What Happens When You Hire an Insolvency Practitioner Many UK directors and business owners face stressful financial problems—ranging from mounting debts to the risk of compulsory liquidation. When these challenges surface, seeking professional support can be the turning point. Hiring an insolvency practitioner UK for your company brings legal protection, business rescue opportunities in the […]

Why Do Companies Go Into Administration and What It Means

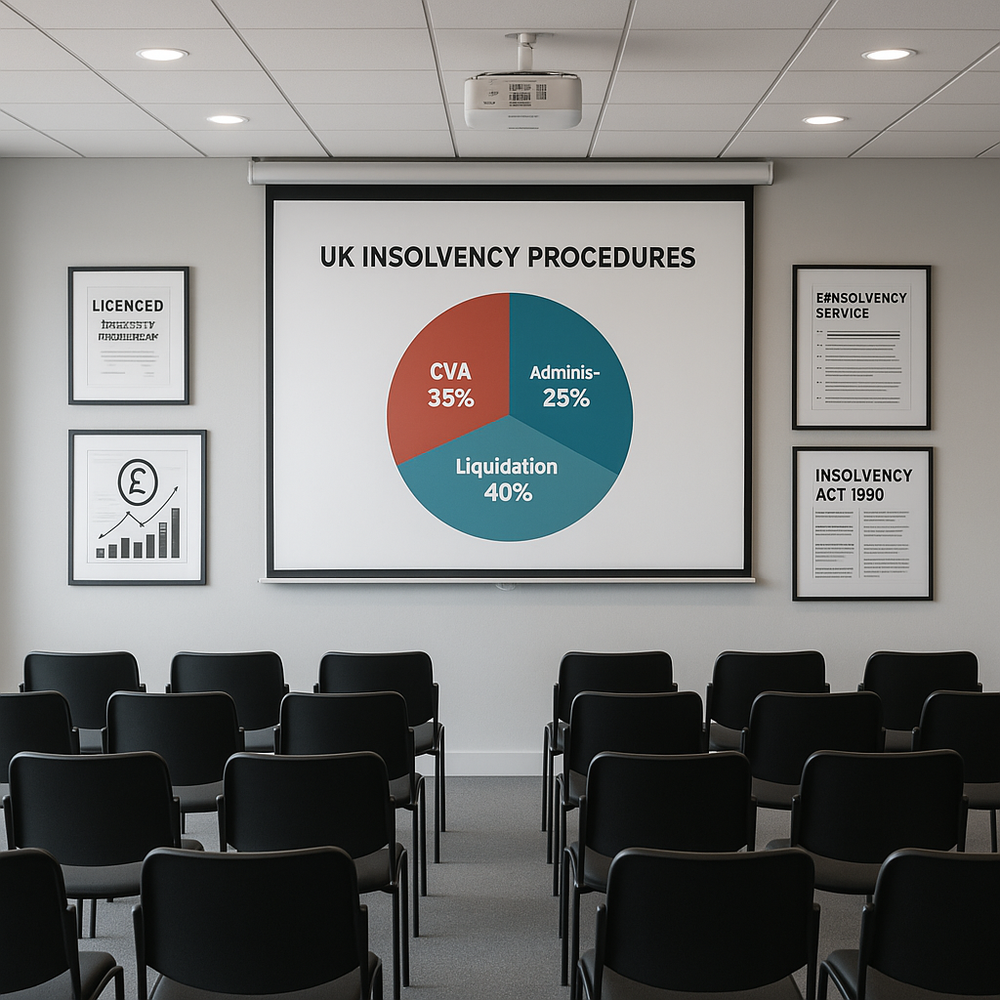

When a company enters administration, it's reached a crossroads. Usually, this happens when debts pile up and there's simply not enough cash coming in to pay what's owed. But here's the thing — administration isn't always the end of the road. Sometimes it's actually a lifeline. Under the Insolvency Act 1986, administration gives breathing space. When a company goes into administration, a licensed insolvency practitioner steps in to take control. Their job isn’t to point fingers or declare the end — it’s to steady the ship. That might mean protecting creditors as best they can, trying to keep people in work, or making sure what’s left of the business is used wisely. The aim is simple: to find a workable way forward in a difficult situation. Rather than rushing straight to closure, companies get time to explore their options while creditors can't take enforcement action. Not ideal for anyone involved, but often better than the alternatives. So what actually happens? Well, control shifts from the directors to a licensed insolvency practitioner — the administrator. This can be triggered by the directors themselves (often the case), creditors, or sometimes the court. Once it's official, it gets recorded with Companies House and published in The Gazette. The administrator takes charge of everything — assets, operations, the lot. They might keep trading if it makes sense, restructure debts, or start selling off assets. The key point? They're trying to get a better outcome than if the company just collapsed tomorrow. And while they figure things out, there's a statutory moratorium in place. Basically, creditors have to wait — no chasing debts, no court action, no seizing assets. Sometimes this breathing space leads to a Company Voluntary Arrangement (CVA), where creditors agree to a repayment plan stretched over several years. Other times, if rescue isn't realistic, the company moves to liquidation — but at least assets have been dealt with properly rather than in a fire sale. Let's break down what administration actually tries to achieve. The Insolvency Act 1986 sets out three objectives, in order of priority: The moratorium is crucial here. It stops creditors from taking legal action while the administrator works out what's possible. And it's not just about creditors — the administrator has duties to all stakeholders. Employees, for instance, have their rights protected under the Employment Rights Act 1996. Small comfort when you're worried about your job, but at least there's some legal framework there. The trigger is usually insolvency — either cash flow insolvency (can't pay bills when they're due) or balance sheet insolvency (liabilities exceed assets). Behind these technical terms, you'll find real problems: sales dropping off a cliff, major customers not paying, unexpected legal claims, or just getting caught out by economic changes. Directors often choose administration over liquidation because it offers hope. Maybe the business can be restructured, debts renegotiated, or parts of it sold while there's still value. It's about buying time — time to work out a recovery plan, time to find buyers, time to do things properly rather than in panic mode. (And