What Happens When You Hire an Insolvency Practitioner Many UK directors and business owners face stressful financial problems—ranging from mounting debts to the risk of compulsory liquidation. When these challenges surface, seeking professional support can be the turning point. Hiring an insolvency practitioner UK for your company brings legal protection, business rescue opportunities in the […]

Who Regulates Insolvency Practitioners in the UK?

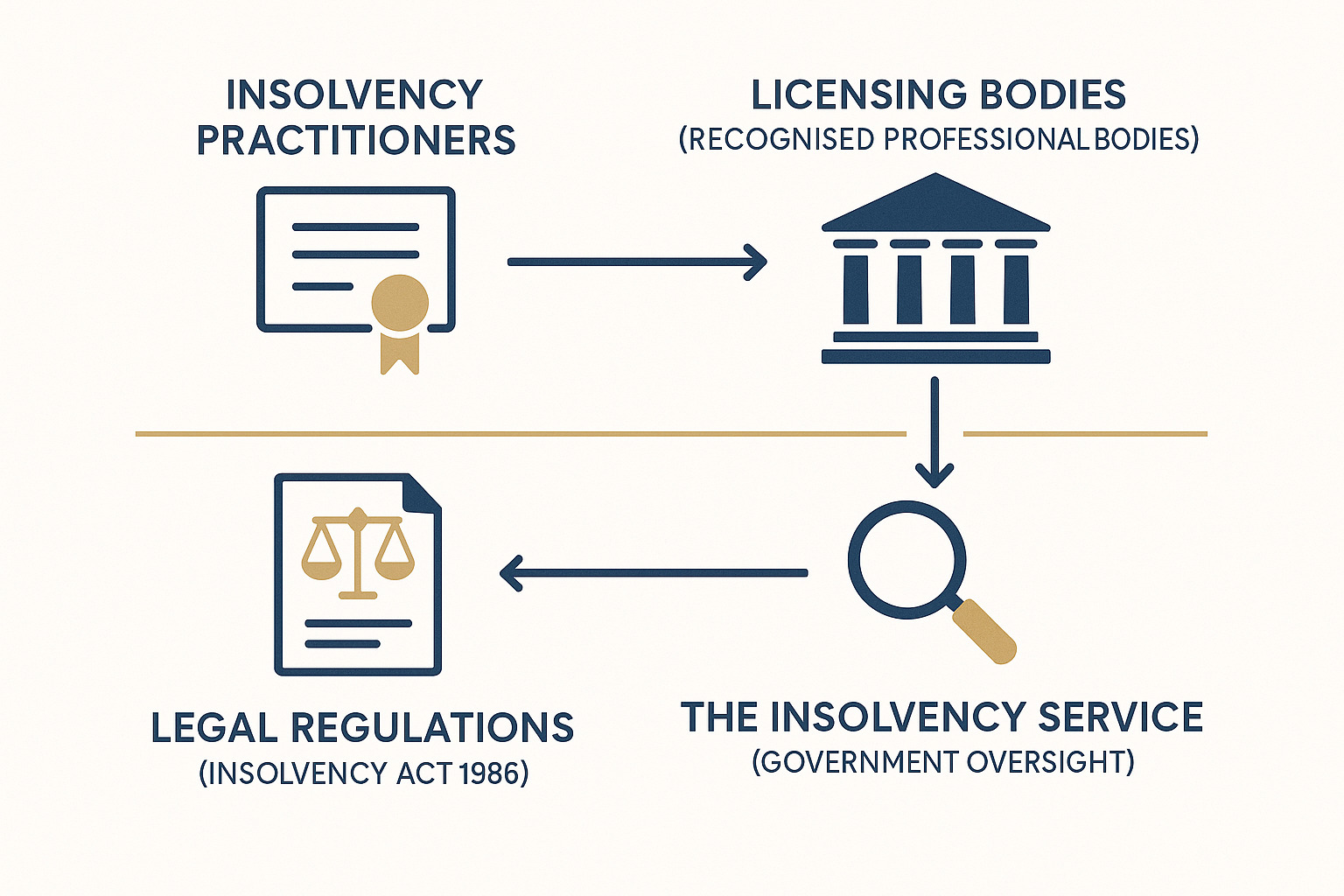

When a company faces financial distress, the role of an insolvency practitioner becomes vital. These professionals guide directors, creditors, and stakeholders through complex recovery or restructuring processes. For businesses to feel confident in their decisions, it is important to understand who regulates insolvency practitioners in the UK and why this oversight matters. This article outlines the regulatory framework, the role of recognised professional bodies, the legislation underpinning practice, and how firms like Nexus Corporate Solutions Limited operate under these standards to provide reliable, transparent services. The insolvency profession deals with sensitive financial matters that affect employees, creditors, shareholders, and directors. Regulation ensures practitioners meet strict professional standards, act with integrity, and apply the law consistently. For business leaders, knowing their adviser is regulated provides reassurance that advice is not only sound but also compliant with statutory obligations. In Great Britain, oversight combines statutory authority and professional governance. This dual structure protects both businesses in distress and the wider economy. Insolvency practitioners in the UK are licensed and supervised by a network of Recognised Professional Bodies (RPBs). These organisations are authorised by the Secretary of State and play a direct role in maintaining standards. The Insolvency Practitioners Association (IPA) and the Institute of Chartered Accountants in England and Wales (ICAEW) are among the most prominent RPBs. They are responsible for: Alongside professional bodies, the UK government plays a role through The Insolvency Service, an executive agency sponsored by the Department for Business and Trade. The agency supports the regulatory framework by: The framework that guides insolvency practitioners is built on robust statutes. The most significant are: Regulation is not a one-off hurdle. Practitioners must demonstrate continuous competence and integrity. This includes: At Nexus Corporate Solutions Limited, regulation underpins every client engagement. Our practitioners operate under licences issued by recognised professional bodies, and every action is benchmarked against statutory requirements and professional codes. Insolvency practitioners in the UK cannot operate without being formally authorised. Every practitioner must hold a licence issued by a