What Happens When You Hire an Insolvency Practitioner Many UK directors and business owners face stressful financial problems—ranging from mounting debts to the risk of compulsory liquidation. When these challenges surface, seeking professional support can be the turning point. Hiring an insolvency practitioner UK for your company brings legal protection, business rescue opportunities in the […]

What Is Corporate Debt Restructuring and Its Types?

Corporate debt restructuring under English law is a vital tool for companies facing liquidity issues, allowing them to renegotiate financial obligations to continue operations and avoid formal insolvency under the Insolvency Act 1986. Strategies like Company Voluntary Arrangements (CVA) under Part 1 of the Insolvency Act 1986, debt-for-equity swaps, and debt rescheduling offer tailored solutions within the UK regulatory framework, overseen by the Insolvency Service and professional bodies like ICAEW, ACCA, and IPA. Each method impacts creditors and debtors differently under English law, altering control and financial forecasts under the statutory hierarchy of the Insolvency Act 1986. Understanding these mechanisms is key to navigating corporate recovery in England and Wales, where licensed insolvency practitioners provide essential guidance throughout the restructuring process. What might the implications of these strategies be for the broader economic ecosystem under the comprehensive UK legal framework? Corporate debt restructuring involves a company in financial distress renegotiating its debt obligations under English law to improve liquidity and continue operations, complying with the Insolvency Act 1986 and Companies Act 2006. This process requires intricate negotiations between the debtor and creditors, overseen by licensed insolvency practitioners authorised by the Insolvency Service and professional regulatory bodies, with roles and concessions defined by the UK statutory framework. Understanding this framework is crucial for stakeholders to assess the outcomes of restructuring efforts in England and Wales, where the regulatory environment provides comprehensive protection for both creditors and debtors. Debt restructuring in the corporate context means reorganising financial obligations under English law to manage liquidity and extend operational lifespan, complying with the Insolvency Act 1986 and Companies Act 2006. Initiated during financial distress, it involves negotiating with creditors, overseen by licensed insolvency practitioners, to adjust debt terms like repayment plans and interest rates, guided by the Insolvency Service. The goal is to allow the company to continue operations while fulfilling its financial obligations under the statutory hierarchy of the Insolvency Act 1986. A detailed financial restructuring strategy, crafted by licensed insolvency practitioners, may include debt-to-equity conversion, selling non-core assets, or securing new financing, all under the Companies Act 2006, to stabilise finances and restore profitability under English law. A creditor agreement is essential, requiring transparency from the company about its financial situation and recovery prospects, all within the UK regulatory framework established by the Insolvency Service and professional regulatory bodies. Corporate debt restructuring under English law reorganises a company's outstanding obligations to enhance financial stability and long-term viability, complying with the Insolvency Act 1986 and Companies Act 2006. It provides relief to companies struggling with repayments, allowing them to improve their financial position and continue operations sustainably, guided by the Insolvency Service. Debt for Equity Swap: This method converts a portion of the company's debt into equity under the Companies Act 2006, with creditors cancelling some debt for a stake in the company, overseen by professional bodies like ICAEW, ACCA, and IPA. Extension of Payment Terms: Creditors may extend payment durations under English law, giving the company more time to meet financial obligations without immediate pressure, following the statutory hierarchy of the Insolvency Act 1986. Restructuring Agreement: A formal agreement under English law outlines the new debt terms, complying with the Insolvency Act 1986 and Companies Act 2006, and guided by the Insolvency Service. These approaches make repayment more manageable and aid in business recovery under the UK legal framework. In corporate debt restructuring under English law, creditors are essential, agreeing to modify loan terms to aid the company's financial recovery, complying with the Insolvency Act 1986 and the statutory hierarchy. This agreement is pivotal to the restructuring plan's success, guided by the Insolvency Service and professional bodies like ICAEW, ACCA, and IPA. Negotiations adjust interest rates, extend payment schedules, or reduce debt principal under the Insolvency Act 1986. Restructuring may also involve