yes, sometimes it's about directors protecting themselves from personal liability — but that's usually just part of the picture.) The administrator isn't just anyone — they're a licensed professional regulated by bodies like ICAEW, ACCA, or the IPA. They act independently, which means they don't work for the directors or any particular creditor. Their job is to look after creditors as a whole. They've got serious powers too. They can sell assets, keep the business trading if it makes sense, restructure operations, negotiate with creditors. But with those powers come duties — they have to treat all creditors fairly according to the law, not play favourites. It's a balancing act, and not an easy one. Day one: the administrator secures everything — assets, bank accounts, records. They need to understand what they're dealing with. Creditors get notified, and that moratorium kicks in immediately. No more threatening letters, no bailiffs at the door. Directors? They lose their powers but have to stick around and cooperate. Full disclosure is required — and I mean everything. The administrator needs the complete picture to do their job properly. Within eight weeks, the administrator presents their proposals. This could be anything from "we think we can save this business through restructuring" to "sorry, but liquidation is the only option." Creditors vote on these proposals — they get a say, though not always the final one. The whole process usually wraps up within twelve months, though complex cases can take longer with creditor consent or court approval. During this time, the business might keep trading, be sold, or wind down gradually. Each situation is different. Right from appointment, the administrator: These first moves often determine whether the company trades during administration, gets packaged up for sale, or starts winding down. Critical decisions, made quickly. For directors, it's a tough transition. One day you're running the show, the next you're providing information and watching someone else make the decisions. You still have responsibilities though — full cooperation is mandatory, and your past conduct might come under scrutiny. The Company Directors Disqualification Act 1986 means wrongful or fraudulent trading could have serious consequences. Employees face uncertainty — will their jobs survive? Often, the answer is no, at least not for everyone. If the business downsizes or closes, redundancies follow. The good news (if you can call it that) is that employment rights are protected by law. Redundancy pay, notice periods, unpaid wages — these become preferential debts. Cold comfort when you're losing your job, but better than nothing. Not all creditors are equal in administration. There's a strict hierarchy: The administrator keeps creditors updated throughout. Sometimes they'll propose a CVA if it means better returns. But let's be honest — secured and preferential creditors usually do okay, while unsecured creditors often see pennies on the pound, if that. Twelve months is standard, but it's not set in stone. Extensions happen when: Some rescues happen quickly — a buyer appears, deal done, business saved. Others need time to untangle years of complicated finances or complete major asset sales. Each case is different. Three main outcomes are possible: Rescue as a going concern — The business survives, usually through restructuring or a CVA. Jobs saved, creditors get ongoing payments, everyone breathes a sigh of relief. Sale of business or assets — Parts or all of the business find new owners. Some jobs might transfer under TUPE, some value is preserved. Liquidation — When rescue isn't viable, the company closes. Assets are