recognised professional body or, in some cases, directly by the Secretary of State. This requirement ensures that only qualified professionals provide insolvency services, protecting both businesses and creditors. When issues arise, complaints should first be raised directly with the practitioner or their firm. If the matter cannot be resolved at that stage, the complaint can be escalated to the practitioner’s licensing body. Organisations such as the Insolvency Practitioners Association (IPA) or the Institute of Chartered Accountants in England and Wales (ICAEW) have clear procedures for investigating complaints and taking action where standards are not met. The system of regulation applies consistently across Great Britain, with similar frameworks in Northern Ireland. This unified approach ensures that wherever a business is based, the standards applied to insolvency practice remain consistent, giving directors and stakeholders confidence in the advice they receive. For directors and business owners, working with a regulated practitioner ensures: If your company is facing financial difficulty, choosing a regulated insolvency practitioner ensures you receive advice rooted in both law and best practice. At Nexus Corporate Solutions Limited, we combine technical expertise with a client-focused approach, providing solutions that protect interests and support recovery. To discuss your options, contact our team in Doncaster for a confidential consultation. Together, we can help you navigate challenges and secure a stronger financial future.Why Regulation Matters in Insolvency

Recognised Professional Bodies and Their Oversight Role

● Granting practitioner licences after rigorous examinations

● Monitoring ongoing compliance with professional standards

● Reviewing ethical conduct and technical competence

● Investigating complaints and, where necessary, taking disciplinary action

For businesses in Doncaster, Leeds, and beyond, this means only qualified, regulated practitioners are entrusted with insolvency work. If concerns arise, complaints can be escalated to the relevant RPB, ensuring accountability across the profession.The Insolvency Service and Government Oversight

● Authorising certain bodies to license practitioners

● Investigating misconduct where appropriate

● Supporting reforms to improve insolvency regulation

This oversight ensures the system remains transparent and responsive to changes in business practice.Core Legislation Governing Insolvency Practice

● Insolvency Act 1986: The cornerstone legislation, setting procedures for liquidations, administrations, and company voluntary arrangements.

● Companies Act 2006: Establishes duties of directors, particularly when insolvency looms, and reinforces principles of corporate governance.

● Insolvency Rules 2016: Provides detailed procedures for communication with creditors, filing with courts, and decision-making processes.