debt-for-equity swaps, giving creditors a stake in the company's future in lieu of repayment, under the Companies Act 2006. This eases cash flow and aligns creditor interests with the company's success, guided by the Insolvency Service. Effective restructuring requires cooperation, transparency, and trust among all parties, complying with the Insolvency Act 1986. Restructuring debt under English law is about building a sustainable financial structure for the company's growth and stability, within the UK's comprehensive legal framework. Debt restructuring strategies under English law offer various pathways for corporations seeking financial relief, complying with the Insolvency Act 1986 and Companies Act 2006. These include debt-for-equity swaps and refinancing options, altering existing debt terms for more favourable conditions, guided by the Insolvency Service. Understanding different types of debt restructurings is essential for their specific applications and impacts on financial health within the comprehensive UK legal framework governing corporate insolvency and restructuring procedures. A debt-for-equity swap under English law is where creditors forgive debt in exchange for equity ownership, complying with the Companies Act 2006 and Insolvency Service requirements. This approach helps companies facing financial challenges manage debt and work towards stability under the Insolvency Act 1986. Converting debt into equity allows creditors to become shareholders with a chance to participate in future growth, guided by the UK regulatory framework. This streamlines debt structure and focuses on long-term growth without immediate repayment burdens, overseen by professional bodies like ICAEW, ACCA, and IPA. Key benefits include: Reduction in debt levels: Lowers immediate financial obligations under the statutory hierarchy of the Insolvency Act 1986. Improved balance sheet: Enhances financial ratios by converting liabilities to equity under the Companies Act 2006. Potential for future growth: Creditors-turned-shareholders may bring expertise and resources, strengthening the company's position under English law. Debt-for-equity swaps are viable within corporate debt restructuring, offering strategic moves to stabilise operations under the UK legal framework. Following debt-for-equity swaps, another significant approach is understanding refinance options available under English law, complying with the Insolvency Act 1986 and Companies Act 2006. Refinance strategies replace existing debt with new debt under more favourable terms, guided by the Insolvency Service. This might include securing lower interest rates, substantially reducing payments and overall debt burden. One common strategy is debt consolidation, combining multiple obligations into a single loan under the statutory hierarchy of the Insolvency Act 1986. This simplifies debt management and offers lower combined interest rates. Restructuring may extend repayment periods, providing immediate relief by reducing monthly payments under the Companies Act 2006, though it could increase total interest paid. Refinance options should align with the company's financial situation under English law, guided by the Insolvency Service and professional bodies like ICAEW, ACCA, and IPA. New repayment terms must be sustainable and conducive to long-term financial health. The goal of refinancing under English law is to improve cash flow and reduce creditor pressure, allowing business stability and continued operations within the UK legal framework. Understanding corporate debt restructuring under English law requires distinguishing between various strategies, each addressing specific financial challenges, complying with the Insolvency Act 1986 and Companies Act 2006. Companies seeking to reorganise debt and meet obligations effectively must identify the right restructuring type, guided by the Insolvency Service. Corporate debt restructuring under English law is complex, often necessary for businesses facing financial distress within the UK legal framework. Key strategies include: Debt Rescheduling: Negotiating with creditors to extend payment terms under the statutory hierarchy of the Insolvency Act 1986. This provides immediate cash flow relief, allowing time to stabilise operations, guided by the Insolvency Service and professional bodies like ICAEW, ACCA, and IPA. Debt Consolidation: Consolidating multiple debts into a single loan with potentially lower interest rates under English law, complying with the Companies Act 2006. This simplifies debt management and can reduce overall monthly payments. Debt for Equity Swap: Creditors cancel outstanding debt in exchange for company equity under English law, complying with regulatory requirements. This reduces debt load and aligns creditor interests with company success, guided by the Insolvency Service. Each type has pros and cons, and choosing the right strategy is essential for effective financial recovery within the UK legal