What Happens When You Hire an Insolvency Practitioner Many UK directors and business owners face stressful financial problems—ranging from mounting debts to the risk of compulsory liquidation. When these challenges surface, seeking professional support can be the turning point. Hiring an insolvency practitioner UK for your company brings legal protection, business rescue opportunities in the […]

How Does Insolvency Affect Credit Rating and Company Liquidation Impact?

Understanding how insolvency affects credit ratings is crucial for business owners and directors operating within the UK's comprehensive regulatory framework. Many worry whether their company's financial difficulties will harm their personal ability to borrow money or impact their business's future creditworthiness. This concern is well-founded, as insolvency can significantly affect your credit rating under UK law, making it considerably more challenging to obtain loans, credit facilities, or favourable terms from suppliers and lenders. A fundamental fact that UK business owners must understand is that insolvency can have lasting consequences for credit ratings, with records maintained on credit files for six years under the UK system. This extended period reflects the serious nature of insolvency proceedings and the importance that UK credit reference agencies place on such events when assessing creditworthiness. Our comprehensive guide will examine the impact of insolvency and company liquidation on credit scores within the UK regulatory environment. We will outline the steps you can take to safeguard your finances during these challenging times, drawing upon the protections and procedures established under UK insolvency law. The guidance provided focuses specifically on UK insolvency procedures, including Individual Voluntary Arrangements (IVAs), Debt Relief Orders (DROs), bankruptcy, and corporate insolvency processes such as Creditors' Voluntary Liquidation (CVL) and administration. Recovery from insolvency might seem daunting, but with proper understanding of UK law and professional advice from licensed insolvency practitioners, it is possible to rebuild your financial standing. The UK's insolvency framework, primarily governed by the Insolvency Act 1986, provides structured pathways for both individuals and companies facing financial difficulties whilst establishing clear rules about credit reporting and rehabilitation. Insolvency typically leads to a sharp decline in your credit rating, as recorded by the three main UK credit reference agencies: Experian, Equifax, and TransUnion. These agencies maintain comprehensive records of insolvency proceedings and make this information available to lenders, suppliers, and other organisations that extend credit. The impact on your credit score occurs because insolvency demonstrates to potential creditors that you have previously experienced significant financial difficulties. Your credit report will show that you are or have been insolvent, serving as a warning to lenders that extending credit to you carries increased risk. This information is particularly significant because UK lenders and credit providers regularly consult these reports before making lending decisions, using sophisticated credit scoring models that heavily weight insolvency events. UK credit reference agencies record insolvency information, which remains visible on credit files for six years from the date the insolvency begins. This six-year period is established under UK regulations and applies consistently across all three major credit reference agencies. The extended duration reflects the serious nature of insolvency and ensures that lenders have access to relevant historical information when assessing credit applications. Even after resolving insolvency proceedings, rebuilding a positive credit rating requires considerable time and effort. The UK credit system places significant emphasis on payment history and financial stability, meaning that individuals and businesses emerging from insolvency must demonstrate consistent, responsible financial behaviour over an extended period. Insolvency significantly influences your credit rating within the UK's regulatory framework, creating substantial barriers to obtaining credit in the future. A deteriorated credit rating occurs because creditors report defaults and unpaid debts to credit reference agencies, highlighting financial difficulties to prospective lenders. This negative impact on your credit history serves as a clear signal to potential creditors that lending to you involves heightened risk, potentially resulting in declined applications or significantly less favourable terms. The UK's credit reporting system ensures that insolvency records are comprehensive and accessible to authorised organisations. When you enter any form of insolvency procedure, whether individual bankruptcy, an Individual Voluntary Arrangement (IVA), or a Debt Relief Order (DRO), this information is recorded on the Individual Insolvency Register maintained by The Insolvency Service. This public register is searchable online and provides details including your name, address, the type of insolvency procedure, and relevant dates. A record of insolvency on your credit file can significantly deter lenders from providing finance, affecting not just business ventures but personal borrowing capabilities as well. UK lenders use sophisticated credit scoring models that assign significant negative weightings to insolvency events, often resulting in automatic declines for credit applications during the six-year reporting period. Even when credit is available, it typically comes with substantially higher interest rates, lower credit limits, and more restrictive terms. For company directors, involvement in an insolvent company can create additional complications, particularly if they have provided personal guarantees for business debts or have overdrawn directors' loan accounts. Under UK law, directors may become personally liable for certain company debts if they have guaranteed loans or if there are outstanding amounts on their director loan accounts when the company enters insolvency. Bankruptcy can severely impact your credit rating within the UK system, making it extremely challenging to borrow money or establish new business ventures during the reporting period. After declaring bankruptcy, the record remains on your credit report for six years from the date the bankruptcy order is made, not from when you are discharged. This