sold, proceeds distributed, then it's dissolved. Even when liquidation is inevitable, administration often delivers better results than just shutting the doors immediately. Assets can be marketed properly, work in progress completed, better deals negotiated. Those extra percentages matter to creditors waiting for payment. Yes — if you act early enough. Administrators have tools at their disposal: A pre-pack is where the sale is arranged before administration but completed immediately after. The business keeps trading, customers barely notice, jobs are often saved. Critics say it lacks transparency (especially when directors buy their own company back), but when done right, it preserves value that would otherwise disappear. Success isn't guaranteed though. It needs cooperation from directors, realistic creditor expectations, and usually, a viable underlying business. You can't rescue what's fundamentally broken. When rescue isn't possible, liquidation follows. The administrator sells everything, distributes proceeds according to that creditor hierarchy we mentioned, then the company is dissolved. Done. Unsecured creditors typically recover very little — harsh but true. Employees face redundancy, though they can claim statutory payments from the government's Redundancy Payments Service. There's also an investigation into director conduct. If wrongful trading or other misconduct is found, directors could face disqualification or personal liability. It's about accountability — and making sure directors think twice before trading on when they shouldn't. The administrator catalogues everything, checks who has valid security over what, then plans the sales strategy. Fixed charge holders get their specific assets. Floating charge assets are more complex — preferential creditors get paid first, plus there's the "prescribed part" set aside for unsecured creditors. Sales might happen through traditional marketing or pre-pack arrangements. Either way, the administrator must get the best reasonably obtainable price. No giving assets away to mates — everything needs to be transparent and justifiable. The proceeds then get distributed strictly according to insolvency law. Pre-packs are controversial but often effective. The sale is negotiated before administration starts, then completed immediately after appointment. Why do it this way? The downsides? Limited creditor involvement and suspicions when management buys the business back (a "phoenix" company). To address concerns, Statement of Insolvency Practice 16 requires independent valuations, marketing evidence, and detailed explanations. Not perfect, but better than the old days. Administration is complex — legally, financially, and emotionally. It represents both an ending and potentially a new beginning. Under the Insolvency Act 1986, it gives struggling companies a framework to either recover or close in an orderly way. Understanding the process helps everyone involved make better decisions. Directors can act before it's too late. Creditors know what to expect. Employees understand their rights. And sometimes — not always, but sometimes — businesses that seemed doomed find a way forward. If your company is facing financial difficulties, the key is acting early. The sooner you understand your options (administration being just one of them), the more likely you'll find a solution that works. Don't wait until creditors are at the door — by then, your options have usually narrowed considerably. Need advice on administration or other insolvency options? Speak to Nexus insolvency practitioner today. The first conversation could make all the difference.What Does It Mean When a Company Goes Into Administration?

