What Happens When You Hire an Insolvency Practitioner Many UK directors and business owners face stressful financial problems—ranging from mounting debts to the risk of compulsory liquidation. When these challenges surface, seeking professional support can be the turning point. Hiring an insolvency practitioner UK for your company brings legal protection, business rescue opportunities in the […]

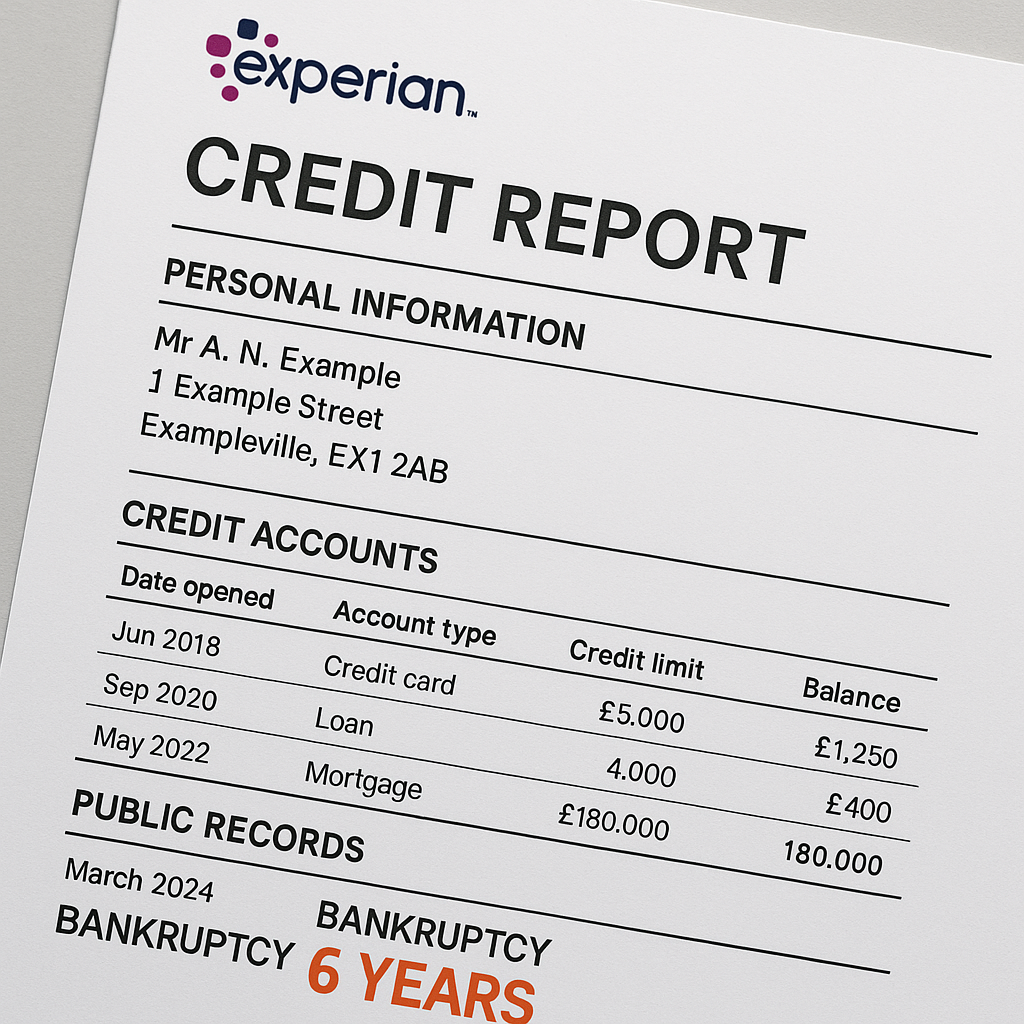

How Long Does Bankruptcy Stay on Your Credit Report in the UK?