distinction is important because whilst most bankruptcies in the UK result in discharge after twelve months, the credit reporting consequences continue for the full six-year period. The UK bankruptcy system, governed by the Insolvency Act 1986, establishes clear timelines and procedures for bankruptcy proceedings. When you are declared bankrupt, either through your own petition or following a creditor's petition, this information is immediately recorded on the Individual Insolvency Register and reported to all three major UK credit reference agencies. Creditors and lenders systematically check credit histories before approving new lines of credit, meaning that a bankruptcy record almost invariably leads to declined applications or substantially higher interest rates. UK lenders typically have strict policies regarding bankruptcy, with many mainstream financial institutions automatically declining applications from individuals with bankruptcy records. Despite these substantial setbacks, it is possible to rebuild your finances and improve your credit score over time through careful debt management and responsible financial behaviour. The UK system recognises the importance of financial rehabilitation, and whilst the six-year reporting period cannot be shortened, individuals can begin demonstrating improved financial management immediately after discharge. Creditors hold a pivotal role during insolvency proceedings under UK law, with their rights and responsibilities clearly defined by the Insolvency Act 1986. They possess significant decision-making powers, including the right to vote on important matters such as whether to accept a Company Voluntary Arrangement (CVA) or proceed with a Creditors' Voluntary Liquidation (CVL). These voting rights are typically exercised based on the value of debts owed, ensuring that creditors with larger financial interests have proportionally greater influence over proceedings. The UK insolvency framework establishes clear hierarchies for creditor payments, with secured creditors holding priority over unsecured creditors. Secured creditors, who hold charges over company assets, typically recover a higher percentage of their debts compared to unsecured creditors such as trade suppliers or HMRC for certain taxes. Creditors also possess the right to demand repayment and initiate legal action if they believe their debts are at risk. Under UK law, creditors can petition for bankruptcy against individuals owing more than £5,000, or present winding-up petitions against companies unable to pay debts exceeding £750. These legal remedies provide creditors with powerful tools to recover debts, though they also trigger formal insolvency procedures with significant consequences for debtors. Many company directors express concern about how liquidating their company might impact their personal finances and creditworthiness. Generally, if you operate a limited company, which constitutes a separate legal entity from yourself under UK company law, the liquidation of your business should not directly affect your personal credit score. This separation provides limited liability protection, meaning that company debts remain the responsibility of the company rather than its directors personally, provided there has been no fraudulent trading, wrongful trading, or other misconduct. The principle of limited liability, established under the Companies Act 2006, creates a clear distinction between company obligations and personal liabilities. This legal separation means that when a company enters liquidation, whether through a Creditors' Voluntary Liquidation (CVL) or compulsory liquidation, the company's debts and credit history remain separate from those of its directors. However, significant exceptions to this protection exist, particularly where directors have provided personal guarantees for business loans or have overdrawn directors' loan accounts. Personal guarantees create direct personal liability for company debts, meaning that if the company cannot fulfil its obligations during liquidation, creditors may pursue directors personally for guaranteed amounts. Company debts can indeed affect your personal finances, particularly if you have provided personal guarantees for business loans or other financial commitments. Personal guarantees create direct personal liability for specified company debts, meaning that if your company enters liquidation and cannot repay guaranteed amounts, creditors possess legal rights to pursue your personal assets for recovery. The legal framework governing personal guarantees in the UK is well-established, with guarantees typically remaining enforceable even after company liquidation. When a company enters liquidation proceedings, the liquidator will identify all company assets and liabilities, including any personal guarantees provided by directors. If company assets are insufficient to repay guaranteed debts in full, creditors can enforce their rights under the guarantees. Directors of limited companies usually benefit from the separation between their personal finances and company debts, as established under UK company law. However, this protection can be compromised in several ways beyond personal guarantees. If directors have withdrawn money from the company through overdrawn directors' loan accounts, these amounts represent personal debts to the company that become immediately payable upon liquidation. The concept of wrongful trading, unique to UK law, can result in directors being held personally liable for company debts if they continued trading when they knew, or ought to have known, that the company could not avoid insolvent liquidation. This provision encourages directors to seek professional advice promptly when companies face financial difficulties. Protecting your credit rating during company liquidation requires careful planning and adherence to UK legal requirements. The most fundamental step involves maintaining clear separation between personal and company finances, ensuring that lenders cannot establish claims against your personal wealth. This separation helps preserve the limited liability protection that UK company law provides to directors. Seeking counsel from a licensed insolvency practitioner at an early stage provides crucial protection for directors facing company liquidation. Licensed insolvency practitioners possess comprehensive knowledge of UK insolvency law and can provide decisive advice on how to navigate liquidation proceedings whilst