What Happens When You Hire an Insolvency Practitioner Many UK directors and business owners face stressful financial problems—ranging from mounting debts to the risk of compulsory liquidation. When these challenges surface, seeking professional support can be the turning point. Hiring an insolvency practitioner UK for your company brings legal protection, business rescue opportunities in the […]

What Is Restructuring and How Does It Mean to Restructure a Business?

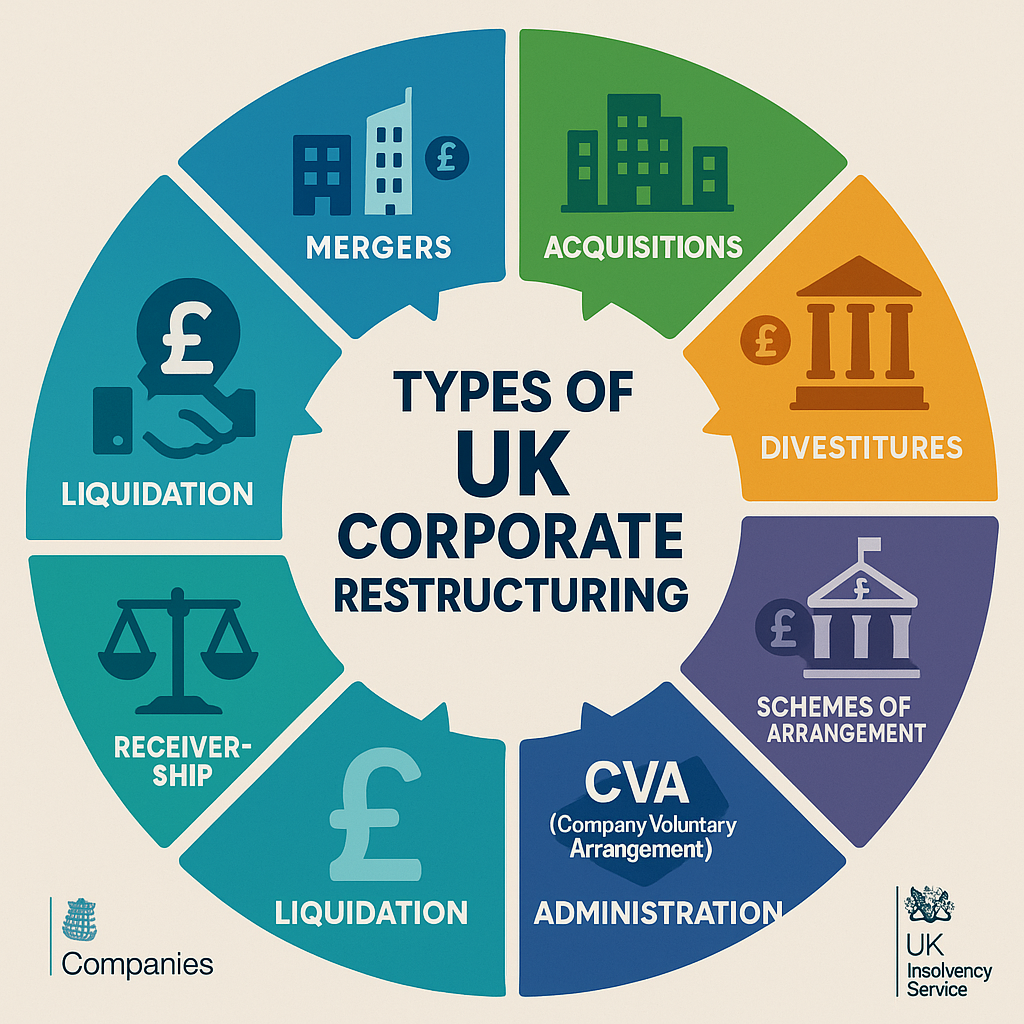

Restructuring is a strategic process where a company modifies its structure, operations, or finances to improve efficiency or address challenges under English law. It often involves cost restructuring, reducing overheads or realigning resources to meet current needs whilst ensuring compliance with the Insolvency Act 1986 and Companies Act 2006. This approach may be necessary due to financial difficulties, declining performance, or to avoid formal insolvency procedures such as administration or liquidation. In some cases, businesses restructure to enhance economic viability or stay competitive in changing markets. Proper restructuring often requires technical support from licensed insolvency practitioners who guide the company through legal and financial adjustments. In a business context, restructuring refers to the process of reorganising a company's legal, ownership, or operational framework to enhance profitability under English law. What restructuring means is often questioned by businesses facing challenges or opportunities for growth. This strategic manoeuvre can be driven by improved efficiency, addressing financial hardships, or adapting to new market environments. For example, when companies merge under Part 27 of the Companies Act 2006, restructuring may involve redefining the core business, renegotiating contracts, or adjusting payroll whilst complying with TUPE regulations. Understanding how restructuring works and the key elements involved are essential under the Corporate Insolvency and Governance Act 2020. This might include raising capital, negotiating a Company Voluntary Arrangement with creditors, or seeking external assistance from licensed insolvency practitioners. Having a clear strategy helps companies manage their finances effectively whilst ensuring compliance with HMRC requirements. Restructuring involves reorganising a company's legal, ownership, operational, or other structures to make it more profitable under English law. The process can be complex, involving strategic, corporate, financial, debt, and operational restructuring under the Insolvency Act 1986. In situations involving financial distress, understanding insolvency procedures available under English law, including administration under Schedule B1, Company Voluntary Arrangements under Part 1, and liquidation procedures, provides insight into which restructuring approach best suits a company's condition. Corporate restructuring involves restructuring legal and ownership frameworks to improve efficiency whilst complying with the Companies Act 2006. Strategic restructuring involves altering the business model to align with market demands under regulatory oversight. Financial restructuring adjusts the capital structure through debt restructuring or Company Voluntary Arrangements, to stabilise finances whilst ensuring compliance with HMRC obligations and creditor protection requirements under the Insolvency Act 1986. Operational restructuring focuses on modifying internal operations, such as supply chains, manufacturing processes, or workforce management, to enhance performance whilst ensuring compliance with employment law including TUPE regulations and the Employment Rights Act 1996. Every company restructures with specific objectives, but the overarching goal is to create a restructured company better positioned to compete whilst maintaining compliance with the regulatory framework governing English companies. Companies may need to restructure to adapt to significant changes in the market, optimise operations, or address financial challenges under English law. This process is often vital for securing a competitive advantage whilst maintaining compliance with regulatory requirements. Key reasons for restructuring include: Through these methods, a company can not only survive challenging economic times but also position itself for future growth whilst maintaining compliance with the legal framework governing business operations under English law. Understanding the key elements of a restructuring plan is fundamental for any business looking to navigate through challenges under English law. A well-crafted plan focuses on strategic aspects essential for successful restructuring whilst ensuring compliance with the Insolvency Act 1986. The primary goals include