What Happens When You Hire an Insolvency Practitioner Many UK directors and business owners face stressful financial problems—ranging from mounting debts to the risk of compulsory liquidation. When these challenges surface, seeking professional support can be the turning point. Hiring an insolvency practitioner UK for your company brings legal protection, business rescue opportunities in the […]

Comparing the Difference Between Liquidation and Dissolution

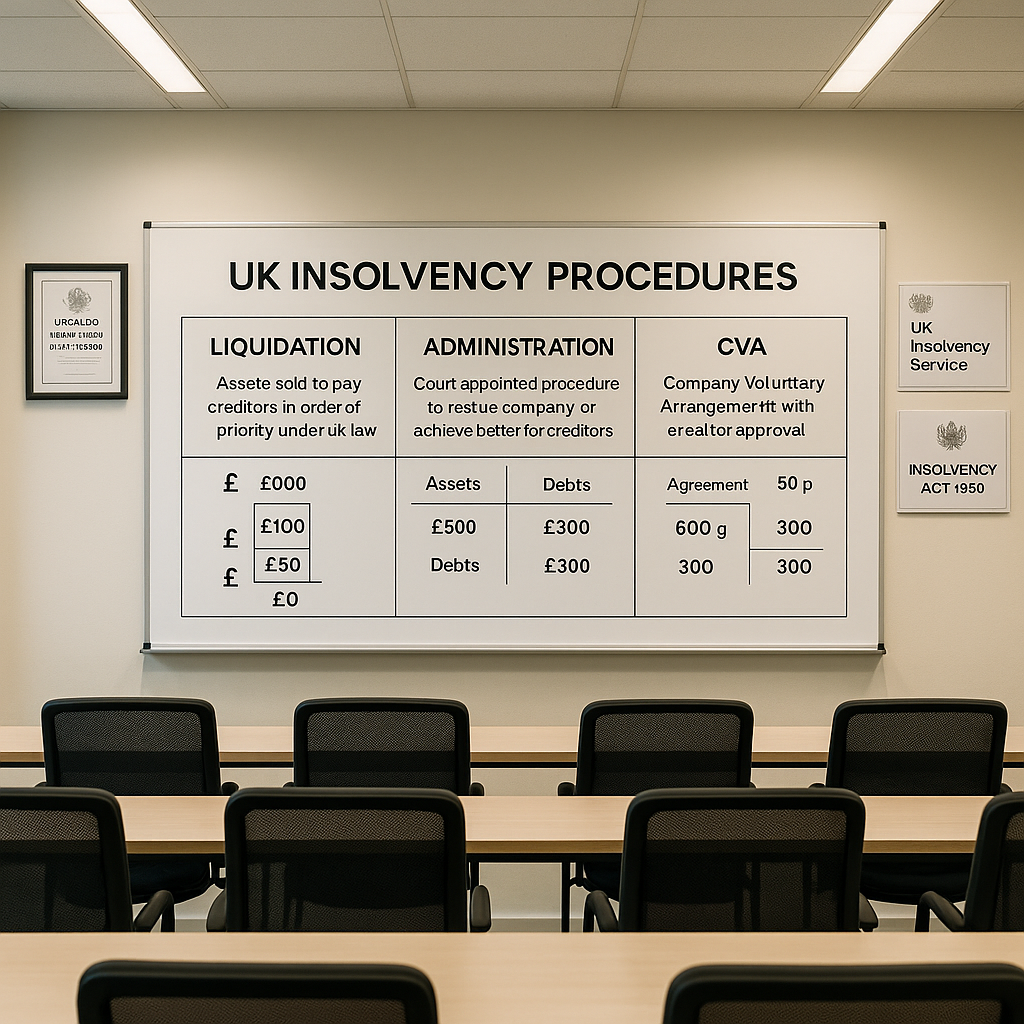

Facing financial challenges is a common issue among business owners and company directors. Making the right decision between liquidation and dissolution can significantly impact your company's future. Some companies may also want to consider broader recovery options, including administration or Company Voluntary Arrangements, before deciding on closure under the Insolvency Act 1986. Understanding the difference between liquidation and dissolution is crucial, as both follow different legal procedures under English law and may lead to different outcomes. Choosing the wrong option could affect your ability to pay creditors, influence your shareholders, and determine the long-term reputation of your business. These consequences can be difficult to manage without proper professional guidance from licensed insolvency practitioners. This article will guide you through understanding the difference between liquidation and dissolution, highlighting how each process works under English law, their impacts, and when one might be more suitable than the other for closing your company. Professional advice can ensure a successful outcome and full compliance with legal and financial rules. Liquidation marks a significant phase in a company's lifecycle, signifying the end of its operations and the sale of its assets under the supervision of a licensed insolvency practitioner. This formal insolvency process occurs when a business can no longer meet its financial obligations as defined in Section 123 of the Insolvency Act 1986, and needs to pay off remaining creditors according to the statutory hierarchy. A licensed insolvency practitioner, authorised by recognised professional bodies such as ICAEW, ACCA, or IPA, oversees this formal procedure, ensuring that assets are fairly distributed among creditors in order of priority. The method varies depending on whether the directors voluntarily place the company into Creditors' Voluntary Liquidation (CVL) or enter Members' Voluntary Liquidation (MVL) for solvent companies, but both lead to winding up the company's affairs under the Insolvency Act 1986. The essence of liquidation lies in settling debts to allow for an equitable closure. After selling all assets and paying off outstanding debts as much as possible, any remaining funds are distributed among shareholders before the company ceases trading. Subsequently, Companies House removes the business from its register, officially dissolving it as a legal entity. Liquidating a company deeply affects everyone involved—from employees losing jobs to directors facing potential restrictions on managing other businesses under the Company Directors Disqualification Act 1986. Liquidation marks the formal ending of a company's life by selling its assets to pay debts under the supervision of a licensed insolvency practitioner. This authorised professional must oversee the process, ensuring money raised goes first to secured creditors, then to preferential creditors including employees and HMRC for certain tax debts, and finally to unsecured creditors according to the statutory waterfall under the Insolvency Act 1986. After paying off as much debt as possible, any remaining funds are distributed among shareholders. This path often comes into play for companies unable to meet financial obligations or those seeking a structured closure that complies with English law requirements. The liquidation process varies depending on whether the business is solvent or insolvent. Members' Voluntary Liquidation (MVL) caters to solvent companies wishing to close cost-effectively, requiring directors to make a statutory declaration of solvency under Section 89 of the Insolvency Act 1986. Creditors' Voluntary Liquidation (CVL) involves insolvent companies that cannot pay their debts as they fall due. One key point in the process is the legal requirement to advertise the liquidation in The Gazette, ensuring transparency for creditors and compliance with statutory notification requirements. The process of liquidation signals the formal closing of a company under the supervision of a licensed insolvency