framework. The process of corporate debt restructuring under English law is critical for companies facing financial challenges to regain stability, complying with the Insolvency Act 1986 and Companies Act 2006. It involves key steps from initial debt assessment to formal creditor negotiations, guided by the Insolvency Service and professional bodies like ICAEW, ACCA, and IPA. Understanding these steps, negotiation conduct, and effective restructuring agreements are pivotal for successful outcomes within the UK legal framework. Several critical steps define corporate debt restructuring under English law, aimed at allowing companies to regain financial stability, complying with the Insolvency Act 1986 and Companies Act 2006. The process involves a strategic approach combining financial management with clear action plans, guided by the Insolvency Service. Initially, companies must thoroughly assess their financial situation under English law, identifying areas where restructuring can provide relief and sustain operations, guided by licensed insolvency practitioners from professional bodies like ICAEW, ACCA, and IPA. Key elements include: Developing a Restructuring Plan: Outlining specific changes to debt structure under the statutory framework, possibly converting debt to equity, extending payment terms, or reducing interest rates, complying with the Insolvency Act 1986 and Companies Act 2006. Negotiating with Stakeholders: Preparing groundwork for restructuring offers, including waivers or amendments to existing covenants, guided by the Insolvency Service. Implementation and Monitoring: Once agreements are reached under English law, restructured terms need implementation. Continuous monitoring ensures debt restructuring aligns with recovery and long-term financial goals within the UK legal framework. Successful debt restructuring requires meticulous planning and execution, positioning companies for financial recovery and stability, guided by the Insolvency Service and professional bodies. Negotiating with creditors under English law is pivotal in corporate debt restructuring, where companies discuss modifying existing liability terms, complying with the Insolvency Act 1986 and Companies Act 2006. This involves negotiating new repayment periods and conditions aligning with current financial capacities. When companies face financial trouble, restructuring debt is essential to avoid formal insolvency procedures, guided by the Insolvency Service. Corporate debt restructuring typically involves rescheduling debt to provide breathing room. Creditors and companies collaborate to restructure existing debt under the statutory hierarchy, ensuring mutual benefit; creditors minimise losses, and companies continue operations without overwhelming pressure, complying with the Insolvency Act 1986. Key negotiation aspects: Once negotiations conclude under English law, formalising the restructuring agreement becomes vital in corporate debt restructuring, complying with the Insolvency Act 1986 and Companies Act 2006. This phase is essential for companies facing financial hardship, legally binding all parties to new terms alleviating debt burden and securing ongoing viability, guided by the Insolvency Service. Establishing restructuring agreements involves detailed documentation outlining negotiated terms, including mechanisms to reorganise debt, defer payments, or convert debt to equity under the statutory hierarchy of the Insolvency Act 1986. The agreement serves as a roadmap for debt payment management, establishing sustainable financial frameworks preventing future liquidity issues, complying with the Companies Act 2006. Key components include: Deferment of Payments: Allowing recovery time by temporarily reducing or postponing debt payments, guided by the Insolvency Service and professional bodies like ICAEW, ACCA, and IPA. Converting Debt into Equity: Creditors may accept company equity in lieu of cash payments under English law, aligning interests with company success, complying with the Companies Act 2006. Out-of-Court Restructuring: Many agreements are concluded out of court to avoid costs and publicity associated with formal insolvency proceedings, complying with the Insolvency Act 1986. Debt restructuring under English law aims to balance company needs and creditor demands, ensuring fair and workable solutions within the UK legal framework. Corporate debt restructuring under English law offers strategic advantages for businesses facing financial challenges, complying with the Insolvency Act 1986 and Companies Act 2006. By restructuring liabilities, companies can regain liquidity, enhance cash flow management, and reduce overall debt burden, guided by the Insolvency Service and professional bodies like ICAEW, ACCA, and IPA. These improvements are important for stabilising operations and fostering long-term sustainability within the comprehensive UK legal framework governing corporate insolvency and restructuring procedures in