optimisation of business operations to reduce costs, reassessment of financial commitments to manage debt payments through formal or informal arrangements, and realignment of business strategies to secure the company's future. Engaging licensed insolvency practitioners and legal advisors is pivotal, ensuring that all proposed changes align with legal requirements under English law. Each component must be carefully considered and integrated into the broader restructuring strategy whilst ensuring compliance with English law. The restructuring process typically progresses through well-defined steps under English law, influenced by internal and external factors. Companies may need to address concerns from dissenting creditors to ensure the plan is approved under the procedures established by the Insolvency Act 1986 and Companies Act 2006. Mergers and acquisitions play a significant role under Part 27 of the Companies Act 2006, often aimed at enhancing operational efficiency and expanding revenue streams whilst ensuring regulatory compliance. To support these changes, businesses might seek refinancing or attract investors whilst ensuring compliance with Companies House filing requirements. Restructuring can involve reorganising divisions to focus on viable parts of the company under the oversight of licensed insolvency practitioners. To initiate corporate restructuring under English law, a detailed assessment of the company's current financial and operational status is essential. This ensures strategic goals align with financial health whilst maintaining compliance with regulatory requirements. Corporate restructuring can take various forms under the Insolvency Act 1986 and Companies Act 2006, each suited to specific corporate needs. Understanding these dynamics is important for crafting a successful restructuring strategy whilst ensuring protection for stakeholders under English law. The steps typically include: Each step demands careful planning and execution under the guidance of licensed insolvency practitioners to ensure the restructuring leads to a stronger organisation whilst maintaining compliance with English law. Internal factors, such as business models and restructuring costs, play critical roles within the regulatory framework established by the Companies Act 2006 and Insolvency Act 1986. A company must assess its current business model to identify less profitable areas where increased efficiency can be achieved. The financial reasons for restructuring, including managing debt load through Company Voluntary Arrangements or schemes of arrangement and operational costs, are pivotal in shaping the strategy under the oversight of licensed insolvency practitioners. External factors also impact the restructuring approach under English law. Changes in the market structure, such as economic downturns or changes in consumer demand, require businesses to adapt swiftly whilst ensuring compliance with regulatory requirements. Understanding these factors helps in crafting a restructuring plan that manages immediate financial pressures whilst positioning the company for future growth under English law. Mergers and acquisitions play a crucial role in the restructuring process under English law, allowing companies to realign resources and expand capabilities strategically whilst ensuring compliance with regulatory requirements established by the Companies Act 2006. When a business decides to restructure, it often looks at mergers and acquisitions as a strategic tool under Part 27 of the Companies Act 2006 to enhance operational efficiency, penetrate new markets, or achieve cost synergies whilst ensuring protection for shareholders, creditors, and employees. Key impacts include: In essence, the purchase of a company or merging with another involves a careful strategy under English law that aims to bolster the company's standing in the industry whilst maintaining compliance with the regulatory framework governing business operations. Corporate restructuring can be classified into various categories under English law, each addressing different needs within a company whilst ensuring compliance with the regulatory framework established by the Insolvency Act 1986, Companies Act 2006, and Corporate Insolvency and Governance Act 2020. Financial versus operational restructuring focuses on improving the financial health or operational efficiency of the business, respectively, under the oversight of licensed insolvency practitioners and regulatory bodies including the Insolvency Service. Legal restructuring involves modifying the legal structure or ownership to optimise benefits under the Companies Act 2006, whilst out-of-court restructuring offers an alternative to formal court procedures under the Insolvency Act 1986, often preserving reputation and reducing costs whilst