practitioner. This formalised procedure comprises several key actions governed by the Insolvency Act 1986 and the Insolvency Rules (England and Wales) 2016. Depending on the financial situation, liquidation can be initiated voluntarily by the company's directors or occur when creditors force the company into liquidation due to unpaid debts. In cases of Compulsory Liquidation, an official receiver may be appointed by the court to manage the process. The key stages involve directors examining the organisation's financial health and determining if liquidation is the optimal solution. The company consults a licensed insolvency practitioner to understand the impacts of choosing liquidation. A resolution for closing down the company is agreed upon at a shareholders' meeting, and a licensed insolvency practitioner is appointed as liquidator. The liquidator compiles and submits a Statement of Affairs, providing an overview of assets and debts. A public announcement is made in The Gazette, notifying creditors and interested parties. All business assets fall under the liquidator's control for valuation and subsequent sale. The income from asset sales proceeds to repay the company's financial obligations, prioritising secured creditors, then preferential creditors including employees and HMRC, followed by unsecured creditors. Employee remunerations are settled as preferential claims before other unsecured creditors. After settling debts, any leftover assets are divided among shareholders. The liquidator delivers final accounts to Companies House and proposes removal of the company from the register, completing the formal dissolution process. A licensed insolvency practitioner plays a crucial role during a company's liquidation process, appointed to oversee the company's affairs under the Insolvency Act 1986. They must be authorised by recognised professional bodies and are subject to ongoing regulatory oversight by the Insolvency Service. Key responsibilities involve liquidating company assets, settling legal disputes, and distributing residual income to creditors according to the statutory hierarchy. This professional ensures the entire process complies with legal requirements under the Insolvency Act 1986 and brings greater clarity and structure to an otherwise complex situation. A licensed insolvency practitioner must guide the company through liquidation with experience and expertise. Their participation is essential in ensuring fairness and transparency throughout the process, owing fiduciary duties to creditors as a whole rather than any particular stakeholder group. By expert handling of assets, they assist in maximising returns for creditors, which may include employees owed wages or redundancy payments through the Redundancy Payments Service. Professional fees charged during the process are generally paid from company assets and require creditor or court approval. Moreover, an insolvency practitioner provides guidance on potential risks of wrongful trading charges under Section 214 of the Insolvency Act 1986 that directors may encounter. Professional advice should be sought early to ensure correct procedures are followed and liabilities are minimised. Understanding dissolution is vital for company directors and business owners. It signifies a company's legal termination through removal from the Companies House register under the Companies Act 2006, effectively declaring it no longer in operation or existence. This action often comes into play when a company chooses to stop trading voluntarily without conducting formal insolvency procedures such as liquidation. Dissolution through voluntary strike-off might seem like a convenient exit, but it necessitates clearing all dues and resolving liabilities beforehand, as dissolution does not extinguish company debts. The procedures for dissolving a company commence with halting operations and settling any pending debts. Directors must also manage all assets, which could entail selling them to repay creditors or distributing them to shareholders before applying for dissolution. After meeting these financial obligations, directors can request dissolution from Companies House using Form DS01. This confirms that the business fulfils its duties to creditors and shareholders before completely shutting down under the voluntary strike-off procedure. Legal implications are significant; directors need to adhere to all pertinent laws during this action to prevent personal liability concerns later, particularly given HMRC's powers to object to dissolution and seek restoration of dissolved companies. Dissolution