England and Wales. Debt restructuring under English law plays an essential role in enhancing company liquidity by altering existing debt terms to improve cash flow, complying with the Insolvency Act 1986 and Companies Act 2006. When distressed companies engage in corporate debt restructuring, they negotiate better terms with creditors, providing immediate financial relief and restoring liquidity, guided by the Insolvency Service. This strategic adjustment helps companies manage outstanding debt more effectively and leads to more sustainable operations. Ways debt restructuring benefits company liquidity: Extended Payment Terms: Renegotiating debt payment timelines under English law allows companies to defer certain liabilities, providing short-term relief and preserving cash for critical operations, complying with the statutory hierarchy of the Insolvency Act 1986. Reduction in Interest Rates: Lowering existing debt costs reduces cash outflow associated with interest payments, directly enhancing available working capital, complying with the Companies Act 2006. Conversion of Debt into Equity: This approach decreases immediate cash liabilities by converting company debt into equity, complying with statutory requirements. It relieves cash flow pressure and aligns creditor and company interests, potentially leading to more supportive relationships, guided by the Insolvency Service and professional bodies. Through these mechanisms, corporate debt restructuring plays a vital role in stabilising company financial health, improving operational effectiveness in challenging economic conditions within the UK legal framework. Through corporate debt restructuring under English law, companies often experience significantly enhanced cash flow, enabling more flexible financial management and operational stability, complying with the Insolvency Act 1986 and Companies Act 2006. This flexibility is essential in corporate finance, enabling businesses to distribute resources more effectively and respond to market conditions with greater agility, guided by the Insolvency Service. Corporate debt restructuring often involves negotiating reduced interest rates or converting company debt into equity. These measures directly improve operational cash flows by reducing cash required for debt servicing under the statutory hierarchy of the Insolvency Act 1986. This improved liquidity can be pivotal in maintaining day-to-day operations and investing in growth opportunities without constant debt repayment pressure, complying with the Companies Act 2006. Here's how various debt restructurings impact cash flow: These strategies underpin core benefits of debt restructurings in corporate finance by directly enhancing company ability to manage finances and prioritise strategic growth over debt management within the UK legal framework. Greatly reducing overall debt burden under English law is a primary advantage of corporate debt restructuring, providing firms with enhanced financial health and strategic flexibility, complying with the Insolvency Act 1986 and Companies Act 2006. This process mitigates immediate financial pressures and repositions companies for long-term success by adjusting debt levels to more manageable amounts, guided by the Insolvency Service. Benefits of corporate debt restructuring are manifold, particularly in enabling businesses to transform their financial landscape, guided by professional bodies like ICAEW, ACCA, and IPA. Conversion of Debt into Equity: This common restructuring form converts company debt into equity, complying with the Companies Act 2006. This reduces balance sheet debt, improving the company's equity position and potentially its credit rating. Negotiated Interest Rates: Negotiating lower interest rates under English law significantly decreases debt-associated costs, improving cash flow and overall profitability, complying with the statutory hierarchy of the Insolvency Act 1986. Extended Payment Terms: Extending debt repayment terms provides crucial breathing room for companies, enabling them to direct resources toward essential areas like development and expansion, guided by the Insolvency Service. Through these strategies, corporate debt restructuring addresses company needs to manage debts for improved operational efficiency. The process alleviates burden and aids strategic realignment of financial goals and obligations within the UK legal framework. Corporate debt restructuring under English law is beneficial but requires careful consideration due to specific challenges and risks, complying with the Insolvency Act 1986 and Companies Act 2006. Addressing insolvency issues demands strategic approaches to stabilise financially distressed companies and avoid potential formal insolvency procedures, guided by the Insolvency Service. Effectively managing debt obligations and understanding potential restructuring pitfalls are critical to ensuring long-term viability and operational success, guided by professional