In the UK, bankruptcy appears on a person's credit report for six years from the date the bankruptcy order is made. This duration considerably impacts one's financial credibility, with bankruptcy serving as a marker of high financial risk to creditors. During these six years, individuals may experience challenges in securing new credit and face higher interest rates. If you're feeling overwhelmed by what comes next, professional insolvency advice is available to help you understand your options and begin rebuilding with confidence. The adverse effects on a credit score necessitate rebuilding efforts, and professional guidance can make a significant difference in how quickly you regain financial stability. Bankruptcy is a legal process that provides relief to individuals unable to repay their debts, and it greatly impacts credit reports. Typically, when you file for bankruptcy, it appears on your credit report shortly after the bankruptcy order is issued, influencing your credit rating and future credit applications. Understanding how bankruptcy is recorded and its consequences on financial credibility is essential for managing post-bankruptcy financial health. Although often misunderstood, bankruptcy represents a legal process whereby individuals unable to repay outstanding debts can seek relief through the courts. In the UK, bankruptcy is a form of personal insolvency that can markedly impact one's credit report. Upon issuance of a bankruptcy order by the court, this event is recorded in the individual's credit history, adversely affecting their credit score and credit rating. This legal process aims to provide a fresh start, yet the ramifications on financial reputation are profound. Bankruptcy details remain on your credit report for a set duration, influencing future financial endeavours. Creditors accessing this report will see the bankruptcy status, affecting decisions on lending. The bankruptcy order is also recorded on the Individual Insolvency Register, which is publicly accessible. Understanding the implications of bankruptcy on credit history is vital for anyone considering this as a debt solution. When exactly does a bankruptcy appear on one's credit report, and what does this mean for the individual involved? In the UK, bankruptcy on your credit report appears immediately upon the completion of the legal process. The bankruptcy order is made by the court and is recorded on the Individual Insolvency Register, detailing the individual's financial status. This entry affects creditworthiness and remains visible for six years—the bankruptcy is automatically removed after this period. Once the six-year mark is reached, the bankruptcy drops off your report, helping improve your ability to obtain credit in the future. The presence of bankruptcy on your credit report serves as a significant marker for lenders, impacting future financial interactions. However, individuals can take steps to improve their credit over time by managing finances responsibly. Understanding this timeline and its implications is essential for individuals navigating financial recovery post-bankruptcy in the UK. The impact of bankruptcy on credit rating and the ability to apply for credit is profound and immediate. Upon declaring bankruptcy, an individual's credit score is markedly reduced, and the Insolvency Service records this event on their credit report. This affects the ability to apply for credit and can remain on the credit record for up to six years. The implications include: In the UK, bankruptcy remains on your credit report for six years from the date the bankruptcy order was made. However, the duration can be influenced by various factors, including the specifics of the bankruptcy proceedings and individual financial circumstances. It's important to understand how long it stays, as bankruptcy can stay on your record even after you've been discharged from the bankruptcy itself. Additionally, bankruptcy can result in limited access to credit, higher interest rates, and difficulty securing loans. The bankruptcy process in the UK follows its own legal framework under the Insolvency Act 1986, which differs significantly from other countries' systems. Typically, bankruptcy remains on a credit report in the UK for six years from the date of the bankruptcy order. This duration is standard and is vital to understanding the impact a bankruptcy filing can have on one's credit score. After this period, the bankruptcy drops off your report, meaning it will fall off your credit file automatically. Whilst bankruptcy may no longer appear, its effects can still influence your credit in the future, especially if lenders consider your financial history during assessments. In the UK, the following points highlight this process: Ultimately, understanding these elements is essential for managing financial recovery. Although bankruptcy generally stays on a credit report for six years in the UK, several factors can influence this duration. The filing date of the bankruptcy order is critical, as it marks the start of the legal process leading to the automatic removal of the bankruptcy from one's credit report. Credit reference agencies play a significant role by ensuring that the bankruptcy stays on your credit report and reflects accurately in accordance with regulations. The specific circumstances of the bankruptcy case might impact how it is recorded and reported. Additionally, changes in credit scores during this period can affect the perception and impact of bankruptcy on future credit applications. Ensuring consistent monitoring and accurate reporting can help manage the effects on one's financial record. Understanding the UK's personal insolvency framework is essential for comprehending how bankruptcy affects credit reports and what alternatives are available. In the UK, personal insolvency procedures are governed by the Insolvency Act 1986 and include several options beyond bankruptcy. Each has different implications for credit reports and financial recovery: Both bankruptcy and IVAs impact the credit score significantly, but they have differing implications and processes. Understanding these distinctions is crucial for anyone facing financial difficulties in the UK. When considering the removal of bankruptcy from a credit report in the UK, individuals must understand the legal frameworks that govern this process. An insolvency practitioner can provide guidance, although misconceptions persist about the feasibility of removing such records prematurely. It is essential to distinguish between legitimate avenues for removal and common misunderstandings that may lead to false expectations. Credit reference agencies are responsible for maintaining these records according to strict regulatory guidelines. In the UK, removing a bankruptcy record from a credit report through legal