protecting personal interests. Updating your contact details with Companies House and credit reference agencies becomes particularly important if your business operated from your home address. UK credit reference agencies sometimes associate business credit information with residential addresses, potentially affecting personal credit scores if negative business information becomes linked to your personal credit file. Avoiding personal guarantees for company debts represents the most effective long-term strategy for protecting personal credit during potential liquidation. However, if personal guarantees already exist, understanding their scope and implications becomes crucial for financial planning. Regular monitoring of personal credit reports throughout the liquidation process helps identify any errors or inappropriate entries that might affect creditworthiness. UK consumers have the right to obtain statutory credit reports from all three major credit reference agencies, and these reports should be reviewed carefully to ensure that company liquidation information does not incorrectly appear on personal credit files. Personal guarantees create significant legal implications during company liquidation, with directors potentially facing substantial personal liability for guaranteed debts. Under UK law, personal guarantees typically remain enforceable regardless of the company's insolvency status, meaning that creditors can pursue directors personally for guaranteed amounts even after the company has been dissolved. The legal framework governing personal guarantees in the UK provides creditors with powerful remedies for debt recovery. If a director fails to honour a personal guarantee following company liquidation, creditors can issue statutory demands requiring payment within 21 days. Failure to comply with a statutory demand can lead to bankruptcy proceedings, with all the associated consequences for personal credit ratings and financial freedom. Legal actions against directors who have provided personal guarantees are commonplace when insolvent companies enter liquidation. Creditors often view personal guarantees as their primary means of recovery when company assets are insufficient to repay debts in full. The enforcement of guarantees can result in directors losing personal assets, including family homes if these have been used as security. The outcome of enforced personal guarantees can severely affect credit ratings and significantly hinder the ability to obtain credit in both the short and long term. Bankruptcy resulting from guarantee enforcement carries the same six-year credit reporting period as any other bankruptcy, whilst County Court judgments remain on credit files for six years and can prevent access to mainstream credit facilities. The liquidation process involves systematically winding up a company's affairs, realising its assets, and using the proceeds to pay creditors according to the priorities established under UK insolvency law. This process typically follows insolvency proceedings when a business can no longer meet its financial obligations, though solvent companies may also choose liquidation through Members' Voluntary Liquidation (MVL) procedures. Directors may choose voluntary liquidation to manage insolvency situations responsibly, demonstrating to creditors and stakeholders that they are taking appropriate action to address financial difficulties. Creditors' Voluntary Liquidation (CVL) represents the most common form of voluntary liquidation for insolvent companies, requiring directors to acknowledge that the company cannot continue trading and cannot pay its debts as they fall due. The shortfall in creditor payments during liquidation severely impacts the company's credit rating, as it demonstrates to future lenders and suppliers that the business failed to fulfil its financial commitments. This failure signals significant risk to potential creditors and typically results in the company being unable to obtain credit or trade on normal commercial terms. Liquidating a company means its credit score will be permanently damaged, making it extremely difficult for any new venture established by the same directors to obtain favourable credit terms or supplier relationships. The impact on credit is profound and long-lasting, with details of insolvency and liquidation remaining on record at Companies House and appearing on company credit reports for several years after the liquidation is completed. Voluntary liquidation provides a structured process for directors to close their company responsibly when it can no longer continue trading profitably or meet its financial obligations. The process involves winding up the company's affairs and distributing assets to creditors according to the legal priorities established under the Insolvency Act 1986. The voluntary liquidation process begins when directors hold a board meeting to acknowledge that the company is insolvent and cannot continue trading. This decision requires careful consideration of the company's financial position, including its ability to pay debts as they fall due and whether its assets exceed its liabilities. Following the directors' decision to proceed with liquidation, they must appoint a licensed insolvency practitioner to act as liquidator. The choice of liquidator is important, as this professional will oversee the entire liquidation process and has significant powers over the company's assets and affairs. The liquidator's first task involves conducting a comprehensive assessment of the company's assets and liabilities, identifying all property, debts, and potential recoveries. This assessment forms the basis for creditor communications and determines the likely dividend that creditors will receive from the liquidation. Directors must inform shareholders and creditors about the liquidation decision, providing statutory notices and calling meetings as required by law. Shareholders must vote to approve the voluntary liquidation resolution, whilst creditors are invited to a meeting to consider the liquidator's appointment and receive information about the company's financial position. The liquidator then proceeds to realise the company's assets, converting property, stock, and other assets into cash for distribution to creditors. This process may involve selling business assets, collecting outstanding debts, and pursuing any claims against third parties. Funds from asset realisations are distributed to creditors according to the statutory