bodies like ICAEW, ACCA, and IPA under the comprehensive UK regulatory framework. Addressing insolvency issues under English law presents significant challenges and risks in corporate debt restructuring, especially when companies fall under different insolvency categories dictating legal obligations and restructuring options, complying with the Insolvency Act 1986 and Companies Act 2006. When companies face severe financial distress, licensed insolvency practitioners from professional bodies like ICAEW, ACCA, and IPA play critical roles in debt management strategy. Their expertise helps navigate complex formal insolvency proceedings, potentially averting full insolvency filing, guided by the Insolvency Service. Converting company debt into equity as part of restructuring can preserve operational viability whilst guaranteeing compliance with legal and financial obligations under the Insolvency Act 1986 and Companies Act 2006. Key considerations include: Legal and Regulatory Compliance: Adhering to legal frameworks governing insolvency and corporate debt restructuring is essential, complying with the Insolvency Act 1986. Licensed insolvency practitioners must provide professional advice ensuring all actions are legally sound and regulatory compliant, guided by the Insolvency Service and professional bodies. Financial Management: Accurate assessment and restructuring of financial obligations are crucial to avoid exacerbating insolvency situations, complying with the Companies Act 2006. This often involves renegotiating creditor terms and identifying viable financial pathways. Stakeholder Communication: Ensuring transparent and consistent communication with all stakeholders, including creditors, employees, and investors, is essential, complying with statutory requirements. This transparency helps manage expectations and fosters cooperation throughout restructuring processes, guided by the Insolvency Service. Successfully navigating these aspects requires thorough understanding of both financial and legal intricacies involved in corporate debt restructuring within the UK legal framework. Effectively managing debt obligations under English law presents strategic challenges and risks requiring careful consideration during corporate debt restructuring, complying with the Insolvency Act 1986 and Companies Act 2006. Numerous companies engage in restructuring to alleviate old debt pressures and improve financial health, guided by the Insolvency Service. One common approach is converting company debt into equity, complying with the Companies Act 2006. This manoeuvre eases immediate cash flow concerns but alters company capital structure. However, it introduces risks of diluting existing shareholders' stakes, guided by professional bodies like ICAEW, ACCA, and IPA. Another aspect involves renegotiating loan terms under English law, which might extend loan terms or reduce interest rates, complying with the Insolvency Act 1986. While providing temporary relief, it may affect the company's ability to attract future financing, as extended debt terms can signal financial instability to potential investors. Additionally, loan types and specific agreed conditions can have long-term effects on company operations and financial strategy, guided by the Insolvency Service. Corporate debt restructuring under English law is not just about managing debt effects but also strategically planning the company's future trajectory, complying with the Insolvency Act 1986 and Companies Act 2006. It requires delicate balance between immediate financial relief and sustaining long-term corporate health and growth potential within the UK legal framework. To sum up, corporate debt restructuring under English law is an essential mechanism for companies grappling with financial difficulties, enabling them to renegotiate debt terms and guarantee sustainability, complying with the comprehensive Insolvency Act 1986 and Companies Act 2006 regulatory framework. Various strategies, including debt-for-equity swaps, rescheduling, consolidation, reduction, and subordination, cater to diverse needs and objectives, guided by the Insolvency Service and professional bodies like ICAEW, ACCA, and IPA under English law. While this process offers significant benefits under English law, such as improved liquidity and extended survival, it also presents challenges, such as complex negotiations and potential impacts on credit ratings, requiring careful consideration and strategic planning within the comprehensive UK legal framework governing corporate insolvency procedures. The success of any restructuring initiative ultimately depends on the cooperation of all stakeholders and adherence to the comprehensive regulatory requirements established under English law, ensuring that both immediate financial relief and long-term corporate viability are achieved through professional guidance and strategic implementation.What is Corporate Debt Restructuring, and What Does it Mean?