marks the end of a company's legal existence through removal from the Companies House register under Section 1003 of the Companies Act 2006. This process starts after owners decide they no longer wish to run their business and can demonstrate compliance with strict eligibility criteria. The voluntary strike-off process for dissolution is straightforward if handled correctly and carried out in accordance with legal procedures. Directors need to ensure that the company has ceased trading for at least three months, has no outstanding liabilities, and meets all statutory requirements before proceeding. They follow a set procedure that includes settling all debts, dealing with any assets appropriately, and ensuring no outstanding obligations remain. The company must complete Form DS01 and submit it to Companies House with the prescribed fee, accompanied by declarations confirming eligibility. However, if the company faces legal action or has unpaid debts, dissolution may no longer be appropriate. In such cases, formal liquidation involving creditor protection may be required under the Insolvency Act 1986. Dissolution can happen when a business chooses to cease operations and shut down through the voluntary strike-off procedure under the Companies Act 2006. It's a cost-effective approach to conclude a business that doesn't intend to continue operations, but requires careful compliance with eligibility criteria. The dissolution steps involve board members establishing consensus on shutting down the business through a formal resolution. The business must resolve all pending payments, including creditors and all fiscal commitments, ensuring no outstanding liabilities remain. The organisation's assets should be dealt with appropriately, either through distribution to shareholders or sale with proceeds distributed. Any leftover funds post-debt repayment should be apportioned among shareholders based on their equity holdings. Directors must arrange final accounts and ensure the company has ceased trading for the required three-month period. Form DS01 must be completed and presented to Companies House with supporting declarations confirming eligibility for voluntary strike-off. The company must notify all pertinent parties about its decision to close, including creditors, employees, shareholders, and any other associated parties. Companies House then issues a notice in The Gazette to accommodate any objections to the closure. If there are no objections within two months, Companies House proceeds with the company's dissolution. The Gazette provides public record accessibility throughout this period, ensuring transparency and allowing interested parties to raise concerns if the dissolution is inappropriate. Company directors need to understand their responsibilities during the dissolution process to ensure compliance with legal requirements under the Companies Act 2006. Directors must certify that the company has no debts or can pay its debts, and failure to meet these obligations could result in personal liability. Directors must not cease trading while pretending the company is dissolved, as this could be considered fraudulent and have serious implications, including disqualification from holding director positions under the Company Directors Disqualification Act 1986. Directors must inform all relevant parties, including creditors and Companies House, about their intent to dissolve the company. Compliance ensures a smoother process and protects directors from potential legal pitfalls, particularly given that dissolution does not extinguish company debts. HMRC possesses extensive powers to object to dissolution and seek restoration of dissolved companies where tax liabilities remain outstanding. Directors should ensure all corporation tax, VAT, PAYE, and other tax matters are properly concluded before proceeding with dissolution. Understanding the difference between liquidation and dissolution is important when deciding how to close a business under English law. Liquidation often means a company stops trading, and its assets are sold under professional supervision to pay off debts through formal insolvency procedures. This process can lead to the end of a business, with all assets distributed among creditors according to the statutory hierarchy under the Insolvency Act 1986. Shareholders might receive a dividend if there's money left after paying debts, particularly in Members' Voluntary Liquidation where the company is solvent. Dissolution, on the other hand, is a cost-effective way of closing a company through voluntary strike-off that may no longer be