Understanding Company Administration

Key Reasons a Company May Enter Administration

The Role of a Licensed Insolvency Practitioner

What Happens When a Company Goes Into Administration?

Immediate Steps in the Administration Process

Impact on Directors and Staff

How Creditors Are Managed During Administration

Creditor Type

Priority Level

What This Means

Fixed Charge Holders

Highest

First claim on specific secured assets

Administration Costs

Very High

Gets paid before floating charges

Preferential Creditors

High

Includes employee claims and certain HMRC debts

Floating Charge Holders

Medium

Paid after preferential creditors

Prescribed Part (Unsecured)

Medium

Ring-fenced portion from floating charge assets

Unsecured Creditors

Low

Share what's left equally (usually not much)

Shareholders

Lowest

Only if everyone else is paid in full (rare)

How Long Can a Company Be in Administration?

What Are the Effects of a Company Going Into Administration?

Can Administration Rescue the Company?

What Happens if a Company Cannot Be Rescued?

How Company Assets Are Handled During Administration

What Is a Pre-Pack Administration?

Ready to Explore Your Options?

How Are Insolvency Practitioners Appointed – UK Expert Guide Navigating financial turmoil can be overwhelming for company directors and sole traders alike. Faced with mounting debts, threats of compulsory liquidation, or creditor demands, knowing “how insolvency practitioners are appointed” becomes crucial for preserving your organisation. In the UK, professional insolvency services, such as company voluntary […]

Administration might be your lifeline when your company's drowning in debt and creditors are circling. But here's what most directors don't understand: it's not just about buying time — it's about buying the right kind of time, with the proper professional support. The difference between administration working for you or against you often comes down […]

Can an Insolvency Practitioner Stop Creditors? In the UK, mounting pressure from creditors can disrupt cash flow, increase stress for directors, and push a company toward insolvency. Professional guidance plays a pivotal role in countering these challenges. Nexus Corporate Solutions Limited specialises in helping businesses find relief from persistent creditors, providing strategic solutions that align […]

When your company's in financial trouble, one of the biggest worries is what happens to everything you've built. Your equipment, property, stock — the assets that represent years of hard work. It's a valid concern, and you're not alone. The reality? How insolvency practitioners handle your company's assets can make or break the outcome for […]

Insolvent trading can trigger severe repercussions for UK directors, including personal liability and possible disqualification. When a business is unable to pay debts and continues to trade without a reasonable prospect of avoiding insolvency, the law may classify this as wrongful trading. The Insolvency Act 1986, alongside related legislation, outlines civil and criminal penalties for […]

Recognising the signs of business insolvency early is vital for UK companies. Overlooked warning signals—such as recurring cash flow issues, unpaid HMRC tax arrears, or missed staff wages—can quickly escalate into serious risks that demand immediate attention. Being aware of these common signs of business insolvency enables directors to take timely action, whether through careful […]

Supplier insolvency can have serious consequences for UK companies, creating ripple effects that extend beyond the affected supplier. Cash flow interruptions, delayed payments, and increased operational risks are common outcomes. When a key supplier or client becomes insolvent, contracts may be disrupted, insurance coverage can be affected, and overall profitability may decline. Nexus Corporate Solutions […]

Struggling with IVA monthly payments can feel overwhelming, especially when daily financial obligations pile up. An Individual Voluntary Arrangement (IVA) is designed to help those in debt regain stability by consolidating and managing repayments under a legally binding agreement. However, life changes—like reduced monthly income, sudden expenses, or shifts in personal circumstances—often make sticking to […]

Experiencing financial difficulty can make everyday life more challenging, especially when an individual or business director needs to secure a stable living arrangement. In the UK, an Individual Voluntary Arrangement (IVA) offers a legally binding debt solution that eases pressure from creditors. However, many worry about problems renting after IVA. Questions about how this might […]

Address: Apex Building, 1 Water Vole Way, Balby, Doncaster, South Yorkshire, DN4 5JP

Tel: 01302 430180

Services

Company