priorities established under UK insolvency law. Secured creditors with fixed charges receive payment first, followed by the costs of liquidation, preferential creditors, secured creditors with floating charges, and finally unsecured creditors. Company Voluntary Arrangements (CVAs) represent a formal insolvency procedure that can significantly impact how creditors and credit reference agencies assess a company's creditworthiness. A CVA demonstrates that the company has experienced serious financial difficulties requiring formal intervention, which credit assessors interpret as indicating elevated risk for future lending or trading relationships. The CVA process requires the company to propose a formal arrangement to its creditors, typically involving reduced payments over an extended period or a composition settlement where creditors accept less than the full amount owed. Whilst this approach allows the company to continue trading and potentially recover, it also signals to the market that the business has been unable to meet its obligations on normal commercial terms. During the CVA period, companies typically face significant restrictions on their ability to obtain new credit or enter into substantial financial commitments without the consent of the CVA supervisor. These restrictions are designed to protect creditors' interests and ensure that the company focuses on implementing the agreed arrangement rather than incurring additional debts. Over time, successfully completing a CVA can demonstrate financial responsibility and commitment to repaying debts, potentially leading to gradual improvement in credit ratings. Companies that fulfil their CVA obligations show creditors that they can manage financial difficulties constructively and meet revised payment terms. During company liquidation, creditors face a structured but often disappointing process for debt recovery, governed by the strict legal priorities established under the Insolvency Act 1986. The liquidation process triggers comprehensive procedures designed to identify all company assets and liabilities, realise assets for the benefit of creditors, and distribute proceeds according to statutory priorities. Initially, a licensed insolvency practitioner appointed as liquidator conducts a thorough assessment of the company's assets and liabilities, preparing detailed statements of affairs that identify all creditors and their claims. This process involves reviewing company records, contracts, and financial documents to ensure that all debts are properly identified and valued. The liquidator then proceeds to realise company assets, converting property, stock, equipment, and other assets into cash for distribution to creditors. This realisation process must be conducted in accordance with the liquidator's duties to achieve the best possible outcomes for creditors whilst managing costs effectively. Secured creditors with fixed charges over specific company assets receive priority treatment, typically recovering their debts from the proceeds of selling the charged assets. These creditors, often banks or finance companies holding charges over property or equipment, usually achieve higher recovery rates than other creditor classes. Following payment of secured creditors with fixed charges, the liquidation expenses and the liquidator's fees are paid from the available funds. These costs, which can be substantial in complex liquidations, reduce the amount available for other creditors and represent a significant factor in determining overall creditor recoveries. Preferential creditors receive the next priority for payment, including certain employee claims such as wages, holiday pay, and pension contributions up to statutory limits. HMRC also ranks as a preferential creditor for certain taxes, including PAYE, National Insurance contributions, and VAT collected but not paid over. Unsecured creditors, including most trade suppliers, customers with deposits, and other commercial creditors, rank last in the payment hierarchy and often receive minimal recoveries or nothing at all. These creditors typically suffer the greatest losses in liquidation proceedings, as insufficient funds remain after meeting higher-priority claims and liquidation costs. Rebuilding your credit rating after insolvency requires patience, strategic planning, and consistent demonstration of improved financial management over an extended period. The process begins with understanding that insolvency records remain on UK credit files for six years from the date they commence, creating a significant but not insurmountable barrier to obtaining credit. The enhancement of creditworthiness can commence immediately after insolvency by obtaining small amounts of credit and repaying them punctually and in full. This approach demonstrates to lenders your renewed commitment to managing borrowed funds responsibly, gradually building a positive payment history that supports credit score improvement. Proper management of new credit facilities represents a crucial strategy for rebuilding relationships with financial institutions following insolvency. This involves using credit sparingly, maintaining low utilisation rates, and ensuring that all payments are made on time and preferably in full. UK credit scoring models place significant emphasis on payment history and credit utilisation, making these factors particularly important for individuals recovering from insolvency. Registering on the electoral roll at your current address significantly assists in improving creditors' perception of your stability and can positively influence credit scores. UK credit reference agencies use electoral roll information as a key factor in identity verification and stability assessment, with registered individuals typically achieving higher credit scores than those not on the electoral roll. Regular monitoring of the Individual Insolvency Register and your credit files helps ensure that insolvency information is accurately recorded and removed at the appropriate time. After six years have passed, insolvency records should be automatically removed from credit files, representing a crucial milestone in complete financial recovery. Restoring creditworthiness after insolvency represents an essential undertaking for business owners and financial professionals seeking to re-establish their financial standing within the UK market. The process requires dedication, strategic thinking, and consistent implementation of proven credit rebuilding