Understanding the Debt Restructuring Process

What Corporate Debt Restructuring Refers To

The Role of Creditor in Restructuring

Types of Debt Restructuring Strategies

Exploring Debt-for-Equity Swap

Understanding Refinance Options in Financial Distress

Distinguishing Between Debt Restructurings

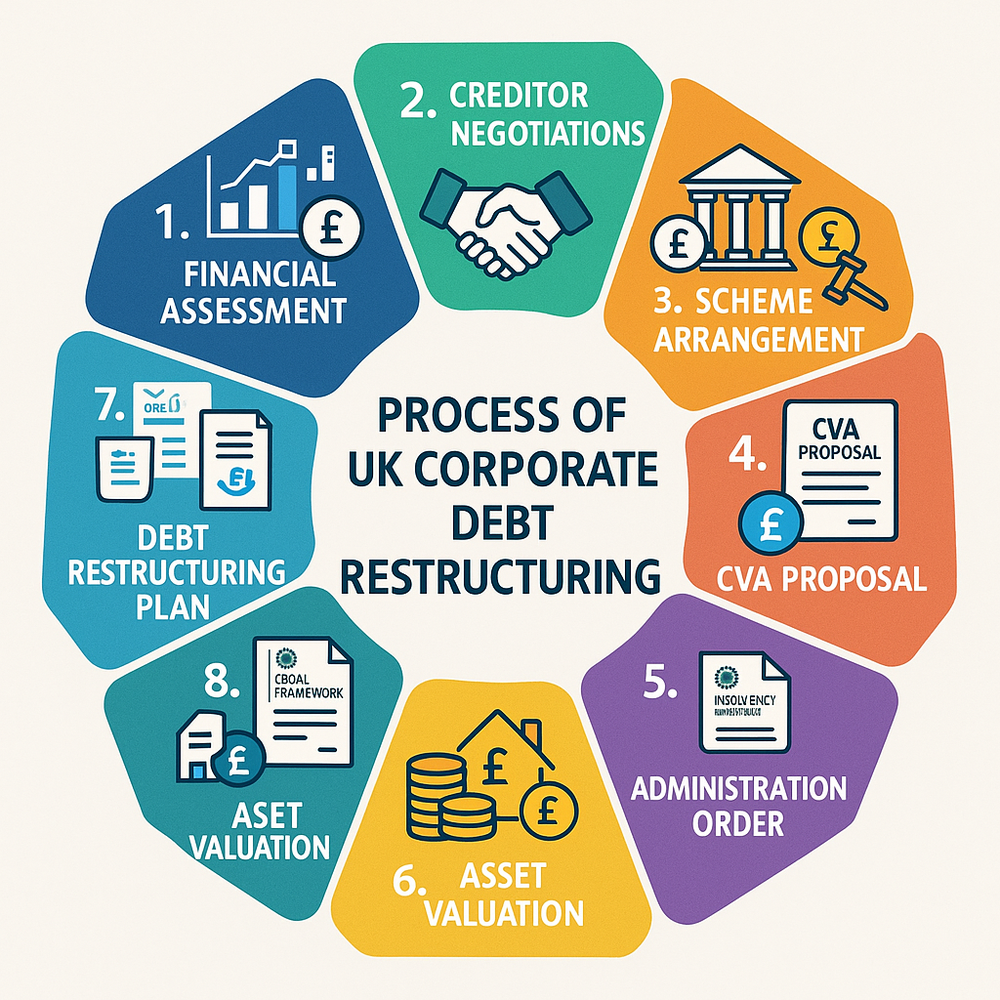

The Process of Corporate Debt Restructuring

Steps in the Debt Restructuring Process

How Companies Negotiate with Creditors

Aspect

Description

Objective

To restructure debt promoting long-term viability under the regulatory framework

Focus

Rescheduling debt and modifying repayment terms under English law

Challenge

Balancing company and creditor interests under the statutory framework

Outcome

Achieving agreements allowing smoother debt repayment under the Insolvency Act 1986