active or trading but doesn't have significant debts. The decision between these processes depends on several factors, including whether the company can afford to pay off its liabilities and meet statutory requirements. In dissolution, there's typically no need to sell off assets as in liquidation, but assets must be properly dealt with before the DS01 application. The process involves formal publication in The Gazette to ensure transparency and provide opportunities for objections. Creditors face different situations in liquidation compared to dissolution under English law. In liquidation, a licensed insolvency practitioner sells the company's assets and uses the funds to pay creditors according to statutory priorities established by the Insolvency Act 1986. Creditors are entitled to receive payment in order of priority, with secured creditors receiving payment from their secured assets, preferential creditors including employees and HMRC receiving priority, and unsecured creditors sharing in any remaining funds through the prescribed part provisions under Section 176A. Dissolution may leave little for creditors if there are no significant assets left after the company stops trading. Dissolution usually applies when a company is solvent and has settled all liabilities, but creditors may object to Companies House if they have legitimate claims. Directors must seek professional guidance throughout the process to avoid being prosecuted for wrongful conduct and to ensure creditors have proper protection where required under the respective legal frameworks. Shareholders face different outcomes in liquidation versus dissolution. In liquidation, assets are sold to clear debts, which can return funds to shareholders if anything remains after creditors are paid according to the statutory waterfall. This means shareholders might not lose everything if assets cover liabilities, particularly in Members' Voluntary Liquidation where the company is solvent. Dissolution usually follows when a company decides to stop trading and has no debts, but shareholders must be notified and have opportunities to object. In both processes, understanding the impact on assets and liabilities helps directors make informed decisions for their business's future. Liabilities play a crucial role, as an insolvent company undergoing Creditors' Voluntary Liquidation ensures outstanding debts are addressed as far as possible with available assets. Directors need to assess their company's financial health accurately before choosing between dissolution and liquidation, considering the different protections and procedures available under English law. Choosing voluntary liquidation, such as Members' Voluntary Liquidation (MVL) or Creditors' Voluntary Liquidation (CVL), depends on the company's situation under the Insolvency Act 1986. Opt for MVL if the business is solvent and you want to close it cost-effectively while dealing with all assets and liabilities properly through professional oversight. This method allows for structured winding-up with potential tax advantages, ensuring any remaining value returns to shareholders efficiently through capital gains tax treatment rather than income tax on distributions. Dissolution might be the better route for companies that are no longer active and without significant debts. This process involves striking off from the Companies House register using Form DS01, ideal if there are no assets left to distribute or liabilities to settle. Directors should consider this option when seeking a simpler and less expensive way to dissolve a company that has stopped trading, provided all eligibility criteria under the Companies Act 2006 are met. Voluntary liquidation comes in two forms under the Insolvency Act 1986: MVL (Members' Voluntary Liquidation) and CVL (Creditors' Voluntary Liquidation). In MVL, company directors decide to close the company because it can pay its debts but no longer wants to trade, requiring a statutory declaration of solvency under Section 89. This type of liquidation shows the business is solvent and aims for a cost-effective way to end operations with potential tax advantages for shareholders. CVL occurs when a company cannot meet its financial obligations and requires creditor involvement in the appointment of the liquidator. Directors choose this path to stop trading, allowing a licensed insolvency practitioner to handle asset distribution among creditors according to statutory priorities. Both processes require expert advice from insolvency practitioners and ensure compliance with legal requirements under English law. Understanding