means is generally not possible before the standard six-year period elapses. Bankruptcy affects your credit considerably, as it will appear on your credit report, impacting your ability to rebuild your credit. However, there are steps one can take to improve credit after bankruptcy: An Insolvency Practitioner plays an essential role in managing the complexities of bankruptcy, but they cannot directly remove a bankruptcy record from a credit report in the UK. Their primary function involves guiding individuals through the legal process of declaring bankruptcy, which is a formal procedure handled by the courts and the Official Receiver. During the bankruptcy period, they manage the debtor's assets and debts, ensuring compliance with legal obligations. Although they cannot influence how credit reference agencies report bankruptcy, their work indirectly affects your credit by helping to resolve outstanding financial issues. The bankruptcy will remain on the credit report for six years, impacting the individual's credit score. Ultimately, only time and adherence to financial management can aid in credit rehabilitation post-bankruptcy. Why do so many believe that bankruptcy can be easily removed from a credit report in the UK? Misconceptions abound, largely due to misinformation and a lack of understanding about the legal process involved. Personal bankruptcy impacts a credit score greatly, and its record is designed to remain on a credit report for six years, as mandated by UK regulations. The notion that it can be removed prematurely is misleading. Key misconceptions include: Bankruptcy has an immediate adverse effect on an individual's credit score, often resulting in a significant drop. Whilst the initial impact is substantial, the long-term effects can vary depending on future financial behaviour and credit management strategies. To effectively rebuild credit after bankruptcy, it is essential first to assess the current credit score to understand the starting point for improvement. Filing for bankruptcy greatly impacts one's credit score, often resulting in a drastic reduction that can hinder future financial endeavours. The immediate impact on a credit report is significant, with the following effects: These elements underscore the initial challenges faced after filing for bankruptcy. As the immediate effects of bankruptcy begin to stabilise, attention shifts to its long-term consequences on one's credit profile. Bankruptcy stays on a credit report for six years from the date of the bankruptcy order, affecting your credit score considerably. The main credit reference agencies monitor this legal process closely, and the specific circumstances of the bankruptcy case influence how it impacts one's creditworthiness. Whilst the entry is eventually removed from your credit report, the long-term effects include challenges in obtaining credit, higher interest rates, and limited borrowing options. Despite these challenges, individuals can start rebuilding credit over time. Understanding the duration and implications of bankruptcy is essential for financial planning during this period of credit rehabilitation and eventual recovery. Why is it essential to understand the impact of bankruptcy on one's credit score before attempting to rebuild it? Recognising how bankruptcy affects your credit report is vital because it remains on your credit report for six years in the UK. Before trying to rebuild your credit, one should first check your credit score to evaluate your starting point. Filing bankruptcy can greatly lower your credit score, which will appear on your credit reports. To effectively rebuild one's credit after a bankruptcy: Understanding these steps can facilitate a smoother recovery. In the UK, individuals facing financial difficulties can consider several alternatives to bankruptcy, each with distinct implications and benefits. Options such as Individual Voluntary Arrangements (IVAs), Debt Relief Orders (DROs), and credit counselling provide structured pathways to manage or reduce debt whilst potentially preserving credit ratings. Carefully considering the pros and cons helps ensure decisions align with your individual financial needs. Whilst bankruptcy is often considered a last resort for those facing financial difficulties, there are several alternative insolvency options available in the UK that can provide relief without the severe consequences associated with bankruptcy. These options can mitigate the impact on one's credit report and avoid the need to navigate the legal process of liquidation and bankruptcy through the courts, which can remain on credit reference agency records for up to six years. Here are four alternatives to bankruptcy: When individuals in the UK seek to manage their debt without resorting to bankruptcy, debt management and credit counselling offer viable pathways. These alternatives provide structured methods for debt repayment, aiming to improve one's credit report over time. A debt management plan, often developed with the help of a credit counsellor, consolidates debts into a single monthly payment, potentially reducing interest rates. Unlike filing for bankruptcy, which is a legal process affecting credit history for up to six years, these options focus on gradual financial recovery. Credit counselling offers personalised financial advice to rebuild credit scores and avoid future financial pitfalls. By addressing debt issues proactively, individuals can potentially enhance their credit history and maintain financial stability without the drastic impact of bankruptcy. Although bankruptcy is a significant legal step that can severely affect credit standing, individuals in the UK have several alternative solutions that may be more suitable depending on their financial situation. These alternatives can help preserve good credit and prevent the long-term impact of a bankruptcy order on a credit report. Key options include: To sum up, bankruptcy in the UK remains on a credit report for six years from the date of the bankruptcy order. This duration can greatly impact an individual's credit score, making it essential to explore alternatives and seek professional advice before proceeding. Whilst removal of a bankruptcy record is generally not possible before the term ends, understanding its implications and exploring options like Debt Relief Orders or Individual Voluntary Arrangements can provide pathways to financial recovery. The key to managing post-bankruptcy financial health lies in understanding the UK's specific legal framework, actively monitoring credit reports, and taking proactive steps to rebuild creditworthiness over time. Professional guidance from qualified insolvency practitioners can make a significant difference in navigating this challenging period and achieving long-term financial stability.Key Takeaways