maintaining creditor protection. Restructuring may become necessary when a crisis occurs that makes it impossible for a company to continue under its current framework whilst meeting its obligations to creditors, employees, and other stakeholders under English law. This can lead to breaking or splitting the business into different parts under the guidance of licensed insolvency practitioners. Within corporate restructuring under English law, two primary categories emerge: financial restructuring and operational restructuring, each governed by specific provisions of the Insolvency Act 1986 and Companies Act 2006. When a company undergoes financial restructuring, it generally focuses on renegotiating debt terms through Company Voluntary Arrangements under Part 1 of the Insolvency Act 1986 or schemes of arrangement under Part 26 of the Companies Act 2006, and restructuring its capital to manage liabilities better and improve liquidity. This type of restructuring directly involves the company and its creditors under English law, aiming to create a more sustainable financial structure that allows the company to continue operations whilst ensuring creditor protection and compliance with regulatory requirements. On the other hand, operational restructuring involves modifying the core activities of the business to help the company better serve the needs of its customers and stakeholders under English law. This could include streamlining processes, downsizing under employment protection legislation, or even pivoting the business model whilst ensuring compliance with TUPE regulations. Key aspects under English law: Legal restructuring involves altering the legal structure or framework of a company under English law to optimise its operations and compliance with regulatory requirements established by the Companies Act 2006, Insolvency Act 1986, and related legislation. This process allows a business entity to undergo restructuring in a way that aligns better with its strategic goals. Legal corporate restructuring might involve seeking administration under Schedule B1 of the Insolvency Act 1986 to reorganise debt, merging with other companies under Part 27 of the Companies Act 2006, or changing the corporate structure to reduce tax liabilities whilst ensuring compliance with HMRC requirements. To restructure your business effectively under English law, it's important to work with licensed insolvency practitioners and legal advisors who understand the nuances of corporate law. Each type of restructuring has distinct legal implications under English law and must be handled with professional care by licensed insolvency practitioners. Businesses may contemplate out-of-court restructuring under English law when they seek to efficiently renegotiate their debts and obligations with stakeholders without the complexities of formal legal proceedings under the Insolvency Act 1986. Out-of-court restructuring provides a platform where a distressed company can deal directly with creditors to reorganise its existing debt. This approach is often preferred when the company aims to quickly return to an economically sound business state whilst maintaining control over the restructuring process under the guidance of licensed insolvency practitioners. Out-of-court restructuring involves direct negotiations under English law, which can be less disruptive and more cost-effective compared to formal proceedings. Key reasons to contemplate this strategy under English law: Choosing out-of-court restructuring can facilitate a smoother pathway to reviving a company's financial health under English law, provided all parties involved agree on the terms. Whilst restructuring can raise concerns about potential layoffs under English law, it does not necessarily lead to workforce reductions when properly managed in accordance with employment protection legislation including the Employment Rights Act 1996 and TUPE regulations. In fact, effective restructuring can enhance retention by aligning roles more closely with business goals. However, the challenges often include the perception that restructuring is expensive and difficult, particularly for large organisations where changes may take months to complete whilst ensuring compliance with employment law and regulatory requirements. Different strategies can be employed to reduce the impact on employees under English law, such as reskilling and reallocation, helping them learn new roles whilst ensuring compliance with TUPE regulations. This can add value to the business without triggering widespread job losses. Restructuring aims to address operational problems and should act as a proactive measure under the guidance of licensed insolvency practitioners. The meaning behind such change must be clearly communicated to ensure staff understand the