feel supported through each phase.

Why Businesses Consider a CVA

Directors often choose a CVA because it provides a balanced way to restructure without shutting the doors. A voluntary arrangement offers several important benefits:

Breathing space: Creditor action, such as winding-up petitions or enforcement, is paused.

Control retained: Directors continue to run the business under the guidance of an insolvency practitioner.

Improved creditor returns: Creditors often receive more than they would through liquidation.

Protection of jobs: Employees remain in place, preserving valuable knowledge and company culture.

Safeguarding reputation: By avoiding the stigma of liquidation, the company protects commercial relationships and brand value.

Safeguarding reputation: By avoiding the stigma of liquidation, the company protects commercial relationships and brand value.

For many directors, this route represents hope and a second chance to rebuild their business on more sustainable terms.

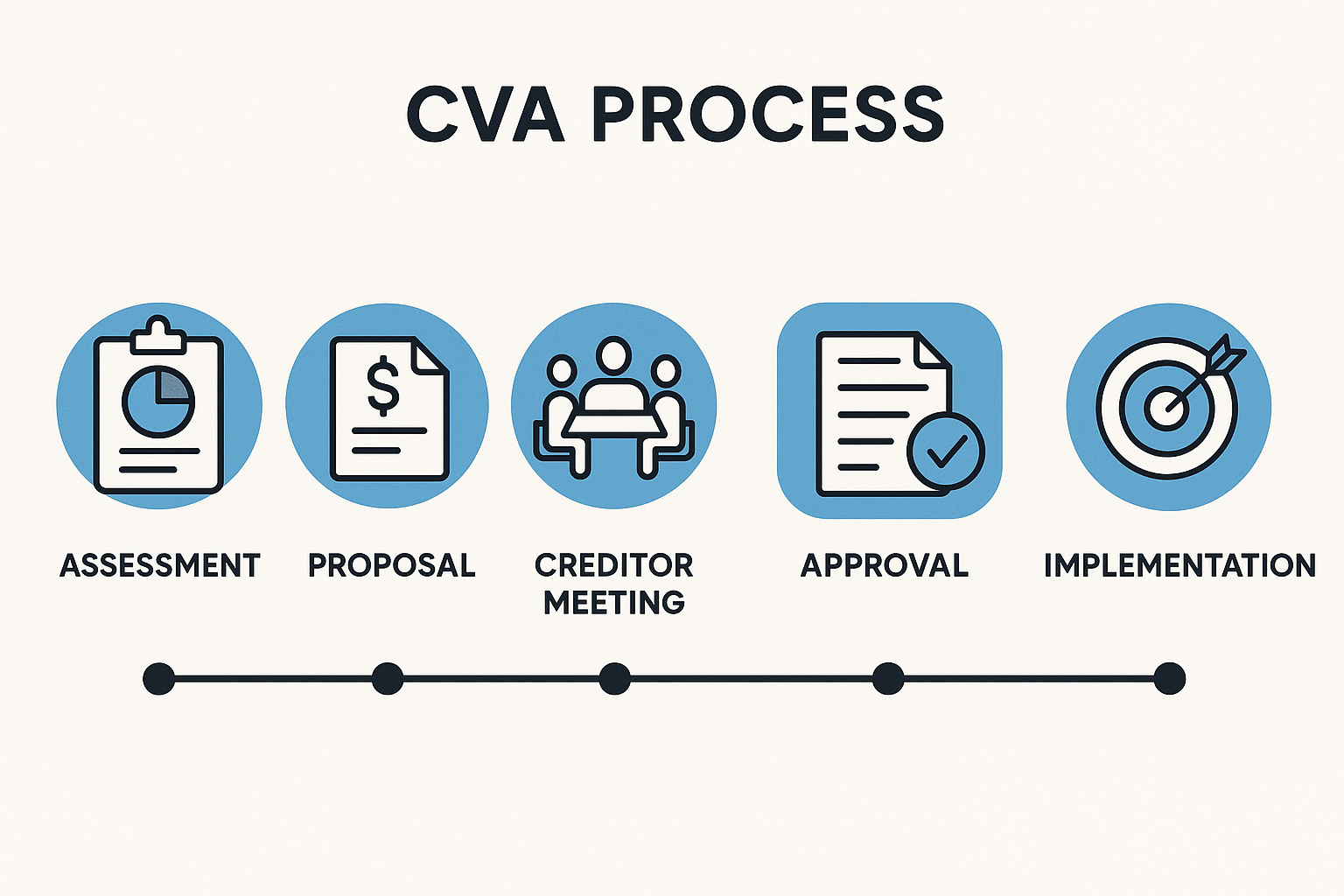

The CVA Process Explained: Step-by-Step Guidance

Navigating the CVA process can seem daunting, but understanding each step empowers directors to steer their company through challenging times. At Nexus Corporate Solutions Limited, we provide clear, actionable guidance from the outset, starting with seeking advice, drafting arrangement proposals, and proceeding through to implementation.

Our expertise as an insolvency practitioner ensures the process is both legally compliant and practical for your business’s needs. From the initial nominee report to creditor meetings and the statutory moratorium, we’re committed to supporting directors at every stage. Let’s clarify how a company voluntary arrangement works and how it may safeguard your operations and legacy.