techniques over an extended period. Regular examination of credit reports from all three major UK credit reference agencies ensures that information is current, accurate, and properly reflects your financial position. Errors on credit reports can significantly impact credit scores, and individuals recovering from insolvency should be particularly vigilant about ensuring that information is correctly recorded. Secured credit cards provide an excellent starting point for rebuilding credit, as they require a deposit that serves as collateral and typically have more lenient approval criteria than unsecured credit products. The deposit reduces the lender's risk whilst allowing individuals to demonstrate responsible credit management. Ensuring prompt payment of all bills, including utilities, mobile phone contracts, and other regular commitments, creates a foundation of positive payment history that credit reference agencies record and factor into credit scores. Late payments can significantly damage credit scores, particularly for individuals already recovering from insolvency. Maintaining low credit utilisation rates demonstrates responsible credit management and positively influences credit scores. Credit utilisation refers to the percentage of available credit that you use, and keeping this below 30% of available limits shows lenders that you can manage credit responsibly without becoming over-reliant on borrowed funds. Removing bankruptcy information from UK credit files follows a fixed timeline established by regulation, with bankruptcy records remaining visible for six years from the date the bankruptcy order is made. This six-year period represents a standard retention time across all three major UK credit reference agencies and cannot be shortened regardless of how quickly the bankruptcy is discharged or debts are repaid. The six-year retention period begins from the date of the bankruptcy order, not from the date of discharge, which typically occurs after twelve months for most bankruptcies in the UK. This distinction is important because whilst the active restrictions of bankruptcy usually end after one year, the credit reporting consequences continue for the full six-year period. After the six-year period expires, bankruptcy information is automatically removed from credit files without any action required from the individual. This automatic removal represents a significant milestone in financial recovery, as it eliminates the most serious negative information from credit reports and typically results in substantial improvement in credit scores. Business owners and financial professionals must understand this timeline because it highlights the long-term consequences of personal insolvency on creditworthiness and financial opportunities. The six-year period can significantly impact the ability to obtain mortgages, business loans, and other forms of credit. Improving financial standing after insolvency requires a systematic approach that addresses the specific factors that influence credit ratings within the UK system. The process involves implementing multiple strategies simultaneously whilst maintaining consistency over an extended period. Examining credit reports from all three major UK credit reference agencies provides essential baseline information about your current financial standing and identifies any errors or inaccuracies that might be affecting your credit score. These reports show how insolvency has impacted your credit rating and provide insight into other factors that may be influencing your creditworthiness. Enhancing financial management through the creation of a detailed budget that includes provisions for emergencies demonstrates the financial discipline that lenders value when assessing credit applications. A well-structured budget helps ensure that all financial commitments can be met consistently whilst building savings that provide financial security. Ensuring that all existing financial commitments are paid promptly establishes a foundation of positive payment history that gradually improves credit scores over time. This includes not only credit commitments but also utility bills, mobile phone contracts, insurance premiums, and other regular payments that credit reference agencies monitor. Applying for credit products specifically designed for individuals with poor credit histories provides opportunities to demonstrate improved financial management whilst rebuilding credit scores. These products typically include secured credit cards, credit-builder loans, and other specialist products that have more lenient approval criteria but higher interest rates. The Insolvency Act 1986 establishes the comprehensive legal framework for managing financial distress and insolvency proceedings throughout the UK, providing the statutory foundation for both individual and corporate insolvency procedures. This landmark legislation consolidates and modernises insolvency law, creating structured processes for dealing with individuals and companies that cannot meet their financial obligations whilst balancing the interests of debtors, creditors, and the broader economy. The Act defines the various insolvency procedures available to individuals and companies, including bankruptcy, Individual Voluntary Arrangements (IVAs), Debt Relief Orders (DROs), administration, Company Voluntary Arrangements (CVAs), and different forms of liquidation. Each procedure serves specific purposes and operates under detailed statutory provisions that govern everything from initiation criteria to creditor rights and asset distribution priorities. Key provisions of the Act include comprehensive protections for creditors' interests, ensuring that available assets are identified, preserved, and distributed fairly according to established legal priorities. The legislation establishes the roles and powers of licensed insolvency practitioners, who must oversee formal insolvency procedures and ensure compliance with statutory requirements. The Act also defines the responsibilities and potential liabilities of company directors when their companies face insolvency, including provisions relating to wrongful trading, fraudulent trading, and director disqualification. These provisions encourage responsible director behaviour and provide remedies for creditors when directors act inappropriately during periods of financial distress. The Insolvency Act 1986 establishes the fundamental legal framework for addressing financial distress and insolvency