● Enterprise Act 2002: Introduced reforms that shifted focus from winding up businesses to encouraging rescue and recovery.

Together, these laws create a balanced environment that protects creditors while offering businesses opportunities to restructure and continue trading where possible.Professional Standards and Ongoing Compliance

● Regular professional development

● Annual compliance reviews

● Adherence to evolving rules and case law

● Transparent communication with stakeholders

These standards ensure practitioners remain up to date and that their advice reflects both legal obligations and best practice.How Nexus Corporate Solutions Limited Works Within This

Framework

We prioritise clear, practical guidance tailored to the circumstances of each business. Directors and stakeholders can expect:

● Advice grounded in the Insolvency Act, Companies Act, and Insolvency Rules

● Transparent explanations of options and obligations

● Collaborative solutions that balance stakeholder interests

● A focus on recovery and continuity wherever possible

Our commitment ensures clients receive advice that is both technically proficient and accessible.Understanding Common Aspects of Insolvency Practitioner Regulation

Why Choosing a Regulated Practitioner Matters

● Compliance with UK insolvency law

● Fair treatment of creditors and employees

● Reliable advice during financial uncertainty

● Confidence that misconduct can be challenged

Without regulation, the risks to businesses and stakeholders would be significant. Choosing a licensed professional is therefore essential.Next Steps for Businesses Seeking Guidance

How Are Insolvency Practitioners Appointed – UK Expert Guide Navigating financial turmoil can be overwhelming for company directors and sole traders alike. Faced with mounting debts, threats of compulsory liquidation, or creditor demands, knowing “how insolvency practitioners are appointed” becomes crucial for preserving your organisation. In the UK, professional insolvency services, such as company voluntary […]

Administration might be your lifeline when your company's drowning in debt and creditors are circling. But here's what most directors don't understand: it's not just about buying time — it's about buying the right kind of time, with the proper professional support. The difference between administration working for you or against you often comes down […]

Can an Insolvency Practitioner Stop Creditors? In the UK, mounting pressure from creditors can disrupt cash flow, increase stress for directors, and push a company toward insolvency. Professional guidance plays a pivotal role in countering these challenges. Nexus Corporate Solutions Limited specialises in helping businesses find relief from persistent creditors, providing strategic solutions that align […]

When your company's in financial trouble, one of the biggest worries is what happens to everything you've built. Your equipment, property, stock — the assets that represent years of hard work. It's a valid concern, and you're not alone. The reality? How insolvency practitioners handle your company's assets can make or break the outcome for […]

Insolvent trading can trigger severe repercussions for UK directors, including personal liability and possible disqualification. When a business is unable to pay debts and continues to trade without a reasonable prospect of avoiding insolvency, the law may classify this as wrongful trading. The Insolvency Act 1986, alongside related legislation, outlines civil and criminal penalties for […]

Recognising the signs of business insolvency early is vital for UK companies. Overlooked warning signals—such as recurring cash flow issues, unpaid HMRC tax arrears, or missed staff wages—can quickly escalate into serious risks that demand immediate attention. Being aware of these common signs of business insolvency enables directors to take timely action, whether through careful […]

Supplier insolvency can have serious consequences for UK companies, creating ripple effects that extend beyond the affected supplier. Cash flow interruptions, delayed payments, and increased operational risks are common outcomes. When a key supplier or client becomes insolvent, contracts may be disrupted, insurance coverage can be affected, and overall profitability may decline. Nexus Corporate Solutions […]

Struggling with IVA monthly payments can feel overwhelming, especially when daily financial obligations pile up. An Individual Voluntary Arrangement (IVA) is designed to help those in debt regain stability by consolidating and managing repayments under a legally binding agreement. However, life changes—like reduced monthly income, sudden expenses, or shifts in personal circumstances—often make sticking to […]

Experiencing financial difficulty can make everyday life more challenging, especially when an individual or business director needs to secure a stable living arrangement. In the UK, an Individual Voluntary Arrangement (IVA) offers a legally binding debt solution that eases pressure from creditors. However, many worry about problems renting after IVA. Questions about how this might […]

Address: Apex Building, 1 Water Vole Way, Balby, Doncaster, South Yorkshire, DN4 5JP

Tel: 01302 430180

Services

Company