the distinction between MVL and CVL helps determine when dissolution might be preferable. A company selects dissolution when it's debt-free or can clear its debts, making dissolution a cost-effective alternative for winding up under the Companies Act 2006. Dissolution is suitable for companies that have ceased trading for at least three months and have no intention to restart business activities. The procedure doesn't involve a licensed insolvency practitioner, reducing professional costs and simplifying the process. If a company possesses assets, these must be dealt with before applying for dissolution through proper distribution to shareholders or sale with proceeds distributed. Dissolution is less formal compared to liquidation, requiring fewer legal responsibilities and less oversight from authorities. The procedure reflects positively on directors, implying they have run the company responsibly until operations ceased. It permits directors to end their business without declaring insolvency, preserving their standing in the business community and avoiding negative connotations often linked with liquidation. The dissolution process requires directors to complete Form DS01 to close the business officially under the Companies Act 2006. This removes the company from the register, but directors should be aware that if certain obligations to HMRC are not settled, the company could be restored to the register. Financial obligations during liquidation are critical. A licensed insolvency practitioner must be appointed to manage this formal procedure under the Insolvency Act 1986, ensuring assets are distributed fairly among creditors according to statutory priorities. This process addresses outstanding debts, ensuring they're paid as much as possible from remaining assets. Creditors, especially HMRC, often have higher priority during asset distribution under the preferential creditor provisions. Compliance with legal requirements is essential throughout both processes to avoid penalties or personal liability for directors. Professional advice from qualified insolvency practitioners ensures proper compliance with the complex legal framework governing company closure. Moving from dissolution considerations, it's crucial to understand financial obligations during liquidation under the Insolvency Act 1986. Liquidating a company involves paying off debts before closing down through a structured process that prioritises creditors according to statutory rules. Creditors receive payment from the sale of company assets through professional realisation by the licensed insolvency practitioner. It's a formal procedure that prioritises secured creditors, preferential creditors including employees and HMRC, and then unsecured creditors through the prescribed part provisions. Licensed insolvency practitioners oversee the process and ensure everything complies with legal requirements. The costs associated with liquidation vary, but professional oversight benefits all parties involved by maximising asset realisations and ensuring fair distribution. Business owners must consider these financial obligations carefully when deciding to close their business through liquidation, especially if there are assets and liabilities requiring professional management under English law. After addressing financial obligations, businesses must focus on adhering to legal requirements under the respective frameworks. Companies must ensure compliance with all relevant laws and regulations for dissolution under the Companies Act 2006 and liquidation under the Insolvency Act 1986. This involves detailed reporting and documentation submission to regulatory bodies, including providing company information for identification. Proper compliance provides reassurance and helps prevent legal complications that could arise from overlooking important duties. Directors should stay informed about their responsibilities during company closure, especially regarding HMRC obligations and creditor notifications. They must work with appropriate professionals who guide them through necessary steps for closing a business in line with English law. If any party wishes to object to dissolution or liquidation, there are formal procedures to raise concerns. Professional partnership helps limit personal liability and ensures the difference between liquidation and dissolution is clearly understood during this critical time. Professional guidance from licensed insolvency practitioners, solicitors, and accountants is essential when navigating the decision between liquidation and dissolution. These qualified