intent and benefits under employment law. Restructuring often raises concerns among employees about potential layoffs under English law, although it does not necessarily result in job cuts when managed in accordance with employment protection legislation including the Employment Rights Act 1996 and TUPE regulations. The impact varies under English law, depending on the approach and execution whilst ensuring compliance with consultation requirements and employment protection obligations. Change management is essential during restructuring under English law, as it helps employees adjust to new roles whilst ensuring compliance with employment protection requirements. Effective communication is necessary, ensuring that employees are aware of the reasons for changes under the consultation framework. Restructuring can be a tumultuous time for a company under English law, but with the right strategies and professional guidance from licensed insolvency practitioners, it should result in a more efficient organisation whilst maintaining employment protection. Key points to consider: Despite common misconceptions, restructuring does not inevitably lead to layoffs under English law—especially when strategies are designed to maximise efficiency without cutting jobs whilst ensuring compliance with employment protection legislation including the Employment Rights Act 1996 and TUPE regulations. Restructuring refers to the modification of a business's operations or structure under English law, aimed at enhancing financial stability whilst maintaining employment protection. When a business faces financial challenges, restructuring can help realign resources whilst keeping the team in place. One effective approach involves streamlining processes under professional guidance from licensed insolvency practitioners. Automating repetitive tasks allows employees to focus on higher-value activities, potentially avoiding cuts whilst ensuring compliance with employment law. Additionally, temporary salary reductions or voluntary pay cuts can help retain staff whilst ensuring compliance with employment protection requirements. These measures can protect jobs whilst supporting long-term goals. Effective change management is essential in restructuring processes under English law to minimise the risk of layoffs whilst ensuring compliance with employment protection legislation including the Employment Rights Act 1996 and TUPE regulations. When a company is adjusted, the aim often includes achieving greater efficiency whilst protecting employee rights. Restructuring can take many forms under English law—some companies may need to raise cash and decrease debt through Company Voluntary Arrangements or schemes of arrangement, whilst others might address issues by restructuring equity under the regulatory framework established by the Companies Act 2006 and Insolvency Act 1986. Change management plays a pivotal role in these transformations under English law, guiding both leadership and employees through the process whilst ensuring compliance with consultation requirements. It helps avert severe outcomes by fostering a culture of adaptability. Key points in change management during restructuring under English law: Restructuring is a strategic response businesses use to overcome financial or operational problems under the comprehensive legal framework established by English law. The purpose is to generate improved performance by realigning resources, locations, and objectives whilst ensuring compliance with the Insolvency Act 1986, Companies Act 2006, and related legislation governing business operations. This process often involves analysing current structures to prepare a plan that may require stakeholder approval and coordination with debt holders under the guidance of licensed insolvency practitioners and professional advisors who understand the regulatory requirements established by the Insolvency Service. Whilst restructuring can involve tough decisions, such as cost reductions, it can also rescue a company in crisis through formal procedures including Company Voluntary Arrangements, schemes of arrangement, or administration under Schedule B1 of the Insolvency Act 1986. If approval is received under the appropriate legal framework, the company may continue in its existing locations, maintain order, and provide a fair response to creditors whilst ensuring protection for employees and other stakeholders. Understanding what restructuring means helps companies act with clarity and intent under English law—turning risk into opportunity through well-planned transformation whilst maintaining compliance with the extensive regulatory framework governing business operations and ensuring protection for all stakeholders involved in the process.What Does Restructure Mean in a Business Context?