The Role of the Insolvency Practitioner

An insolvency practitioner acts as an independent and licensed professional, balancing the interests of both the company and its creditors. Their responsibilities include:

Reviewing the company’s financial position.

Preparing the nominee report and arrangement proposals.

Acting as a neutral point of contact for creditors.

Supervising the arrangement once approved.

At firms like Nexus Corporate Solutions Limited, practitioners also provide transparent communication, proactive guidance, and reassurance to directors navigating this complex process.

How the CVA Process Works

The CVA procedure involves a number of structured steps, each designed to ensure transparency, fairness, and compliance with insolvency law.

Seeking Professional Advice

The process begins when directors consult a licensed insolvency practitioner. At this stage, the practitioner assesses the company’s financial position, liabilities, and ongoing trading potential. The advice given helps directors decide whether a CVA is the most viable option.

Drafting Arrangement Proposals

If a CVA is suitable, the insolvency practitioner prepares arrangement proposals. These documents outline the repayment terms, explain how the company plans to restructure its debts, and demonstrate its realistic trading prospects. The proposals are reviewed carefully to ensure that they are practical and equitable for creditors.

Statutory Moratorium

In some cases, the company may apply for a statutory moratorium. This legal protection prevents creditors from taking action while the proposal is being prepared and assessed. It allows directors to continue trading without constant disruption from creditor demands. The moratorium typically lasts until the creditors’ meeting.

Creditors’ Meeting and Decision

The proposals are presented to creditors, who then vote on whether to approve them. For the CVA to proceed, at least 75% (by value) of voting creditors must agree. If the proposal is accepted, the CVA becomes legally binding on all creditors, including those who voted against it.

Implementation and Supervision

Once approved, the company continues trading in line with the new repayment terms. The insolvency practitioner supervises the arrangement, ensuring that payments are made and compliance is maintained. Regular updates are provided to both the company and its creditors.

Benefits of Choosing a CVA over Other Insolvency Routes

Directors often compare voluntary arrangements with other insolvency procedures such as liquidation or administration. The advantages of a CVA include:

Retention of business control: Unlike administration, where external administrators often take over, directors remain in charge.

Better returns for creditors: Liquidation may result in fire-sale values, whereas a CVA offers creditors structured repayments.

Preservation of relationships: Suppliers and customers are reassured that the business remains active and committed.

Flexibility: Repayment schedules can be tailored to suit the business’s genuine capacity.

Job protection: Staff retention helps maintain continuity and avoids mass redundancies.

For directors, the process is not only about survival but about building a foundation for long-term resilience.

What Directors Should Know About CVAs

When directors first consider a Company Voluntary Arrangement, several practical issues usually come to mind. One of the most common concerns is whether a CVA is simply another form of liquidation. In reality, the two are very different. Liquidation closes the business permanently and results in the sale of assets, while a CVA is designed to allow the company to continue trading with new repayment terms in place.

Another important aspect is the duration of the arrangement. Most CVAs run for three to five years, though the exact timeframe depends on the repayment plan agreed with creditors. This gives companies enough time to restructure and stabilise while still offering creditors a fair return.

Directors must also understand the consequences of failing to comply with the arrangement. If repayments are missed and the terms are not met, creditors have the right to end the CVA and pursue other options, such as administration or liquidation. For this reason, proposals need to be realistic from the outset.

Finally, the role of creditors cannot be overstated. Their approval is what brings a CVA into effect, and they remain closely involved throughout the process. By working collaboratively with creditors and providing clear financial disclosure, directors can build trust and increase the likelihood of their proposals being accepted.

Practical Tips for Directors Preparing a CVA

Engage early: The sooner directors seek advice, the more options remain open.

Be transparent: Honest financial disclosure builds trust with both the practitioner and creditors.

Communicate with creditors: Engage key creditors in advance to address concerns.

Plan realistically: Repayment terms must reflect what the company can afford, not what directors hope for.

Use the moratorium productively: Focus on stabilising operations and preparing robust proposals.

By following these steps, directors improve their chances of securing creditor approval and successfully completing the arrangement.

Why Work with Nexus Corporate Solutions Limited

Selecting the right insolvency practitioner is as important as choosing the right restructuring option. Nexus Corporate Solutions Limited stands out by providing:

-

Clear, empathetic advice tailored to each company’s situation.

-

Transparent communication with directors and creditors alike.

-

Practical restructuring solutions that safeguard jobs and preserve company value.

-

Licensed expertise in insolvency law and financial recovery.

For directors facing financial uncertainty, this kind of support can mean the difference between decline and renewed confidence.

Work directly with seasoned insolvency practitioners.

Clear, step-by-step guidance through the CVA process.

CVA plans designed specifically for your business’s unique challenges.

Regular check-ins to ensure your business remains on track.

Read about businesses revived through our CVAs.

Empowering you with knowledge for confident decision-making

2,600+

£50M+

90%

Ready for a New Beginning?

Let’s work together

Address: Apex Building, 1 Water Vole Way, Balby, Doncaster, South Yorkshire, DN4 5JP

Tel: 01302 430180

Services

Company