Establishing a Restructuring Agreement

Benefits of Corporate Debt Restructuring

How Restructuring Can Restore Liquidity

The Impact on a Company's Cash Flow

Type of Restructuring

Impact on Cash Flow

Common Examples

Reduced Interest Rates

Decreases monthly payment amounts under English law

Negotiated lower interest terms

Debt in Exchange for Equity

Reduces debt, enhances equity base under the Companies Act 2006

Conversion of bonds into shares

Extended Payment Terms

Delays outflows, improves current liquidity under the Insolvency Act 1986

Lengthening debt maturity dates

Combination Approaches

Optimises overall financial structure

Mix of interest cuts and equity swaps

Reducing Overall Debt Burden

Challenges and Risks in Corporate Debt Restructuring

Addressing Insolvency Issues

Managing Debt Obligations Effectively

Conclusion

How Are Insolvency Practitioners Appointed – UK Expert Guide Navigating financial turmoil can be overwhelming for company directors and sole traders alike. Faced with mounting debts, threats of compulsory liquidation, or creditor demands, knowing “how insolvency practitioners are appointed” becomes crucial for preserving your organisation. In the UK, professional insolvency services, such as company voluntary […]

Administration might be your lifeline when your company's drowning in debt and creditors are circling. But here's what most directors don't understand: it's not just about buying time — it's about buying the right kind of time, with the proper professional support. The difference between administration working for you or against you often comes down […]

Can an Insolvency Practitioner Stop Creditors? In the UK, mounting pressure from creditors can disrupt cash flow, increase stress for directors, and push a company toward insolvency. Professional guidance plays a pivotal role in countering these challenges. Nexus Corporate Solutions Limited specialises in helping businesses find relief from persistent creditors, providing strategic solutions that align […]

When your company's in financial trouble, one of the biggest worries is what happens to everything you've built. Your equipment, property, stock — the assets that represent years of hard work. It's a valid concern, and you're not alone. The reality? How insolvency practitioners handle your company's assets can make or break the outcome for […]

Insolvent trading can trigger severe repercussions for UK directors, including personal liability and possible disqualification. When a business is unable to pay debts and continues to trade without a reasonable prospect of avoiding insolvency, the law may classify this as wrongful trading. The Insolvency Act 1986, alongside related legislation, outlines civil and criminal penalties for […]

Recognising the signs of business insolvency early is vital for UK companies. Overlooked warning signals—such as recurring cash flow issues, unpaid HMRC tax arrears, or missed staff wages—can quickly escalate into serious risks that demand immediate attention. Being aware of these common signs of business insolvency enables directors to take timely action, whether through careful […]

Supplier insolvency can have serious consequences for UK companies, creating ripple effects that extend beyond the affected supplier. Cash flow interruptions, delayed payments, and increased operational risks are common outcomes. When a key supplier or client becomes insolvent, contracts may be disrupted, insurance coverage can be affected, and overall profitability may decline. Nexus Corporate Solutions […]

Struggling with IVA monthly payments can feel overwhelming, especially when daily financial obligations pile up. An Individual Voluntary Arrangement (IVA) is designed to help those in debt regain stability by consolidating and managing repayments under a legally binding agreement. However, life changes—like reduced monthly income, sudden expenses, or shifts in personal circumstances—often make sticking to […]

Experiencing financial difficulty can make everyday life more challenging, especially when an individual or business director needs to secure a stable living arrangement. In the UK, an Individual Voluntary Arrangement (IVA) offers a legally binding debt solution that eases pressure from creditors. However, many worry about problems renting after IVA. Questions about how this might […]

Address: Apex Building, 1 Water Vole Way, Balby, Doncaster, South Yorkshire, DN4 5JP

Tel: 01302 430180

Services

Company