What is Bankruptcy, and How Does it Appear on Credit Reports?

Understanding the Basics of Bankruptcy

When Does Bankruptcy Appear on Your Credit Reports?

How Bankruptcy Affects My Credit Rating and Ability to Apply for Credit

How Long Does Bankruptcy Stay on Your Credit Report in the UK?

The Standard Duration for Bankruptcy

Factors Influencing How Long Bankruptcy Stays

UK Personal Insolvency Procedures

Can Bankruptcy Be Taken Off Your Credit Report Early?

Legal Options for Removing Bankruptcy

Role of an Insolvency Practitioner

Misconceptions About Bankruptcy Removal From Your Credit Report

How Does Bankruptcy Affect Your Credit Score?

Immediate Impact on Credit Score

Long-Term Effects of Bankruptcy on Credit

Rebuild Your Credit After Bankruptcy? Check Your Credit Score First

What are the Alternatives to Bankruptcy in the UK?

Exploring UK Insolvency Options

Debt Management and Credit Counselling

Pros and Cons of Alternative Solutions

Conclusion

How Are Insolvency Practitioners Appointed – UK Expert Guide Navigating financial turmoil can be overwhelming for company directors and sole traders alike. Faced with mounting debts, threats of compulsory liquidation, or creditor demands, knowing “how insolvency practitioners are appointed” becomes crucial for preserving your organisation. In the UK, professional insolvency services, such as company voluntary […]

Administration might be your lifeline when your company's drowning in debt and creditors are circling. But here's what most directors don't understand: it's not just about buying time — it's about buying the right kind of time, with the proper professional support. The difference between administration working for you or against you often comes down […]

Can an Insolvency Practitioner Stop Creditors? In the UK, mounting pressure from creditors can disrupt cash flow, increase stress for directors, and push a company toward insolvency. Professional guidance plays a pivotal role in countering these challenges. Nexus Corporate Solutions Limited specialises in helping businesses find relief from persistent creditors, providing strategic solutions that align […]

When your company's in financial trouble, one of the biggest worries is what happens to everything you've built. Your equipment, property, stock — the assets that represent years of hard work. It's a valid concern, and you're not alone. The reality? How insolvency practitioners handle your company's assets can make or break the outcome for […]

Insolvent trading can trigger severe repercussions for UK directors, including personal liability and possible disqualification. When a business is unable to pay debts and continues to trade without a reasonable prospect of avoiding insolvency, the law may classify this as wrongful trading. The Insolvency Act 1986, alongside related legislation, outlines civil and criminal penalties for […]

Recognising the signs of business insolvency early is vital for UK companies. Overlooked warning signals—such as recurring cash flow issues, unpaid HMRC tax arrears, or missed staff wages—can quickly escalate into serious risks that demand immediate attention. Being aware of these common signs of business insolvency enables directors to take timely action, whether through careful […]

Supplier insolvency can have serious consequences for UK companies, creating ripple effects that extend beyond the affected supplier. Cash flow interruptions, delayed payments, and increased operational risks are common outcomes. When a key supplier or client becomes insolvent, contracts may be disrupted, insurance coverage can be affected, and overall profitability may decline. Nexus Corporate Solutions […]

Struggling with IVA monthly payments can feel overwhelming, especially when daily financial obligations pile up. An Individual Voluntary Arrangement (IVA) is designed to help those in debt regain stability by consolidating and managing repayments under a legally binding agreement. However, life changes—like reduced monthly income, sudden expenses, or shifts in personal circumstances—often make sticking to […]

Experiencing financial difficulty can make everyday life more challenging, especially when an individual or business director needs to secure a stable living arrangement. In the UK, an Individual Voluntary Arrangement (IVA) offers a legally binding debt solution that eases pressure from creditors. However, many worry about problems renting after IVA. Questions about how this might […]

Address: Apex Building, 1 Water Vole Way, Balby, Doncaster, South Yorkshire, DN4 5JP

Tel: 01302 430180

Services

Company