How Does Restructuring Work?

Why a Company May Need to Restructure

Key Elements of a Restructuring Plan

Key Element

Contribution to Restructuring Plan

Financial Reassessment

Evaluates and restructures debt payments through CVAs or schemes of arrangement under Insolvency Act 1986

Operational Optimisation

Streamlines operations to reduce costs whilst ensuring TUPE compliance

Strategic Realignment

Revises business strategies to respond to market dynamics under regulatory oversight

How Does the Restructuring Process Unfold?

Steps in the Corporate Restructuring Process

Internal and External Factors Affecting Business Restructuring

Factor Type

Examples

Internal

Business models, restructuring costs, debt load, operational efficiency

External

Market changes, economic conditions, regulatory shifts under English law

Impact

Decision on which areas to cut or invest for increased efficiency

Outcome

Enhanced operational efficiency and strategic realignment under English law

The Role of Mergers and Acquisitions in Restructuring

What Are the Different Types of Corporate Restructuring?

Financial vs. Operational Restructuring

Legal Restructuring and Its Implications

Type

Description

Example

Merger

Combining two entities under Part 27

Company A merges with Company B under Companies Act 2006

Acquisition

One company acquiring another

Company A acquires Company B under regulatory oversight

Divestiture

Selling off parts of the company

Company A sells its subsidiary under Companies House procedures

Administration

Formal insolvency procedure for rescue

Company A enters administration under Schedule B1

When to Consider Out-of-Court Restructuring

Does Restructuring Mean Layoffs?

Impact of Restructuring on Employees

Strategies to Minimise Workforce Reductions

Managing Change: Why Change Management is Crucial

Conclusion

How Are Insolvency Practitioners Appointed – UK Expert Guide Navigating financial turmoil can be overwhelming for company directors and sole traders alike. Faced with mounting debts, threats of compulsory liquidation, or creditor demands, knowing “how insolvency practitioners are appointed” becomes crucial for preserving your organisation. In the UK, professional insolvency services, such as company voluntary […]

Administration might be your lifeline when your company's drowning in debt and creditors are circling. But here's what most directors don't understand: it's not just about buying time — it's about buying the right kind of time, with the proper professional support. The difference between administration working for you or against you often comes down […]

Can an Insolvency Practitioner Stop Creditors? In the UK, mounting pressure from creditors can disrupt cash flow, increase stress for directors, and push a company toward insolvency. Professional guidance plays a pivotal role in countering these challenges. Nexus Corporate Solutions Limited specialises in helping businesses find relief from persistent creditors, providing strategic solutions that align […]

When your company's in financial trouble, one of the biggest worries is what happens to everything you've built. Your equipment, property, stock — the assets that represent years of hard work. It's a valid concern, and you're not alone. The reality? How insolvency practitioners handle your company's assets can make or break the outcome for […]

Insolvent trading can trigger severe repercussions for UK directors, including personal liability and possible disqualification. When a business is unable to pay debts and continues to trade without a reasonable prospect of avoiding insolvency, the law may classify this as wrongful trading. The Insolvency Act 1986, alongside related legislation, outlines civil and criminal penalties for […]

Recognising the signs of business insolvency early is vital for UK companies. Overlooked warning signals—such as recurring cash flow issues, unpaid HMRC tax arrears, or missed staff wages—can quickly escalate into serious risks that demand immediate attention. Being aware of these common signs of business insolvency enables directors to take timely action, whether through careful […]

Supplier insolvency can have serious consequences for UK companies, creating ripple effects that extend beyond the affected supplier. Cash flow interruptions, delayed payments, and increased operational risks are common outcomes. When a key supplier or client becomes insolvent, contracts may be disrupted, insurance coverage can be affected, and overall profitability may decline. Nexus Corporate Solutions […]

Struggling with IVA monthly payments can feel overwhelming, especially when daily financial obligations pile up. An Individual Voluntary Arrangement (IVA) is designed to help those in debt regain stability by consolidating and managing repayments under a legally binding agreement. However, life changes—like reduced monthly income, sudden expenses, or shifts in personal circumstances—often make sticking to […]

Experiencing financial difficulty can make everyday life more challenging, especially when an individual or business director needs to secure a stable living arrangement. In the UK, an Individual Voluntary Arrangement (IVA) offers a legally binding debt solution that eases pressure from creditors. However, many worry about problems renting after IVA. Questions about how this might […]

Address: Apex Building, 1 Water Vole Way, Balby, Doncaster, South Yorkshire, DN4 5JP

Tel: 01302 430180

Services

Company