professionals understand English law and can provide tailored advice based on your company's circumstances, ensuring compliance with statutory requirements. Early consultation helps identify potential issues such as outstanding HMRC obligations, contingent liabilities, or director conduct concerns. Professional advisers assist with required documentation, including statutory declarations for MVL, Form DS01 for dissolution, or creditor notifications for CVL procedures. Professional fees for insolvency practitioners are regulated and must be approved by creditors or the court in liquidation proceedings. Whilst dissolution involves lower costs, directors bear greater responsibility for ensuring compliance with legal requirements. HMRC plays a significant role in both procedures, with extensive powers to protect tax revenues. In liquidation, HMRC enjoys preferential status for certain tax debts under the Finance Act 2020, including VAT and PAYE that rank ahead of floating charge holders. Directors considering dissolution must ensure all tax affairs are concluded before submitting Form DS01, as HMRC can object to dissolution and seek restoration of dissolved companies. Corporation tax returns must be filed up to dissolution date, and outstanding liabilities settled. The tax treatment of distributions differs between procedures, with potential capital gains tax advantages in Members' Voluntary Liquidation compared to income tax treatment of normal dividends. Professional tax advice ensures compliance with HMRC requirements whilst optimising outcomes. Employee rights receive protection under English law during both procedures. In liquidation, employees rank as preferential creditors for wages and holiday pay up to statutory limits under the Employment Rights Act 1996. The Redundancy Payments Service provides a safety net when companies cannot meet employment obligations, covering statutory redundancy payments and unpaid wages. TUPE regulations may apply where business assets are sold as going concerns, protecting employee rights. Directors must ensure employment obligations are addressed before dissolution, as outstanding liabilities could disqualify the company from voluntary strike-off and expose directors to personal liability. The finality of each procedure differs significantly. Liquidation results in comprehensive investigation and asset realisation before dissolution, providing greater certainty that issues have been addressed. Dissolution may be reversed through restoration to the register under Section 1029 of the Companies Act 2006 if inappropriate or if creditors emerge with legitimate claims. This reflects the less comprehensive nature of dissolution. Directors should consider long-term implications including potential liability exposure, impact on their ability to act as directors of other companies, and reputational consequences. Professional advice helps assess these factors and ensure the chosen approach aligns with directors' interests. Choosing between liquidation and dissolution is crucial for business owners, company directors, and financial professionals operating under English law. Understanding the difference helps in making the right decision based on the company's circumstances and legal requirements. Liquidation means formally closing a business through professional procedures under the Insolvency Act 1986 when it can't pay its debts, involving selling assets to pay creditors according to statutory priorities. Dissolution marks the end of a company's legal existence through voluntary strike-off under the Companies Act 2006 without necessarily involving formal insolvency procedures. Opting for voluntary liquidation might be more appropriate if professional oversight and creditor protection are required. During liquidation, companies benefit from licensed insolvency practitioner expertise to ensure compliance with legal requirements and maximise creditor recoveries. The main difference lies in how each affects shareholders, liabilities, and creditors under English law. Dissolution could be a smoother path for companies without significant debts that meet strict eligibility criteria, while liquidation offers structured procedures for dealing with outstanding obligations. Always ensure compliance with legal requirements during these processes under the appropriate statutory framework. The choice significantly impacts your company's closure and should be made with professional advice from qualified insolvency practitioners who understand the complexities of English law. What is Liquidation, and How Does it Affect a Company?