throughout the UK, creating comprehensive procedures for both individuals and companies facing financial difficulties. The Act consolidates various insolvency procedures into a single legislative framework, providing clarity and consistency in how insolvency matters are handled across different situations and stakeholder groups. The legislation defines different types of liquidation procedures, including Creditors' Voluntary Liquidation (CVL) for insolvent companies where directors acknowledge that the company cannot pay its debts as they fall due. CVL procedures allow companies to wind up their affairs voluntarily whilst ensuring that creditors' interests are protected through the appointment of licensed insolvency practitioners. Members' Voluntary Liquidation (MVL) provides a procedure for solvent companies whose shareholders wish to cease trading and distribute assets. MVL requires directors to make a statutory declaration of solvency, confirming that the company can pay its debts in full within twelve months of the liquidation commencing. The Act establishes the crucial role of licensed insolvency practitioners, who must be appointed to oversee formal insolvency procedures and ensure compliance with statutory requirements. These professionals must hold appropriate qualifications and authorisation from recognised professional bodies, ensuring they possess the necessary expertise to conduct insolvency procedures in accordance with legal requirements. Company Voluntary Arrangements (CVAs) represent another key provision of the Act, allowing companies to propose formal arrangements with their creditors that may enable business rescue and continued trading. CVAs require approval from creditors holding at least 75% by value of the debts owed, ensuring that arrangements have substantial creditor support. Licensed insolvency practitioners play a pivotal role in the UK's insolvency system, serving as independent professionals who oversee formal insolvency procedures and ensure compliance with the comprehensive requirements established under the Insolvency Act 1986. These qualified professionals must obtain authorisation from recognised professional bodies and maintain their competence through continuing professional development. The appointment of a licensed insolvency practitioner provides essential independent oversight of insolvency procedures, protecting the interests of creditors, employees, shareholders, and other stakeholders. These professionals serve as officers of the court in many procedures, carrying significant responsibilities for conducting insolvency processes fairly, transparently, and in accordance with statutory requirements. In Creditors' Voluntary Liquidation procedures, licensed insolvency practitioners work closely with company directors to manage the complex process of winding up insolvent businesses efficiently and in accordance with legal requirements. Their responsibilities include conducting comprehensive investigations into company affairs, identifying and realising assets for the benefit of creditors, and ensuring that all statutory procedures are followed correctly. Licensed insolvency practitioners possess extensive powers to investigate company affairs, including the ability to examine company records, interview directors and employees, and pursue recoveries from third parties where appropriate. These investigative powers help ensure that all available assets are identified and recovered for the benefit of creditors. Navigating insolvency and liquidation presents unique challenges for business owners and directors operating within the UK's comprehensive regulatory framework. Understanding how these procedures impact credit ratings becomes essential for anyone facing financial difficulties or seeking to rebuild their financial standing after insolvency. The UK system, whilst providing necessary protections for creditors and structured procedures for debt resolution, creates lasting consequences that extend well beyond the immediate insolvency period. The law provides various pathways for addressing financial distress, including the comprehensive framework established by the Insolvency Act 1986, which offers systematic approaches to handling both individual and corporate financial difficulties. This legislation balances the interests of debtors and creditors whilst providing clear procedures for asset realisation and debt resolution. However, the impact on credit ratings remains significant, with insolvency information remaining on credit files for six years and affecting access to credit throughout this period. During company liquidation, protecting personal finances requires careful attention to personal guarantees that may create direct links between company debts and individual liability. Taking proactive steps early in the process can help protect credit scores from negative impacts arising from company insolvency, though the effectiveness of these measures depends on the specific circumstances and the extent of personal financial exposure. Directors must remain informed about their obligations under UK insolvency law and engage with licensed insolvency practitioners to navigate these challenging circumstances effectively. Professional advice becomes particularly important given the complexity of insolvency law and the potential for personal liability in various circumstances. The path to financial recovery after insolvency, whilst challenging, remains achievable through careful planning, consistent financial management, and strategic use of credit rebuilding techniques. The UK system recognises the importance of financial rehabilitation, and individuals who demonstrate improved financial behaviour can gradually rebuild their creditworthiness over time. Success requires patience, discipline, and a thorough understanding of how credit scoring systems work within the UK regulatory environment. Ultimately, whilst insolvency creates significant challenges for credit ratings and financial opportunities, it does not represent a permanent barrier to financial recovery. The structured procedures established under UK law provide pathways for addressing financial difficulties whilst the credit system allows for rehabilitation over time. With proper professional advice and strategic financial management, individuals and businesses can navigate insolvency proceedings and rebuild their financial standing within the UK's comprehensive regulatory framework. How Does Insolvency Affect Your Credit?