Definition and Meaning of Liquidation

The Liquidation Process: Steps and Procedures

Role of a Licensed Insolvency Practitioner in Liquidation

Exploring Dissolution and Its Impact on a Company

Understanding Dissolution: Key Concepts

Steps Involved in the Dissolution Process

Legal Implications of Dissolution for Company Directors

Key Differences Between Liquidation and Dissolution

Aspect

Liquidation

Dissolution

Legal Framework

Insolvency Act 1986

Companies Act 2006

Professional Oversight

Licensed insolvency practitioner required

Directors manage process

Eligibility

Any company (solvent or insolvent)

Strict criteria: no trading, no liabilities

Cost

Higher due to professional fees

Lower - administrative fees only

Creditor Protection

Comprehensive statutory procedures

Limited - relies on directors' declarations

Investigation

Detailed examination of affairs

No formal investigation

How Creditors Are Affected Differently

Impact on Shareholders and Liabilities

When to Choose Voluntary Liquidation or Dissolution

Understanding Voluntary Liquidation: MVL and CVL

Criteria for Opting for Dissolution Over Liquidation

Legal and Financial Considerations

Financial Obligations During Liquidation

Ensuring Compliance with Legal Requirements

Professional Guidance and Best Practices

HMRC Considerations and Tax Implications

Employee Protection and Employment Law

Future Considerations and Restoration

Conclusion

How Are Insolvency Practitioners Appointed – UK Expert Guide Navigating financial turmoil can be overwhelming for company directors and sole traders alike. Faced with mounting debts, threats of compulsory liquidation, or creditor demands, knowing “how insolvency practitioners are appointed” becomes crucial for preserving your organisation. In the UK, professional insolvency services, such as company voluntary […]

Administration might be your lifeline when your company's drowning in debt and creditors are circling. But here's what most directors don't understand: it's not just about buying time — it's about buying the right kind of time, with the proper professional support. The difference between administration working for you or against you often comes down […]

Can an Insolvency Practitioner Stop Creditors? In the UK, mounting pressure from creditors can disrupt cash flow, increase stress for directors, and push a company toward insolvency. Professional guidance plays a pivotal role in countering these challenges. Nexus Corporate Solutions Limited specialises in helping businesses find relief from persistent creditors, providing strategic solutions that align […]

When your company's in financial trouble, one of the biggest worries is what happens to everything you've built. Your equipment, property, stock — the assets that represent years of hard work. It's a valid concern, and you're not alone. The reality? How insolvency practitioners handle your company's assets can make or break the outcome for […]

Insolvent trading can trigger severe repercussions for UK directors, including personal liability and possible disqualification. When a business is unable to pay debts and continues to trade without a reasonable prospect of avoiding insolvency, the law may classify this as wrongful trading. The Insolvency Act 1986, alongside related legislation, outlines civil and criminal penalties for […]

Recognising the signs of business insolvency early is vital for UK companies. Overlooked warning signals—such as recurring cash flow issues, unpaid HMRC tax arrears, or missed staff wages—can quickly escalate into serious risks that demand immediate attention. Being aware of these common signs of business insolvency enables directors to take timely action, whether through careful […]

Supplier insolvency can have serious consequences for UK companies, creating ripple effects that extend beyond the affected supplier. Cash flow interruptions, delayed payments, and increased operational risks are common outcomes. When a key supplier or client becomes insolvent, contracts may be disrupted, insurance coverage can be affected, and overall profitability may decline. Nexus Corporate Solutions […]

Struggling with IVA monthly payments can feel overwhelming, especially when daily financial obligations pile up. An Individual Voluntary Arrangement (IVA) is designed to help those in debt regain stability by consolidating and managing repayments under a legally binding agreement. However, life changes—like reduced monthly income, sudden expenses, or shifts in personal circumstances—often make sticking to […]

Experiencing financial difficulty can make everyday life more challenging, especially when an individual or business director needs to secure a stable living arrangement. In the UK, an Individual Voluntary Arrangement (IVA) offers a legally binding debt solution that eases pressure from creditors. However, many worry about problems renting after IVA. Questions about how this might […]

Address: Apex Building, 1 Water Vole Way, Balby, Doncaster, South Yorkshire, DN4 5JP

Tel: 01302 430180

Services

Company