What is the Impact of Insolvency on Credit Ratings?

Can Bankruptcy Affect Your Credit Score Permanently?

What Role Do Creditors Play in the Insolvency Process?

Does Company Liquidation Affect My Credit Score?

Will Company Debts Impact My Finances?

How to Protect My Credit During Liquidation

What are the Legal Implications of Personal Guarantees During Liquidation?

What is the Liquidation Process and How Does it Affect a Company's Credit?

Understanding the Steps in Voluntary Liquidation

Liquidation Step

Description

Timeframe

Directors' Resolution

Board meeting to acknowledge insolvency

Initial decision

Liquidator Appointment

Licensed insolvency practitioner appointed

Within days

Asset Assessment

Comprehensive review of assets and liabilities

2-4 weeks

Creditor Meetings

Statutory notices and creditor communications

Within 14 days

Asset Realisation

Sale of company assets

3-12 months

Distribution

Payment to creditors according to priority

After asset sales

Dissolution

Company removed from register

3-12 months

How Company Voluntary Arrangements Can Affect Credit

What Happens to Creditors During Liquidation?

Creditor Priority

Description

Typical Recovery Rate

Fixed Charge Holders

Secured creditors with charges over specific assets

80-100%

Liquidation Costs

Liquidator fees and expenses

100%

Preferential Creditors

Employee claims, certain taxes

Variable

Floating Charge Holders

Banks with general security

20-60%

Unsecured Creditors

Trade suppliers, customers

0-10%

Shareholders

Company owners

0%

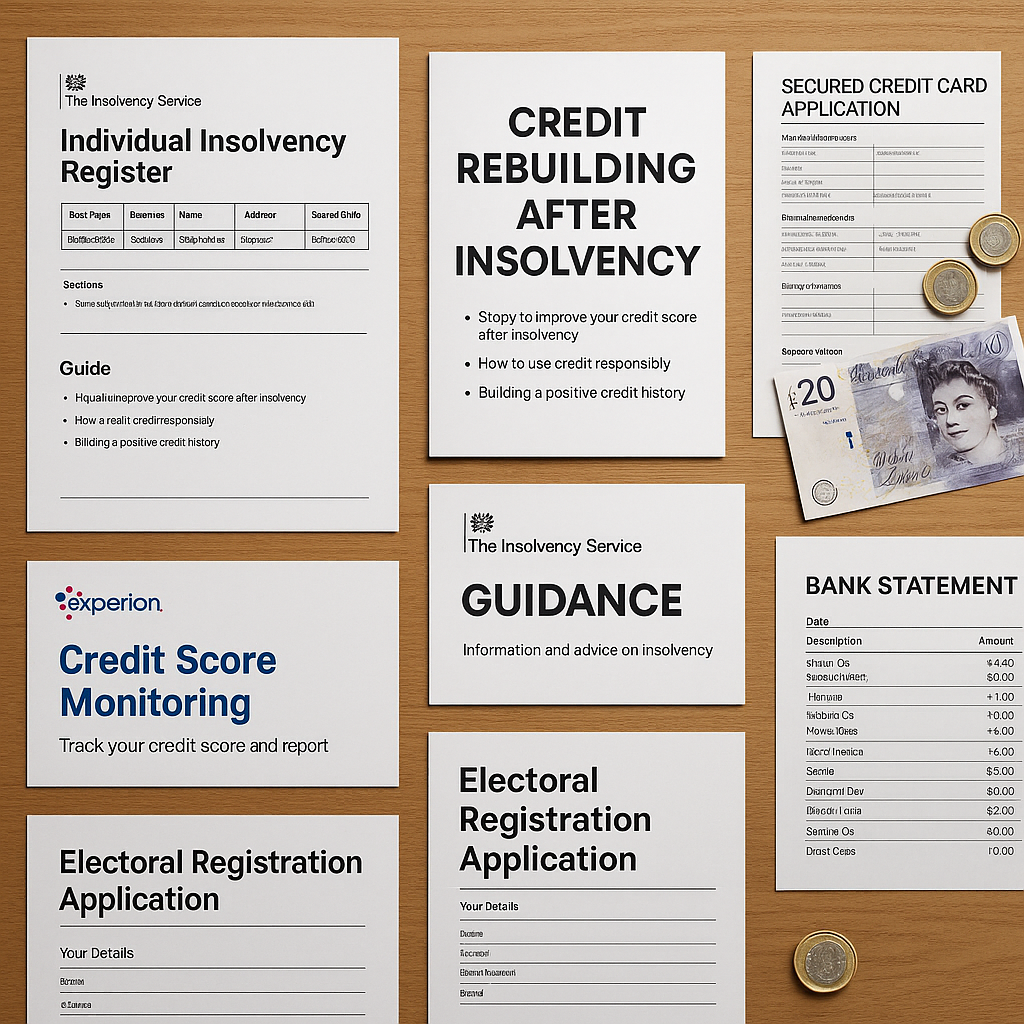

How Can You Rebuild Your Credit Rating After Insolvency?

Effective Strategies to Rebuild Your Credit Post-Insolvency

How Long Does It Take to Remove Bankruptcy from Your Credit File?

Steps to Improve Creditworthiness After Insolvency

What Are the Legal Aspects of Insolvency Under the Insolvency Act 1986?

Key Provisions of the Insolvency Act

Role of a Licensed Insolvency Practitioner

Conclusion

How Are Insolvency Practitioners Appointed – UK Expert Guide Navigating financial turmoil can be overwhelming for company directors and sole traders alike. Faced with mounting debts, threats of compulsory liquidation, or creditor demands, knowing “how insolvency practitioners are appointed” becomes crucial for preserving your organisation. In the UK, professional insolvency services, such as company voluntary […]

Administration might be your lifeline when your company's drowning in debt and creditors are circling. But here's what most directors don't understand: it's not just about buying time — it's about buying the right kind of time, with the proper professional support. The difference between administration working for you or against you often comes down […]

Can an Insolvency Practitioner Stop Creditors? In the UK, mounting pressure from creditors can disrupt cash flow, increase stress for directors, and push a company toward insolvency. Professional guidance plays a pivotal role in countering these challenges. Nexus Corporate Solutions Limited specialises in helping businesses find relief from persistent creditors, providing strategic solutions that align […]

When your company's in financial trouble, one of the biggest worries is what happens to everything you've built. Your equipment, property, stock — the assets that represent years of hard work. It's a valid concern, and you're not alone. The reality? How insolvency practitioners handle your company's assets can make or break the outcome for […]

Insolvent trading can trigger severe repercussions for UK directors, including personal liability and possible disqualification. When a business is unable to pay debts and continues to trade without a reasonable prospect of avoiding insolvency, the law may classify this as wrongful trading. The Insolvency Act 1986, alongside related legislation, outlines civil and criminal penalties for […]

Recognising the signs of business insolvency early is vital for UK companies. Overlooked warning signals—such as recurring cash flow issues, unpaid HMRC tax arrears, or missed staff wages—can quickly escalate into serious risks that demand immediate attention. Being aware of these common signs of business insolvency enables directors to take timely action, whether through careful […]

Supplier insolvency can have serious consequences for UK companies, creating ripple effects that extend beyond the affected supplier. Cash flow interruptions, delayed payments, and increased operational risks are common outcomes. When a key supplier or client becomes insolvent, contracts may be disrupted, insurance coverage can be affected, and overall profitability may decline. Nexus Corporate Solutions […]

Struggling with IVA monthly payments can feel overwhelming, especially when daily financial obligations pile up. An Individual Voluntary Arrangement (IVA) is designed to help those in debt regain stability by consolidating and managing repayments under a legally binding agreement. However, life changes—like reduced monthly income, sudden expenses, or shifts in personal circumstances—often make sticking to […]

Experiencing financial difficulty can make everyday life more challenging, especially when an individual or business director needs to secure a stable living arrangement. In the UK, an Individual Voluntary Arrangement (IVA) offers a legally binding debt solution that eases pressure from creditors. However, many worry about problems renting after IVA. Questions about how this might […]

Address: Apex Building, 1 Water Vole Way, Balby, Doncaster, South Yorkshire, DN4 5JP

Tel: 01302 430180

Services

Company